eCommerce Fashion Segment Taking a Breather Several notable names in […]

Don't Count this High-End Retailer Out!

The apparel sector kicked off 2023 with cloudy expectations.

Headlines like this dominated the news cycle:

Consumers, stretched from persistent inflation indicated they were less willing to spend on softgoods like apparel, footwear, and accessories.

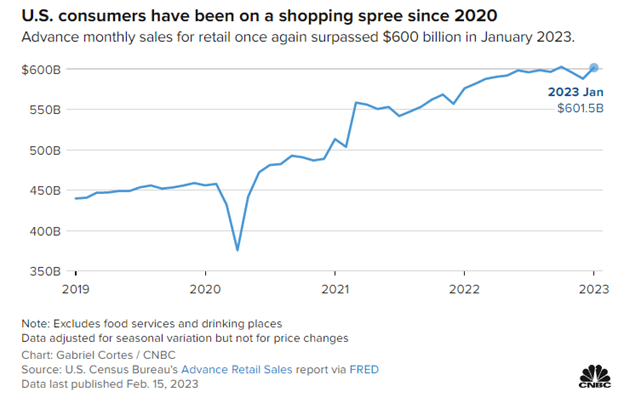

Advance monthly retail sales in January exceeded $600 billion but also reflected a slowdown in growth vs. levels recorded a year ago.

In addition, unsold merchandise and forced price reductions weighed on company margins.

So – doom and gloom for apparel retailers?

Not necessarily.

Thanks to LikeFolio consumer insights, is possible to spot some diamonds in the rough.

By listening to real-time consumer mentions of purchasing apparel items and understanding how satisfied consumers are with their purchases, we’re able to identify which companies are rising above the rest.

One company that caught our attention 5 months ago continues to outperform…

Revolve Group (RVLV)

Revolve is an online retailer for high-ish fashion.

The company’s apparel is on-trend, well-made, and flaunted by some of the most well-known celebrities and influencers (like Sydney Sweeney).

Not quite runway-level, but definitely a higher price point than anything you’re going to find at Target or other fast-fashion e-commerce retailers, like Shein.

In 2022, the average value of an order from Revolve was $304.

This semi-luxury status is what caught our attention in October when we featured RVLV on a High End Retail MegaTrends report.

The stock has gained as much as 48% in value since that send.

However, it has given back a good chunk of those gains over the last month.

And according to LikeFolio data, a double down is warranted. Here’s why…

Revolve Demand is Rising Ahead of the Peak Shopping Season

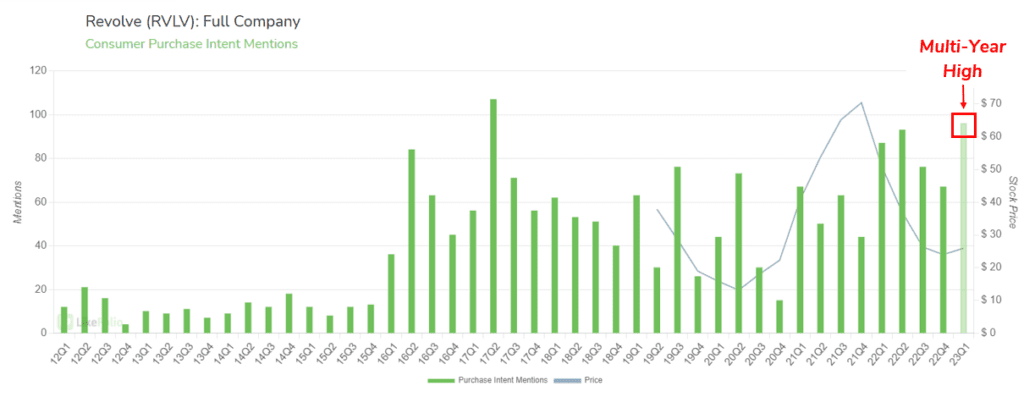

Consumer mentions of shopping with Revolve are on pace for the highest level we’ve recorded since the company’s pre-IPO days.

This is critical, especially heading into “festival season” in Spring and Summer when Revolve’s apparel pieces (and influencers) shine.

RVLV shares popped last month after the company exceeded Q4 expectations and said it expected sales momentum to continue.

Continued Purchase Intent growth confirms ongoing momentum on the consumer front.

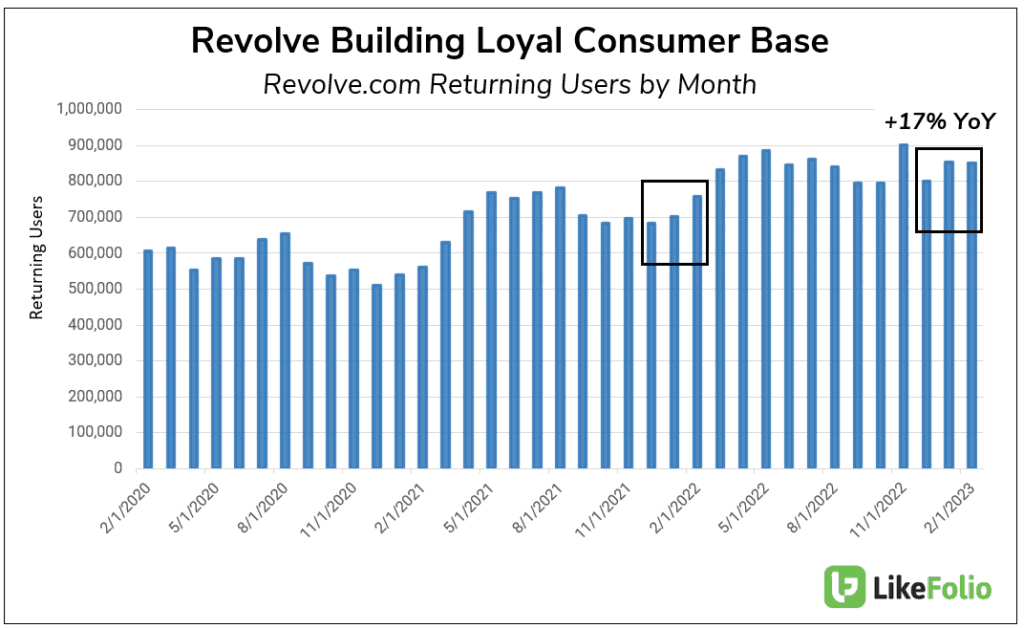

Digital Web Traffic Confirms Demand Momentum

We know Revolve is doing a good job of attracting new shoppers.

Last quarter, Revolve active customers exceeded 2.3 million, with 500K added over the last calendar year alone.

But we also know that Revolve is doing a good job of incentivizing existing customers to come back for more.

Returning web users grew by +17% YoY over the last 3 months.

This is an acceleration vs. 2 quarters ago when returning user growth was +10%.

What do consumers love?

Revolve’s High-End Apparel Keeps Customers Happy

Revolve Consumer Happiness is near 90% positive.

That means 9/10 consumers discussing their experience with the brand are reporting a positive experience.

For apparel – especially an online-based retailer – that sentiment level is extremely high.

Users on Twitter seem to love the quality of Revolve clothing and how fast orders ship. One user even compared the clothing company to Amazon.

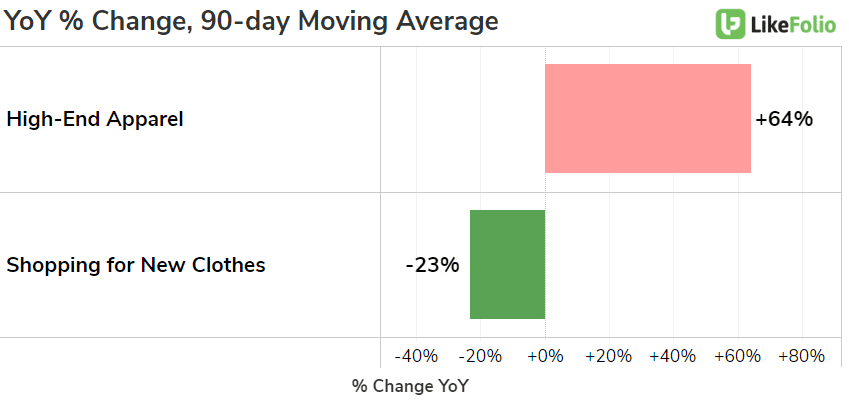

These shoppers appear willing to spend more on high end apparel for the perceived quality.

And they aren’t alone.

Consumer demand for high-end apparel continued to significantly outperform generic apparel shopping mentions.

Looking Ahead: RVLV

RVLV shares continue to trade above levels from October but are trading -15% lower in March alone.

This increasing divergence in share performance vs. consumer demand may present investors with a double down (or initial entry) near-term for a retailer showing signs of continued outperformance vs. peers.

We’ll continue to monitor through the peak shopping season, but early signals support our existing Bullish position.