Last September we used Purchase Intent data to predict that […]

Digital Wallets are Blurring the Lines between Finance and Tech ($V, $COIN, $FB, $AAPL, $SQ)

Digital Wallets are Blurring the Lines between Finance and Tech ($V, $COIN, $FB, $AAPL, $SQ)

There's a powerful shift in consumer behavior underway, one that we’ve been tracking closely since September: the rise of Digital Wallets. Digital wallet transactions are expected to top $10tn globally by 2025 – LikeFolio's consumer data confirms a rapid increase in popularity is underway:

Mentions of digital wallet usage and online finance management have gained +162% YoY (90d MA), and we’re not expecting to see a major pullback anytime soon. Why? Because consumers prefer digital wallets.

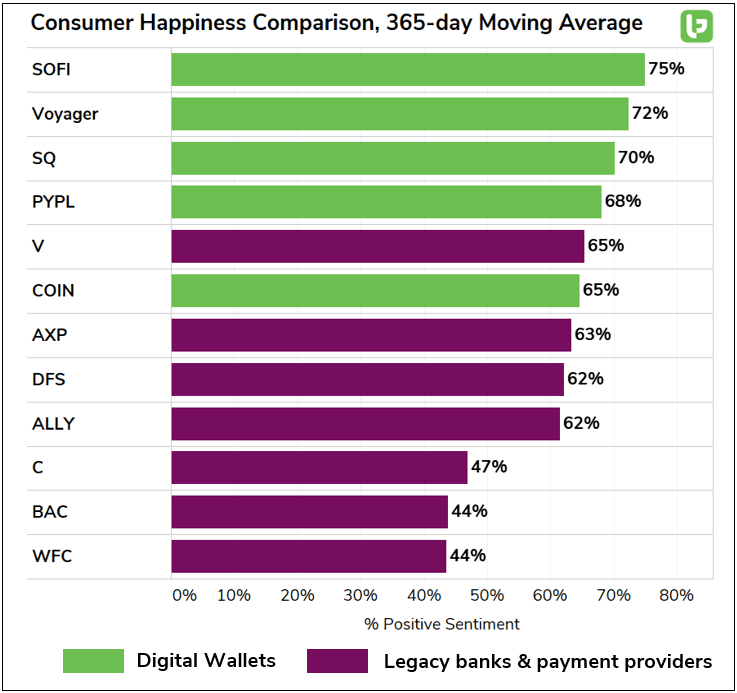

Compare the Consumer Happiness levels of companies offering digital wallets vs. their legacy competitors...

Traditional financial institutions are losing in terms of popularity growth and customer satisfaction.

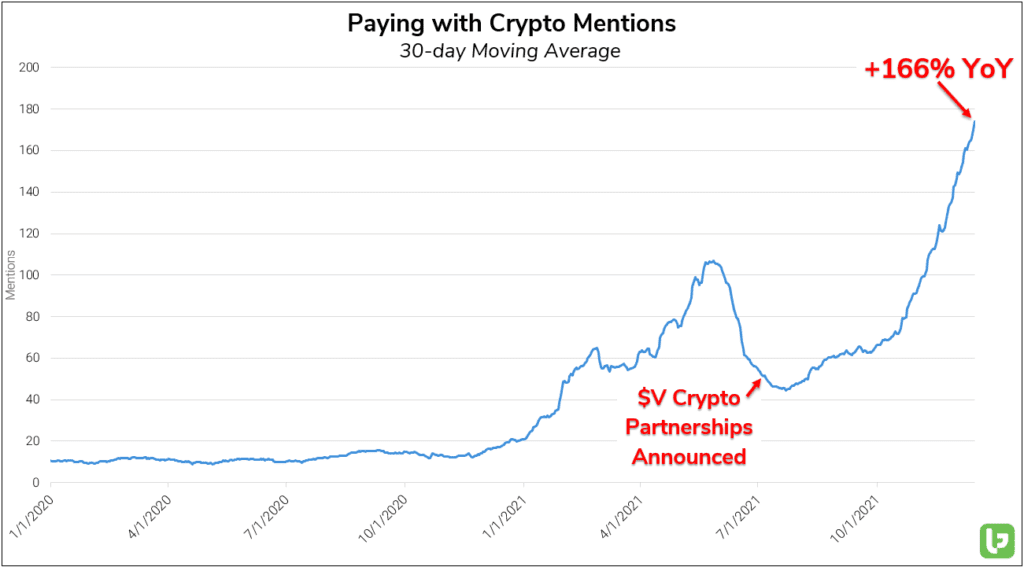

Coinbase ($COIN), which primarily operates as a crypto brokerage, shows the lowest level of Consumer Happiness among digital wallet providers…Ironically, it’s now tied with Visa ($V), the company that helped to empower COIN as a true payment provider. Visa granted Coinbase principal membership in early 2020, making it the first cryptocurrency company with the power to issue Visa debit cards. This wasn't a one-off endeavor. In fact, Visa is still paving the way for crypto-powered payments. The payment technology company recently partnered with over 50 crypto companies to enable crypto purchases from supported merchants and debuted crypto advisory services earlier this month.

These actions have already had a measurable impact — Consumer Mentions of purchasing goods and services using cryptocurrency are at an all-time high level: +166% YoY and +256% since Visa's 50-company partnership (30d MA).

Established payment providers and newcomers alike are scrambling to meet consumer demand for digital wallets and crypto functionality:

- Meta Platforms ($FB) just launched its “Novi” Digital Wallet, integrated onto WhatsApp with plans to support an array of cryptocurrencies.

- Square ($SQ), taking a cue from the company formerly known as Facebook, just announced a rebrand to “Block” — Hinting at further cryptocurrency-related developments (not surprising considering Jack Dorsey’s involvement).

- Apple's ($AAPL) 'Apple Pay' service, which accounted for 92% of mobile wallet transactions in 2021, has publicly announced that it's considering the addition of crypto support.

Thanks in part to growing cryptocurrency adoption and the rise of 'the Metaverse', the lines between finance and tech are starting to blur.

Consumers want mobile-enabled, purely digital financial products with crypto support, and the companies who can deliver on these desires are set to benefit immensely going forward.