General Mills, the American branded foods manufacturer, will report its […]

Does General Mills have a Cereal Problem?

Ah, cereal. The delightful, crunchy, sugary morning companion that's been with us since our youth, from rushed weekday mornings to lazy Sunday brunches.

Have you ever stopped to think about where it all began? It wasn't born in a bustling city or a fancy food lab. Instead, it sprouted in the most unlikely of places, thanks to a pair of brothers with a vision. (We may know something about that.)

Meet the Kelloggs: John Harvey and Will Keith, two brothers from a devout Seventh-day Adventist family in Battle Creek, Michigan. With limited education John Harvey still managed to snag a medical degree. His passion? ‘Biologic living’ - a lifestyle that would make even the most dedicated health nuts of today raise an eyebrow. Think vegetarianism, zero alcohol, and a big no-no to our beloved caffeine fixes.

As the head honcho of an Adventist sanitarium, John Harvey was on a mission to reform America's eating habits. But let's face it, his diet plan was a bit… bland. So, in a bid to add some flavor to their patients' plates, the Kellogg trio (including John's wife, Ella) began tinkering with recipes.

One night, while attempting to manufacture this digestible bread variant, they accidentally created wheat flakes, which they called Granose…aka the world’s first flaked cereal product was born!

Business-savvy brother Will was able to package and market this creation as the iconic Cornflakes we all know. And for decades, consumers enjoyed the convenience and long shelf life of this breakfast staple.

It solved a major problem for consumers and established breakfast as “the most important meal of the day.”

Over the last 100 years the cereal market has been transformed – rife with sugar, marshmallows, and chocolate…and plenty of competition.

The problem?

Now consumers are shifting away from Cereal – and the market is looking at companies to respond.

Declining Cereal Popularity

Major cereal companies like General Mills, Kellogg, and Post Holdings are grappling with a declining cereal market. While cereals were a staple in the '80s and '90s, consumer preferences have shifted away from sugar and carbohydrates toward nutrient-rich breakfasts in favor of higher protein, lower sugar, and more on-the-go breakfast options.

The COVID-19 pandemic momentarily revived cereal sales as families ate more at home. However, this surge was short-lived, with sales dropping significantly in 2021 and 2022.

The rise of on-the-go lifestyles and a shift in favor of frozen foods have popularized high-protein alternatives like breakfast sandwiches, burritos, bars, and shakes. Additionally, fast-food chains have expanded their portable breakfast menus, further challenging traditional cereals.

How are companies responding?

Kellogg's Radical Move

Kellogg plans to spin off its North America cereal division into a new company named WK Kellogg. This move will allow Kellogg to focus on its snacking segment, including brands like Pringles and Cheez-It, under a new name, Kellanova.

General Mills' Resilience

Amidst the industry's challenges, General Mills has managed to gain market share, particularly with its Cheerios brand. The company has effectively marketed the heart-health benefits of Cheerios and introduced new product lines to cater to evolving consumer tastes.

GIS has also leaned into a growing market…which could make all the difference long-term.

We’re talking about Pet Food.

General Mills owns premium pet food brand, Blue Buffalo.

Pet ownership skyrocketed during the pandemic, which served as a major catalyst for growth in the pet supply segment.

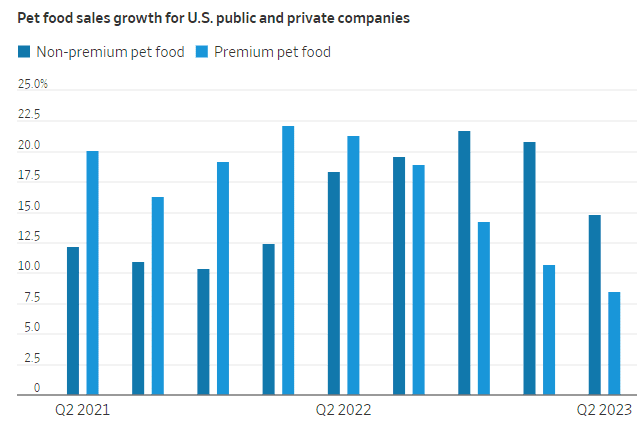

However, as consumer wallets tighten, tough choices are being made.

Earlier this month GIS leadership noted challenges as pet owners opt for cheaper or smaller-sized food options. As a result, the company anticipates its pet segment's organic net sales to remain flat in its first quarter, with an operating profit margin of around 19%.

However, the company's CFO, Kofi Bruce, believes that the long-term trend will still favor premium pet food offerings as consumers often treat their pets like family.

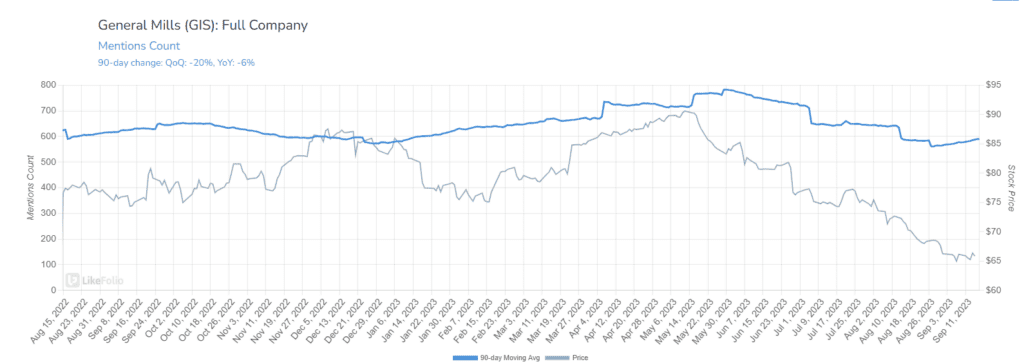

LikeFolio data confirms YoY softening for General Mills as a whole, at least on the consumer front.

Mentions have slipped by -6% YoY.

The only bright spot? Expectations are already low.

We’re sidelined for this earnings event but will be watching all names with a heavy footprint in the cereal market to see how they overcome shifting consumer appetites.