Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Dollar Tree (DLTR) has some catching up to do

Dollar Tree (DLTR) has some catching up to do

Dollar Tree took an interesting approach at the beginning of lockdown: it shut down its website and announced it would not take online orders. The idea was that on-site inventory would be protected from depletion by online shoppers. Turns out people didn't want to shop in stores, and sales fell -19% in the last week of March.

Since then, the company has updated its vision. In early February, Family Dollar announced plans to integrate Instacart same-day delivery with more than 6,000 stores. The company is optimistic because of increased basket size recorded during the pilot.

In-store pick up is underway for both Family Dollar and Dollar Tree.

These moves are strategic. Right now, curbside pickup and delivery is the top growing retail shopping trend in our universe, with mention volume pacing more than +1000% YoY.

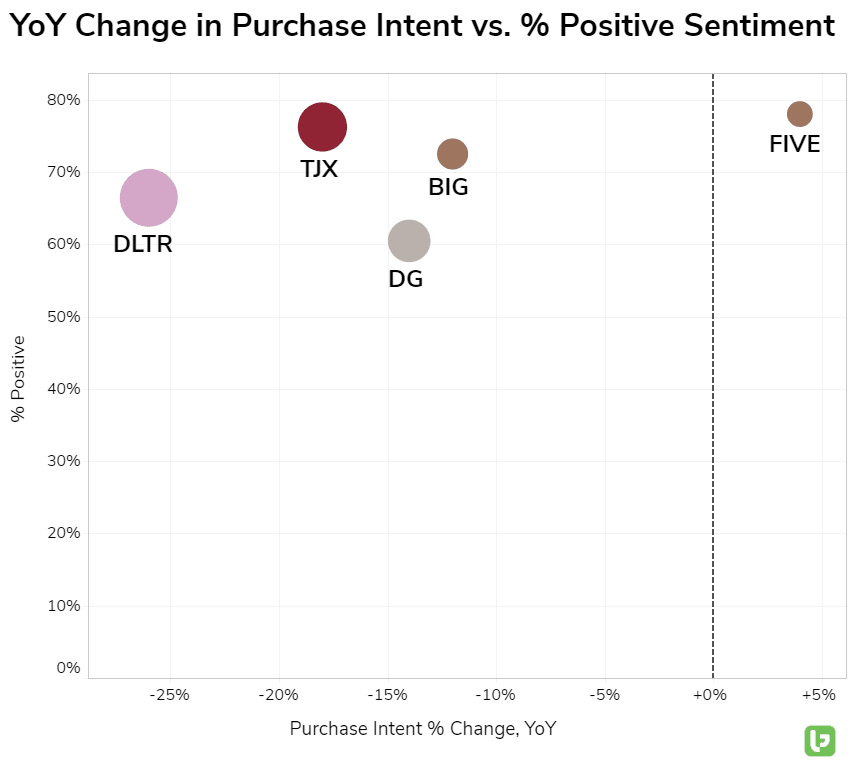

But Dollar Tree has some ground to cover. The chart below shows where Dollar Tree sits in the discount retail market: essentially, a laggard.

Dollar Tree Sentiment is 7 points higher vs. peer Dollar General (67% positive vs. 60% positive), but trails fellow novelty discount retailer FIVE (78% positive). It also trails the bunch in Purchase Intent growth.

Last quarter, Dollar Tree reported net sales +7.5% YoY, driven partially by higher average ticket: +19% YoY, and fewer transactions: -12.6% YoY. LikeFolio data can not quantify basket size.

Dollar Tree reports Q4 earnings March 3 before the bell.