eCommerce Fashion Segment Taking a Breather Several notable names in […]

Exclusive: Earnings Season Preview

July 8, 2022

| Earnings Season is our favorite time of the year. Why? Because LikeFolio’s consumer data gives us a unique advantage…We can predict which companies will surprise the market and which ones will disappoint expectations. How? Earnings Scores. Our Earnings Scores compress the underlying data for a given company and provide a snapshot of its near-term performance on a scale of -100 (most bearish) to +100 (most bullish). Combined with other factors like price momentum and past performance, these scores allow us to identify opportunities for actionable earnings trades. Grocery Outlet ($GO) is a great example from last quarter: |

| With a very bullish Score of +62 backed by strong macro tailwinds, we decided to take a big shot to the upside…GO shares gained by more than +15% on the week, and LikeFolio booked a +360% gain with a bullish call spread. This is just one example of our earnings edge in action, and with 300+ covered companies, there’s never a shortage of setups. Here’s a sneak-preview of 4 companies that we’re excited to trade this quarter: Oversold Tech Unicorns ($POSH & $OPEN) It’s an understatement to say that unprofitable technology companies have sold off recently. Many tech “unicorns” have declined by -75% or more from the highs seen in 2021, but bullish Scores suggest that some of these names could be due for a relief rally this quarter. Shares of the clothing resale platform Poshmark (POSH) are down -90% from their January 2021 debut and -35% YTD. But contrary to Wall Street’s outlook, the LikeFolio Earnings Score is starting to reach new highs: |

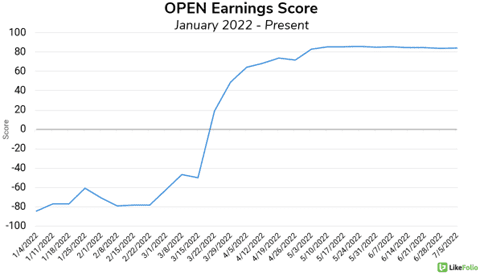

| Currently, the Earnings Score is sitting at a new high in 2022: +79. Opendoor (OPEN), an online real estate marketplace that went public in 2020, hasn’t fared much better, with shares down -65% YoY. |

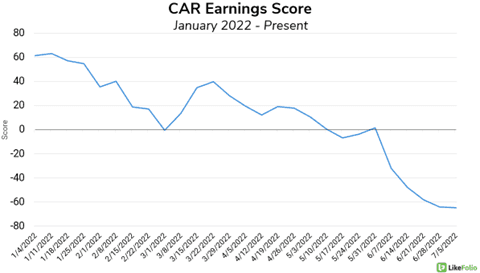

| Its earnings score is showing similar strength: +84. These “oversold” names are hated by Wall Street but could surprise big to the upside when earnings are released. We’ll be looking at “home run” swings on these names as the Earnings Season progresses. Car Rental Weakness ($CAR & $HTZ) Last year’s auto shortage and travel restrictions made rental cars a hot commodity. Now, gas prices are soaring, consumers are returning to air travel, and LF earnings scores suggest a slowdown in revenue for car rental companies. Avis (CAR) was a huge bullish winner for us in 2021 — We rode the stock from below $100 in June to a blow-off high of $500+ in November. Although CAR shares are still up by more than +100% YoY, they’re showing signs of weakness. |

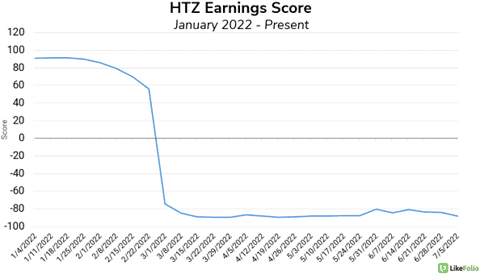

| CAR’s earnings score has been trending lower for most of the year, currently a decidedly bearish -64. Hertz (HTZ) enjoyed an equally incredible influx of consumer Demand in 2021, which resulted in the share price gaining by more than +200% in a matter of months. The stock has already pulled back -32% YTD, and considering the company’s less-than-stellar balance sheet, we’re expecting to see more selling ahead. |

Hertz’s Earnings Score dove lower in March of 2022 and has remained incredibly bearish since then: -88.

Bottom Line: Preliminary scores are pointing to hidden strength for several oversold tech names and a slowdown in the red-hot car rental market.

We’re gearing up for another action-packed season of earnings trading.

The Week 1 Earnings Sheet and video will be going out to LikeFolio Earnings Season Pass subscribers Sunday, July 10th at 7pm ET!