LikeFolio's MegaTrends June update for hedge funds highlighted some unbelievable […]

‘Fake Meat’ is a Tough Pill to Swallow

Beyond Meat is having a rough time.

And that’s putting it lightly.

The once-favored plant-based meat company’s shares have fallen more than 83% in the last 12 months.

The initial hype for plant-based meat pre-empted this share purge.

We spotted this major consumer behavior tide shift back in October 2020 -- and we subsequently released a Bearish alert for members featuring BYND.

At the time, it was trading at over the $100 mark — Now, it’s down to $25 per share.

It’s easy to see why.

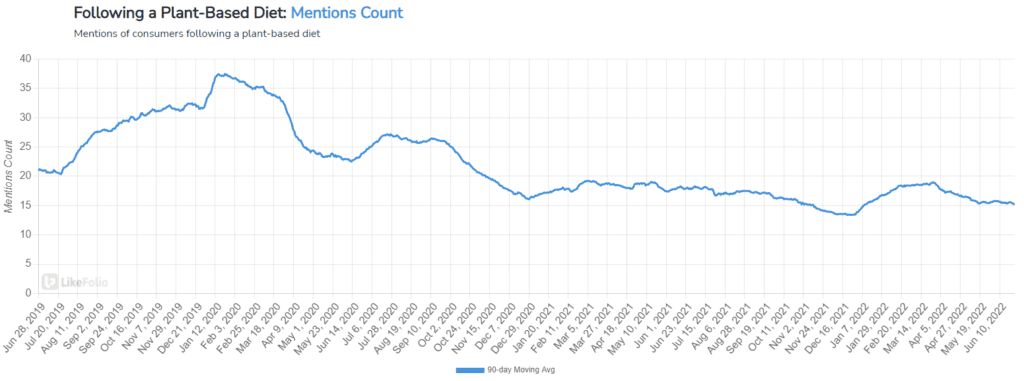

LikeFolio data shows that plant-based diet trend adoption has steadily dropped since peaking at the end of 2019.

Consumer mentions of following a plant-based diet are currently pacing -20% QoQ and -15% YoY.

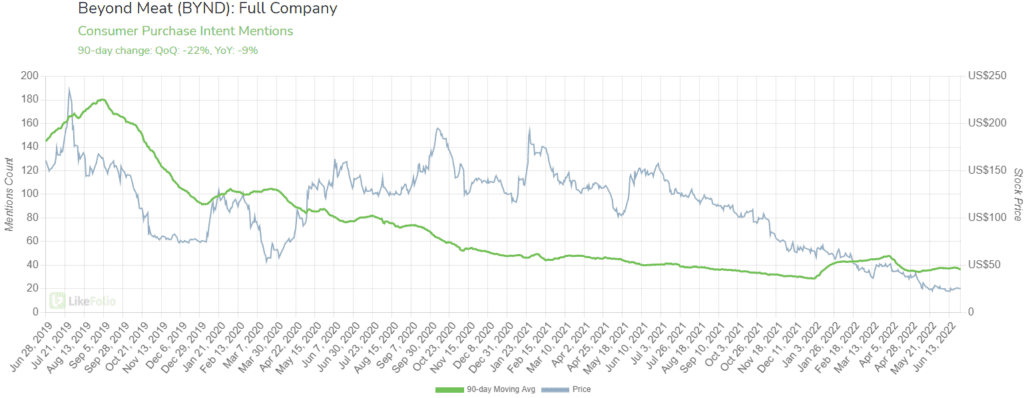

And in near direct tandem, Beyond Meat consumer demand continues to fade.

Despite high-profile tie-ups with celebrities such as Kim Kardashian and Chelsea Soccer player Romelu Lukaku in recent months, Purchase Intent Mentions for BYND have failed to get off the ground, trending -22% QoQ and -9% YoY.

No doubt, those collaborations came at a large cost to the company.

BYND’s tumble has us asking ourselves: is there any sign of any light at the end of the tunnel?

Perhaps…in the very near term.

Here’s why:

Inflation is Driving Meat Prices Higher

Historically, one of the main obstacles to consumers trying and repeatedly purchasing plant-based meat has been elevated prices vs. real meat. Beyond and Impossible Foods have been working to improve pricing for some time.

But now the scales are changing.

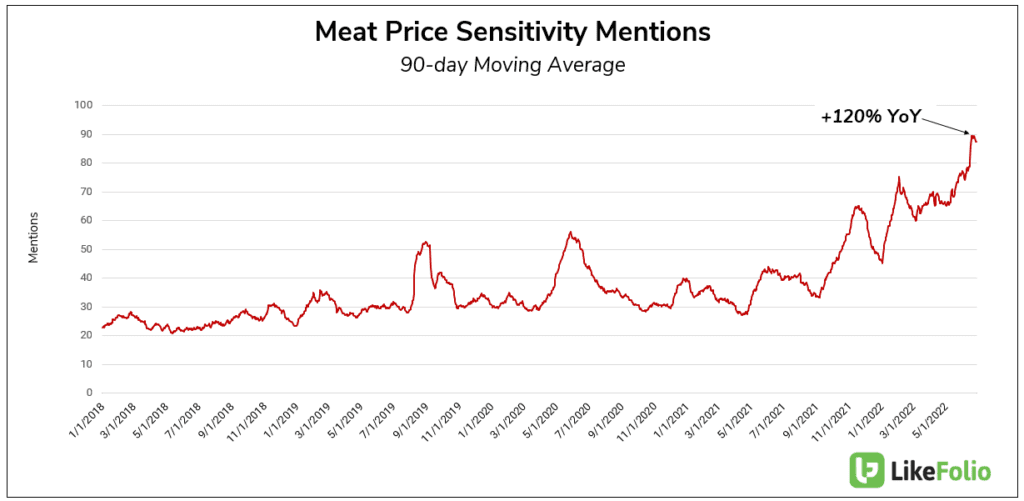

From April 2021 to April 2022 chicken prices have risen 16.4%, beef is up almost 15%, and fish and seafood are up 11.9%.

This is weighing on consumers. Food price concern mentions are at all-time highs, currently pacing more than +300% higher on a YoY basis.

Meat price sensitivity mentions make up a large portion of this trend.

Consumers are starting to take notice…

Beyond Meat Consumer Buzz Improvement

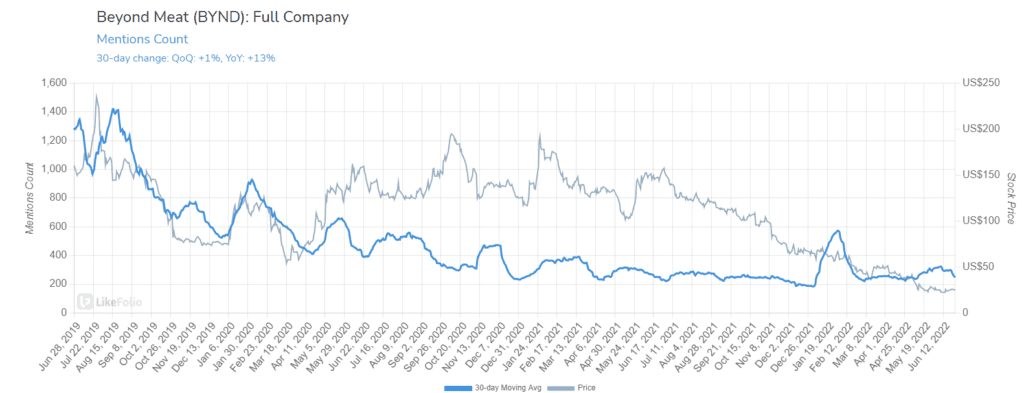

We ARE seeing some early signs of mention volume improvement.

Beyond Meat product mentions have risen by +13% YoY.

While some of this increase is driven by hype from the partnership above, qualitative analysis revealed another trend: consumers are starting to realize Beyond Meat pricing is more affordable, comparatively now.

Beyond Meat affordability mentions have risen by +14% YoY.

Bottom Line: The plant-based meat industry (and BYND specifically) has an opportunity to tempt would-be buyers with price parity for the first time in the company’s history.

But, it’s up to the company to keep any new consumers around and manage internal supply chain pressures effectively.

We’ll be monitoring BYND demand long-term to see if the company can capitalize.