Last September we used Purchase Intent data to predict that […]

Does Apple TV+ Have a Retention Problem?

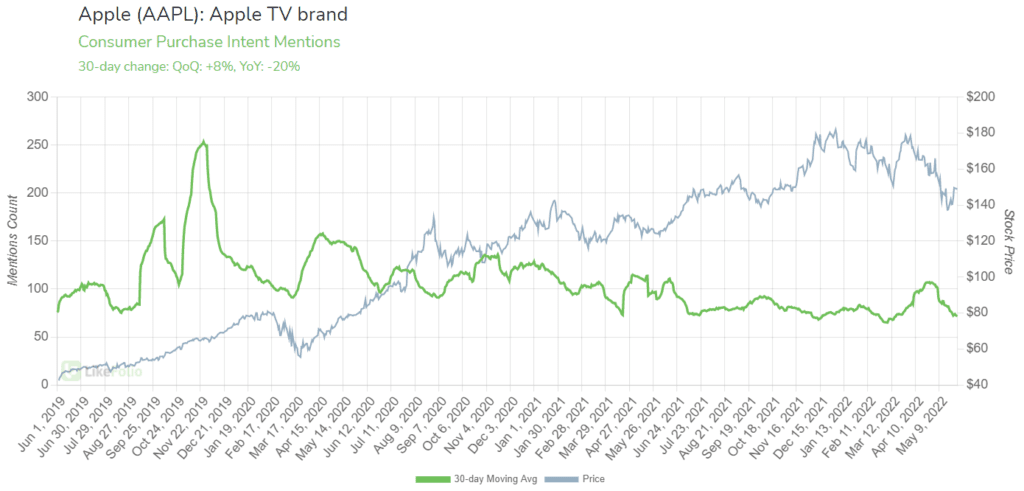

| Historically speaking, Apple has been guarded when it comes to subscription numbers. But, according to Statista, paid subscribers of Apple TV+ are estimated to be around 25 million, with a further 50 million with access to the platform via promotions. For context, Netflix has around 222 million subscribers, while Disney+ has 137.7 million subscribers. But is this audience expanding? According to LikeFolio data, user growth is continuing to slip. Consumer mentions of signing up for an Apple TV+ account (or purchasing a device) have slipped by -20% YoY. |

| Due to the nature of brand naming, it's difficult to discern between the platform and player usage. This decline in demand across the board is congruent with macro streaming trends. In fact, streaming mentions (think eyeballs on screens that aren’t traditional cable) remain significantly lower vs. pandemic levels. |

| While time spent streaming tempers, the number of streaming options for consumers is higher than ever. And viewers are feeling the burn. Subscription fatigue mentions are +44% higher on a YoY basis. This spells trouble…especially if you’re Apple TV. |

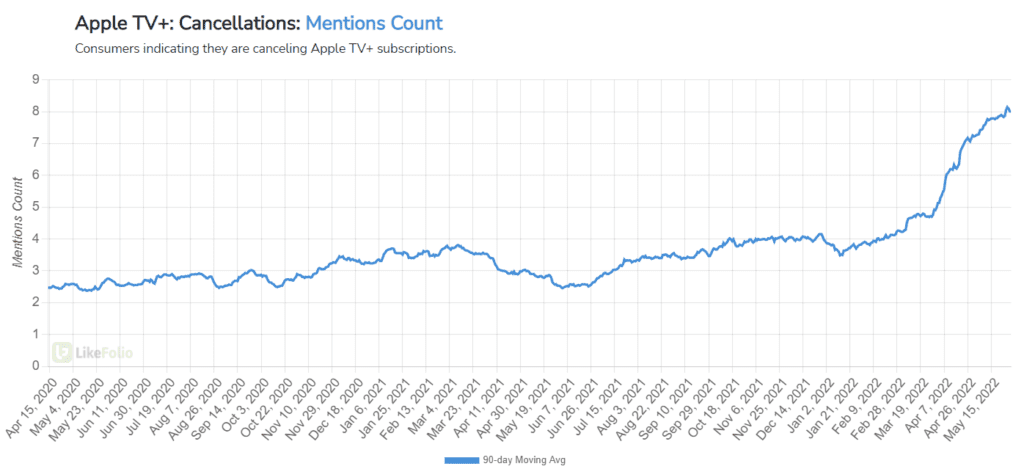

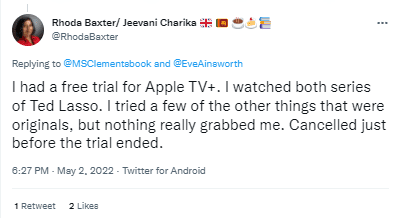

| In fact, consumer mentions of canceling Apple TV+ are on track to close at all-time highs, trending +89% QoQ and an enormous +212% YoY. Translation: customer churn for the subscription service is likely elevated. What can Apple do to stop the rot? Based on qualitative analysis of cancellation mentions since March, Apple TV+ needs more Ted Lasso’s. |

Quality content is the obvious answer, but as Netflix has shown, throwing tons of money into content in an attempt to see what works, isn’t always best, and Apple doesn’t yet have the content library to compete with the likes of Disney+.

But maybe there is another way…

Back in January, Wedbush analyst Dan Ives said Apple is ‘ready to spend billions’ on live sports content deals over the next four years.

“We believe the company is gearing up to bid on a number of upcoming sports packages coming up for contract/renewals in future years,” the analyst said.

And it seems he’s right, with the streaming service having already secured a deal to bring Major League Baseball’s Friday Night Baseball games to its platform.

Bottom Line: From the outside looking in, it looks like Apple’s subscription service has somewhat stalled with a lack of quality content on the platform.

However, changing pace and focusing on sports streaming may see previous subscribers leave and new subscribers stick around.