Roku makes streaming devices that allow its customers to stream […]

Fed week preview (SPY, QQQ, AMZN, PTON & more)

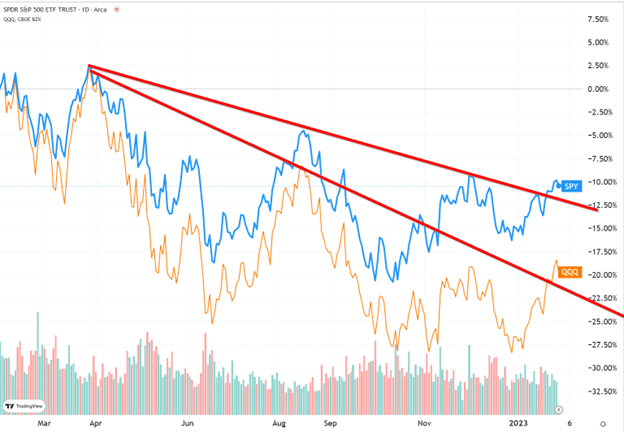

Downtrend break – real rally or head fake?

Both the S&P 500 (SPY) and the Nasdaq (QQQ) moved above their 1-year downtrend levels last week.

The Nasdaq has consistently underperformed the broader market for the past year as tech/growth tends to react more violently to rising interest rates.

Key levels to watch on SPY are 400 and 408 – a break out of this range could result in momentum players extending the move another 3-5%.

On the upside, short-sellers are getting extremely nervous and “boxed in” when SPY gets into the 407-410 level. A break below 400 on SPY could disappoint bulls in a big way as it would return us back into the downtrend range and make last week look like a fluke head fake.

Hit the snooze button until Wednesday

The only thing markets really care about right now is getting as much clarity as possible on the interest rate environment through 2023.

Wednesday at 2pm, the Fed Funds rate is widely expected to be raised 25 basis points to 4.5%.

Traders will key in on the language of the statement and tone in the 2:30 press conference – with bulls banking on indications that the Fed is nearing the end of the rate-raising cycle.

Thursday at 8:30am we get jobless claims data and productivity estimates, which are unlikely to move the needle too much after Wednesday’s fireworks show.

Friday at 8:30am could be another major market-moving event, as monthly unemployment data is released.

My gut tells me the markets may have already priced in a small rate hike and softer language from the Fed. If we don’t get that, things could get ugly --- and even if we do, it could quickly turn into a sell-the-news situation.

I will be cautious with positioning into the event, and looking to sell (or short) into any initial pops on data that comes in “as expected”.

If however, the FED does lay out a clear blueprint for an end to the rate hikes, we could see another monster rally like last week.

Earnings to watch:

UPS (UPS), Mcdonald's (MCD), and Spotify (SPOT) report earnings on Tuesday prior to the open. Let’s see how the overall economy, the fast-food consumer, and the tech audio streamer are holding up.

Peloton (PTON) will be announcing its results on Wednesday before the market -- this could be a tough scene as the stock has rallied more than 50% in January while all indications show that consumer demand simply isn’t coming back.

Amazon (AMZN), Starbucks (SBUX), and Ford (F) each report Thursday after the market closes, which should produce extra end-of-week fireworks.

We’ll be playing earnings throughout the week… keeping positions small and staying nimble in a minefield of economic data.