Despite recent market volatility and some arguing for a bear […]

Expecting a Lyft into Earnings

Lyft (LYFT)

Last week, we were ready to roll into LYFT earnings with a clear bullish lean.

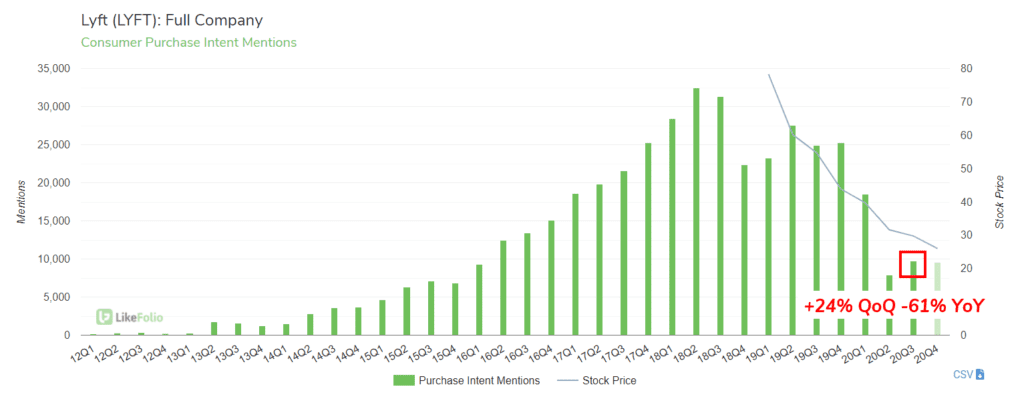

Demand in 20Q3 showed signs of recovery. While ridership mentions were down YoY, they increased 24% QoQ, in-line with Lyft's positive note of rideshare recovery in July and August.

Since then, LYFT shares have gone for a ride.

- Californians approved Prop 22, allowing ridesharing companies to classify drivers as independent contractors vs. employees (UBER and LYFT shares jumped on this announce).

- Positive vaccine trial news sent LYFT shares rocketing higher, as investors became optimistic about a sooner-than-later return to normalcy.

We also watched UBER beat expectations as its food delivery segment drove success. Uber Eats revenue increased +125% YoY and bolstered gross bookings.

Lyft does not boast the same diversified business model as Uber, and Uber's rider bookings did not meet expectations.

LYFT shares are down ~15% YTD but have rallied of late, gaining 23% since Friday's close.

While our Earnings Signal leans bullish, recent activity has us questioning if investor expectations are too high.

Landon talked about this today on the TD Ameritrade Network.

Zoom Video Communications (ZM)

Has ZM Peaked? Demand for Zoom Video peaked in April, and shares followed suit. Since then, Purchase Intent Mention volume has leveled off at a considerably high level, +1337% YoY in the past 30 days.

COVID vaccine optimism has caused shares of Zoom Video to crash more than -25% since Friday close, casting a shadow of doubt over the stock's future. We're watching to see if usage mentions sustain...