Celsius (CELH) Demand is Strong Ahead of Earnings Underlying consumer […]

Everyone’s Drinking Celsius $CELH

Celsius is an energy drink company that’s on the rise…

The company's Q4 earnings smashed both EPS and revenue expectations.

In fact, the company’s Q4 revenue increased +192% from the $35.7 million it reported in Q4 2020.

And, to LikeFolio subscribers, it's no surprise that the numbers are represented in the data we are seeing…

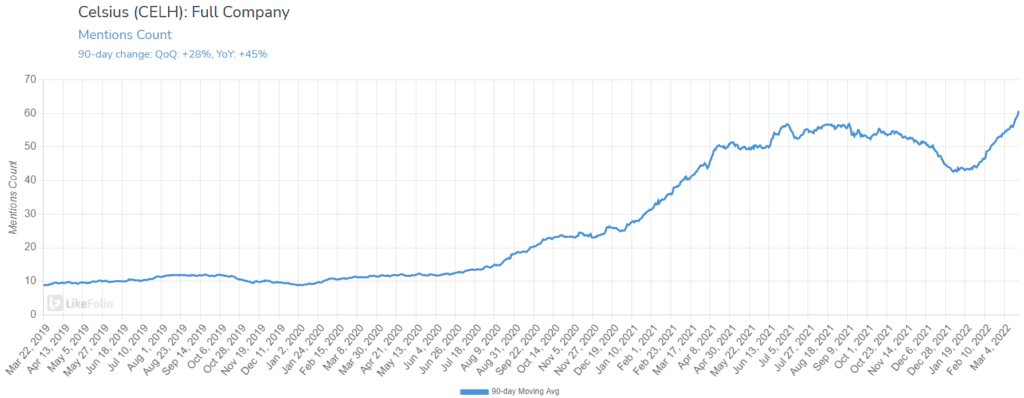

The Overall Mentions count of the company and its drink are trending at +28% QoQ and +45% YoY on a 90-day MA.

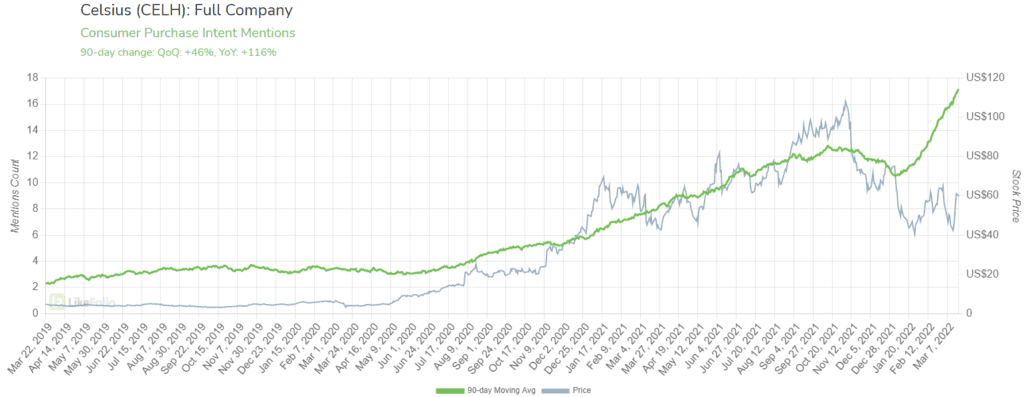

That is of course impressive, but not as impressive as Consumer Purchase Intent Mentions, which are at a whopping +46% QoQ and +116% YoY.

It really is a great representation of the company’s growth over the past year or so.

Most of that growth has come domestically in the US, with domestic revenue jumping by +238% in Q4 to $95.9 million, up from $28.4 million in Q4 2020.

Meanwhile, international revenue increased +15% to $8.3 million, from $7.3 million.

Despite the rise in revenue and earnings, the company’s shares like most other stocks this year, have hit a bit of a hurdle, down -20% in 2022…

A discount, maybe?

Well, let’s not jump to that conclusion just yet. There is a lot more that goes into our analysis of a stock before we assess if it is a potential buying opportunity or not.

Consumer metrics for the company look very good, and while it's not one we are jumping into just yet, it is a stock we are looking at and analyzing very closely.