When social-data and stock price are moving sharply in opposite […]

Has eBay Missed the Boat?

Has eBay Missed the Boat?

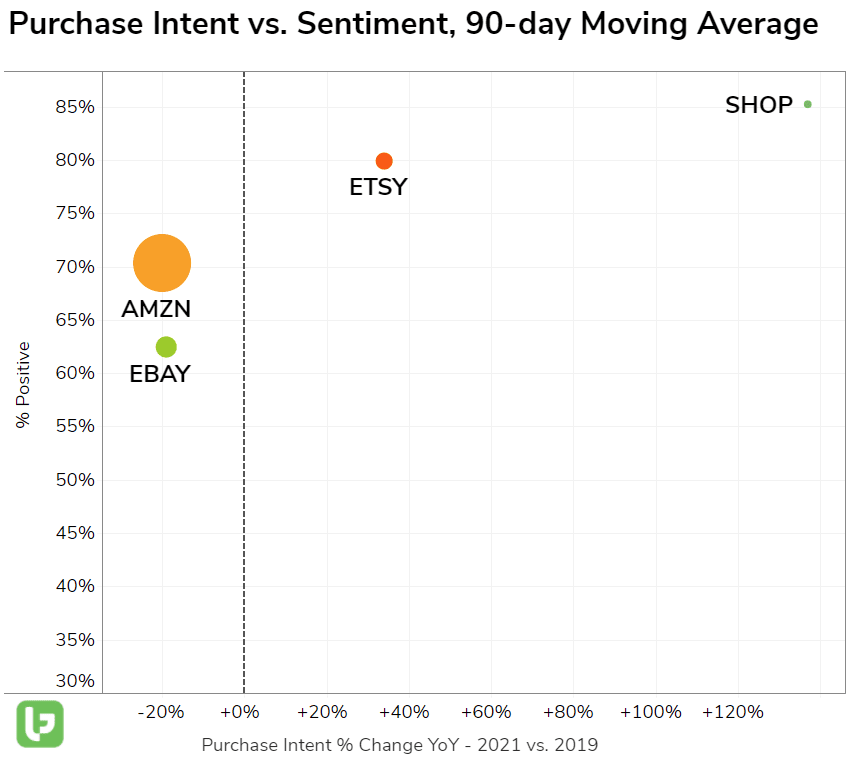

eBay is a classic story of what could have been. The company was a first-mover in the eCommerce space but is quickly losing favor with consumers to the Amazons, Facebook Marketplaces, and Etsys of the world. You can see how eBay stands vs. eCommerce peers on the outlier grid below:

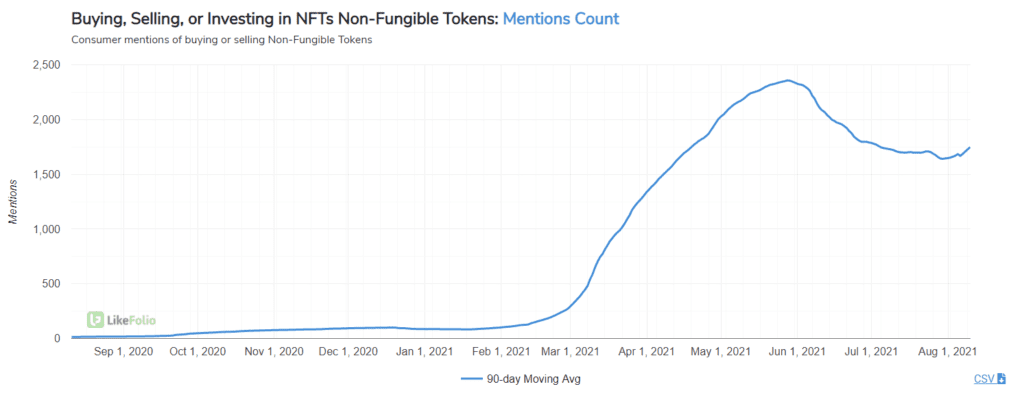

Purchase Intent growth is slowing, and Consumer Happiness is low. eBay sentiment is 63% positive -- much lower vs. platforms AMZN (70%), ETSY (80%), and SHOP (85%). What is driving Negative Sentiment for eBay? Consumer mentions often reference logistical issues (in buyer/seller fulfillment), unexpected fees, and low-quality items. Shopify and Etsy could prove to be viable threats to eBay long-term, as Shopify makes it easy to set up an eCommerce platform and ETSY offers a platform with a better-reported consumer experience One positive tailwind is worth noting. EBAY is well-positioned to capitalize on rising consumer interest in collectibles from trading cards to luxury items. Trading card active buyers doubled in the U.S. last quarter. EBAY has expanded its potential capture here by allowing for the sale of Non-Fungible Tokens (NFTs). Shopify also supports this. Total mentions volume for NFTs has increased exponentially in the last year.

EBAY shares sold off more than -10% after its last report because the company indicated it expected sales volume growth to slow in Q2 (from +24% YoY to 8%-10% YoY). LikeFolio data supports a slowdown in growth. EBAY reports 21Q2 results August 11 after the bell.