Roku makes streaming devices that allow its customers to stream […]

Early holiday winners: EBAY, AMZN, and debt

The week after Thanksgiving is extremely important in the retail sector. Much like the Apple Keynote event, it’s a week when consumers tip their hands!

What is the hottest item on their list? Where are they shopping? And are they spending more than last year?

At LikeFolio, we were listening to consumers in real-time. And to be honest, some of these insights were surprising, even to our research team!

But Andy, give it to me straight, you say. What’s the real health of the consumer?

To put it bluntly: The consumer is strong…thanks to debt!

Many factors informed this outlook, as you’ll see below.

Hot off the data press, here are LikeFolio’s Top 6 Holiday Shopping Takeaways:

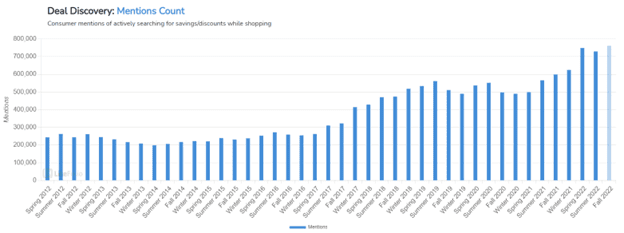

Value Matters

- Consumer mentions of actively searching for savings/discounts increased by +30% YoY in the month of November, now at all-time highs.

- Private label demand is also rising, with mentions from consumers shopping for generic or store-brand items up +50% YoY.

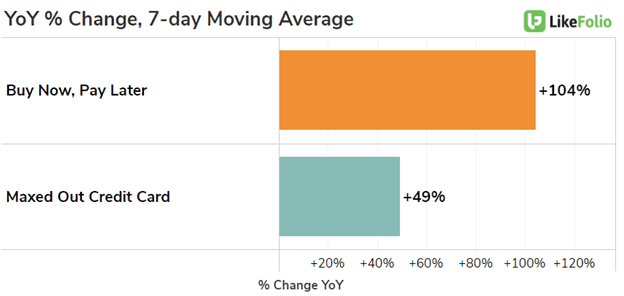

Consumers are Kicking the Can Down the Road, Relying on Financing to Complete Purchases

- Buy Now, Pay Later usage increased by +104% YoY during cyber week, and mentions of maxing out credit cards increased by +49% YoY.

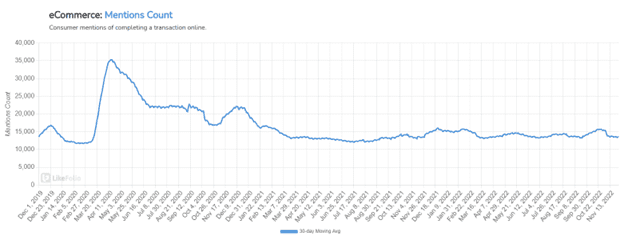

The In-Store Experience is Superior (and so is Mobile Shopping)

- Consumer mentions of shopping in a brick-and-mortar retail location increased by +13% in Nov. 2022 vs. 2021.

- eCommerce mentions slipped by -3% in the same time frame.

- However, one segment of eCommerce grew significantly: Mobile Shopping. Mobile shopping mentions increased +37% YoY during Cyber week.

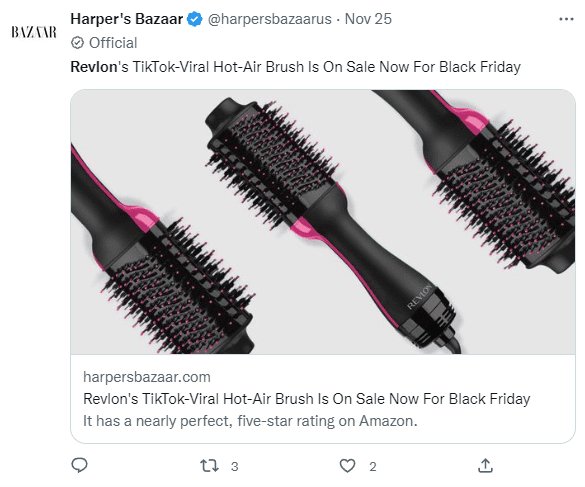

The TikTok Effect is Real

- Demand for Glossier, Henkel (HENOY), and Revlon (REVRQ) all surged on Black Friday thanks to product endorsements on the social media site alongside retailer sales.

- Example: Glossier's Swiss Miss Lip Balm, Henkel's Dial Soap, and Revlon's viral Hot Air Brush.

- Across the board, consumer mentions of shopping for brands/products discovered on social media increased by +100% YoY.

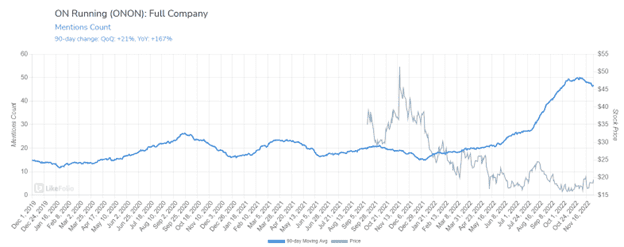

Trendy Footwear is Poppin'

- Many consumers can expect a new pair of shoes under the Christmas tree. The top brands?

- On (ONON) +264% YoY

- Hey Dude Shoes (CROX) +195% YoY

- Birkenstocks +39% YoY

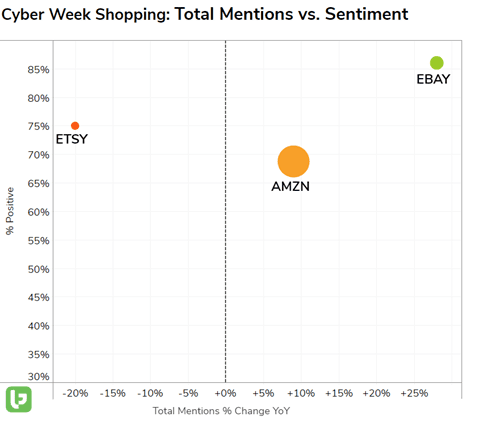

eBay and Amazon are Feeling the Love

- While overall mentions of shopping online were fairly flat, AMZN and EBAY outperformed.

- Top brands on AMZN included Hydroflask (HELE), AAPL accessories (Airpods and Airtags), Crocs (CROX), and generic hoodies made by HBI (Hanes and Champion).

- Amazon's eCommerce prowess may be expected, but eBay's performance is a surprising improvement vs. last year that fits alongside the company's value proposition.

- In contrast, ETSY demand continues to fade -- is the company getting edged out as small companies launch shoppable content on social channels?

Of course, it’s still early. We’ll be closely monitoring these trends through the rest of the month to see who stays on Santa’s nice list.

Members can expect an update once the dust-- err tinsel -- has settled.