Nike reported an awesome quarter Tuesday evening. The stock is […]

Footlocker got a Stimmy Bump...is it enough?

Footlocker got a Stimmy Bump...is it enough?

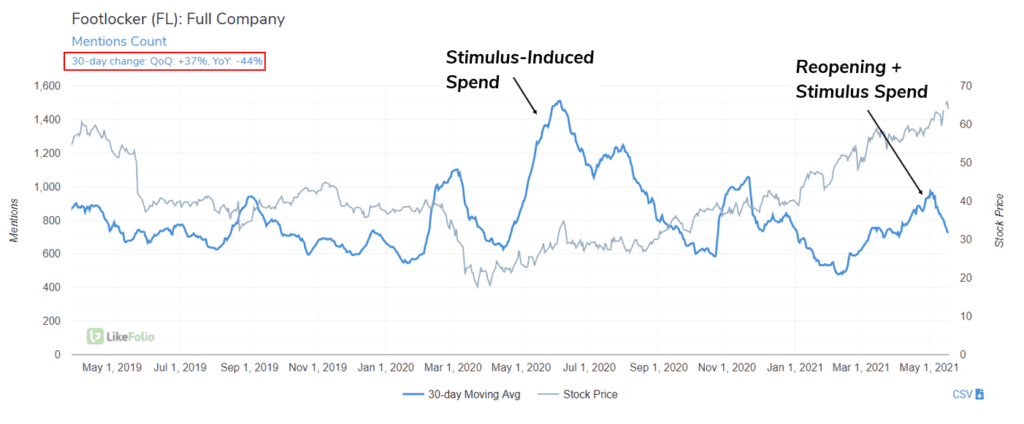

Footlocker may be the purest example of a stimulus injection moving the needle for a company in our coverage universe.

In 2020, we watched a massive increase in Mention volume following the first round of government stimulus checks. FL same-store sales unexpectedly increased by +18% YoY and shares rallied.

However, as our data shows, this injection was short-lived. Buzz retreated to 2019 average levels by October 2020, and again earlier this year.

Recently, we recorded a familiar volume increase....right alongside additional rounds of government stimulus. You can see this reflected in tweets, like this -- and this.

Buzz is currently pacing +37% QoQ, but is normalizing as stimulus infusions dry up.

Another potential driver for unexpected upside in 2021 is the return of foot traffic to malls. Mall shopping mentions are +13% YoY -- but there's not a tough comparison bar.

While FL may suprise investors on its current report, data suggests this is a short-term blip. Footlocker has a lot of ground to make up and is located in an increasingly tough spot.

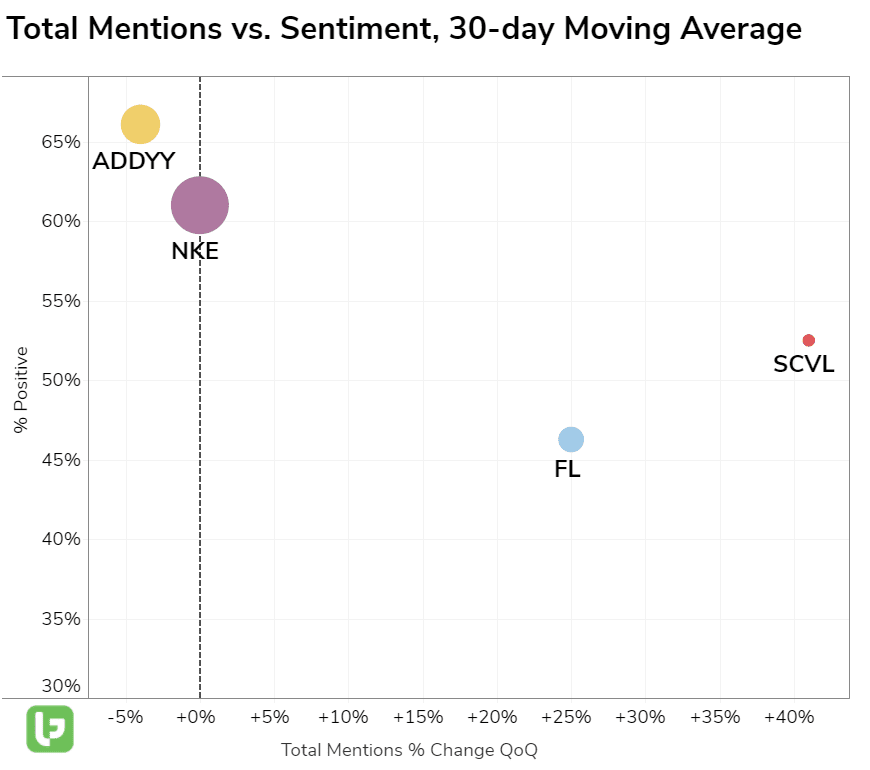

Consumer happiness is significantly lower than peers at 46% positive vs. NKE at 61% positive.

And analysts have described Nike's DTC offense as being "on steroids".

If you're a middleman like Footlocker, this isn't music to your ears -- NKE accounts for 75% of all merchandise purchased.