Harley-Davidson found itself in hot water with the President when […]

Harley-Davidson Has a Brand Problem

Harley-Davidson Has a Brand Problem

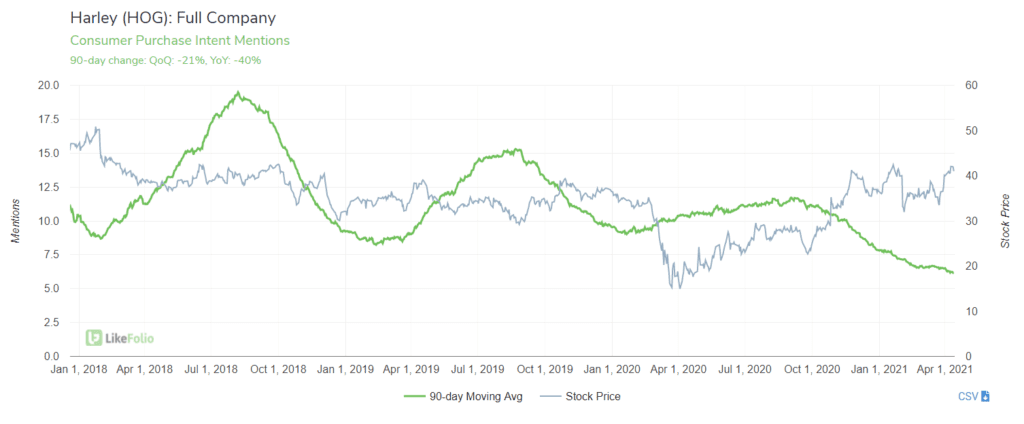

HOG just capped off the company's 10th quarter in a row of YoY Purchase Intent decline. In fact, 20Q1 marked the lowest demand volume we've ever recorded. Purchase Intent Mentions for Harley-Davidson Motorcycles and related products are currently pacing -40% YoY on a 90day moving average.

And as demand falls, so is consumer happiness: -4% YoY. Harley-Davidson sentiment is 6 points lower vs. that of Polaris' Indian Motorcycles brand (77% positive vs. 83% positive). Last quarter, HOG posted a fourth quarter loss of $96 million, with revenue declining -32% YoY. North American Motorcycle sales fell, bike sales fell, and it exited 39 markets world wide. Shares tumbled -13% in pre-market trading. Ouch. Since then, the stock has completely recovered. Some investors are hopeful in a five-year turnaround plan, "The Hardwire" featuring capital investments, a used bike program, and a separate division for electric motorcycle development. But the industry shift to electric could be a headwind for Harley-Davidson -- its brand is partially built on the sound and experience of a big, loud bike on the open road...a tough experience to pitch to a younger generation. Meanwhile, Polaris has successfully engaged a new generation (and women), suggesting it may be better positioned to capitalize on these shifting consumer preferences. On its last report, Polaris noted +30% growth in millenial customers and +40% growth in female customers in FY20. The electric scooter market is expected to more than double in the next decade, reaching $42 billion by 2030. This is a trend we're closely tracking, but we're certainly not seeing traction within HOG at the moment.