Drinker’s tastes and priorities are shifting in a major way. […]

Divergence Opportunities

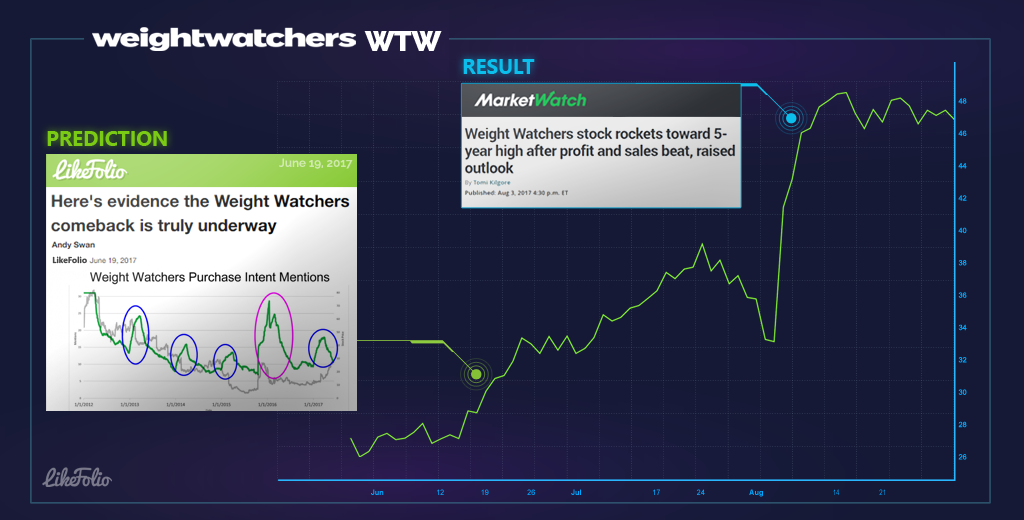

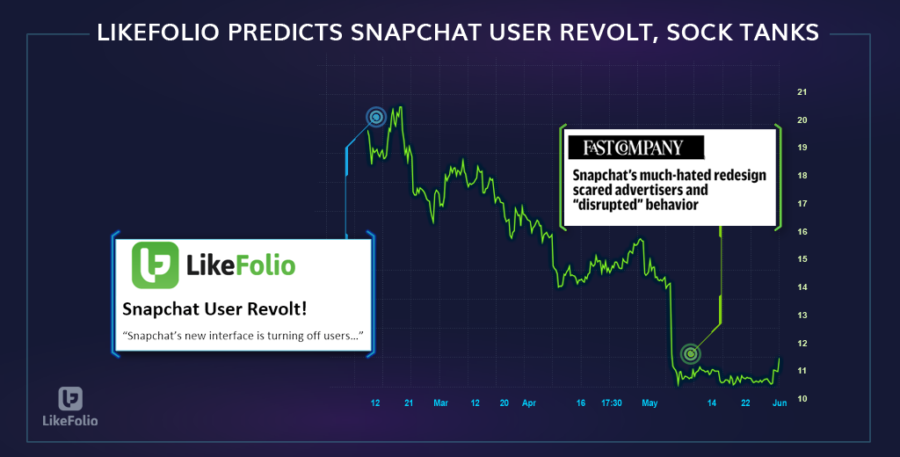

When social-data and stock price are moving sharply in opposite directions, we call that divergence. It’s a signal to us that Wall St is could be incorrect (or looking backwards) in its assessment of the company.

There are two ways that divergence can happen:

1. Bullish divergence – this occurs when the social volume and social sentiment numbers for the company are improving in a significant way while the stock is falling or near lows.

2. Bearish divergence– this occurs when social data is moving negatively as the stock rallies or stalls near highs.

How to find divergence plays

- Get access to the LikeFolio research dashboard and Opportunity Alerts with a membership.

- Get your feet wet and some free lessons via the LikeFolio Letter.

It’s important to note that divergence plays can take time to develop and can go against you for a while. Keeping an eye on social data to make sure it’s still confirming your hypothesis is critical.

Remember, social data tells us what’s going on at the Main Street level. What consumers are actually doing and buying. It’s fantastic signal for the company’s fundamentals, but it can take time to manifest its way into sales/earnings reports and the company stock price.