Spotify (SPOT) purchase intent surging Spotify Purchase Intent was the […]

First Peloton, then Zoom. Is Chewy Next?

First Peloton, then Zoom. Is Chewy Next?

In the past two weeks, covid-darling stocks have been punished after earnings failed to dazzle investors.

- Peloton revenue growth tempered in Q4 and the company posted a tepid outlook. PTON shares have shed more than -10% in value since the company's pre-earnings close.

- Zoom Video (ZM) shares followed suit after the company posted slowing growth, and revenue numbers that just met expectations. ZM is trading more than -16% lower from its pre-earnings close.

LikeFolio highlighted Bearish Earnings Scores for each of these names, citing a significant slow down in growth for both companies.

Next up: Chewy (CHWY).

A different name, but according to LikeFolio data, the same story.

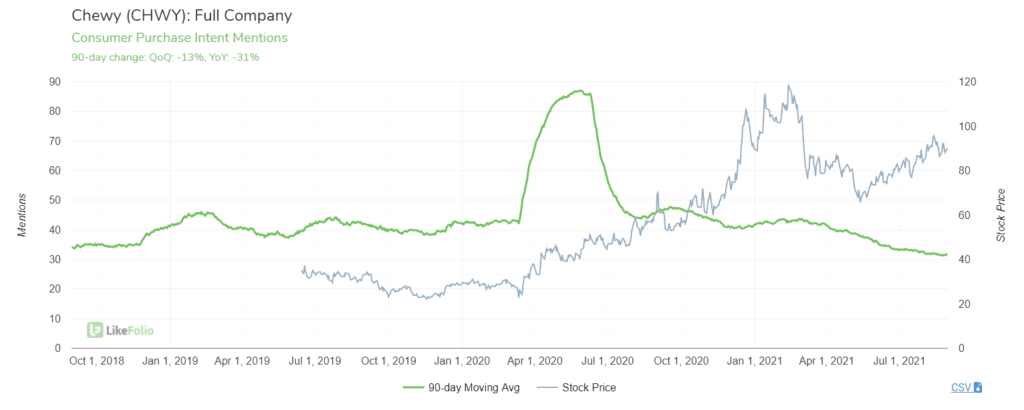

The chart below showcases Chewy Purchase Intent Mentions, which have dropped -31% YoY and are continuing lower.

We were already picking up on this weakness before the company's previous report. Shares tumbled after earnings due to inventory and supply chain concerns that cost the company an estimated $40 million in sales.

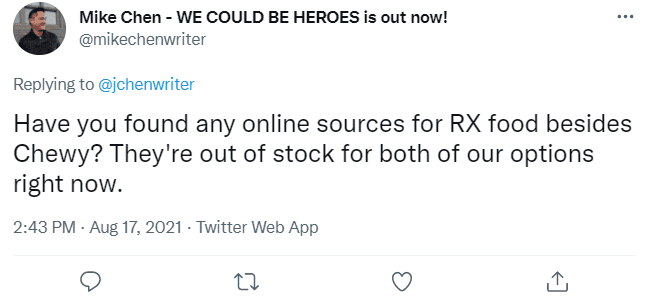

You can see the implications of this present in consumer tweets:

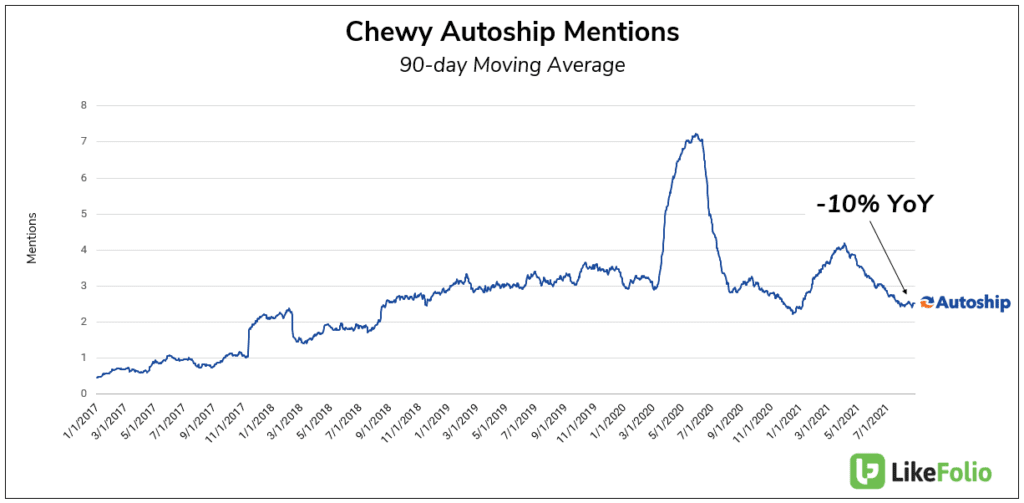

Looking ahead, it will be critical to understand how underlying demand weakness and potential out-of-stock items are impacting Chewy's traditionally extremely happy and loyal consumer base, many of which use Autoship.

LikeFolio data shows signs of some tempering here as well, with Autoship service mentions down ~10% YoY.

On the positive side of things, Chewy's Consumer Happiness levels are stable, just above 80% positive. This is extremely high, and shows that Chewy still has a core consumer base.

But for this earnings event, we're not sure it will be enough.

Chewy reports 21Q2 earnings Sept. 1 after the bell.