Healthy Energy Drinks Net +70% gains in 2022 $CELH

This week I stopped by my favorite smoothie shop for a post-workout recovery treat.

While I was waiting, I scanned the macro-nutrient-packed snack items around. High protein cookies and power bars…and a fridge full of energy drinks.

Wow, I thought. Energy drinks have officially transitioned from every mom’s worst nightmare to a healthy pick-me-up in a smoothie shop.

But these weren’t just any energy drinks. They were all Celsius (CELH).

The display made my LikeFolio heart grin. Because we’ve been closely following the company (to the upside) for years now.

And this is one more signal that the company’s strategy is indeed working.

Here’s how we spotted Celsius (CELH) as a major winner – TWICE – well before the energy darling went mainstream.

And why we think the company may just be getting started…

Celsius Broke the “Energy Drinks are Unhealthy” Mold

Celsius worked meticulously to carve itself a niche among health-conscious consumers.

With ingredients like green tea, guarana seed extract, ginger root, vitamins B and C, and chromium – alongside the caffeine kick that fell under daily recommended values – consumers can reach for this slim can and not feel bad about it.

And they have been…in droves.

We first noted this when we added the company to our coverage universe…way back in May 2020…when CELH shares were trading around $7.

The stock crossed $80 last week.

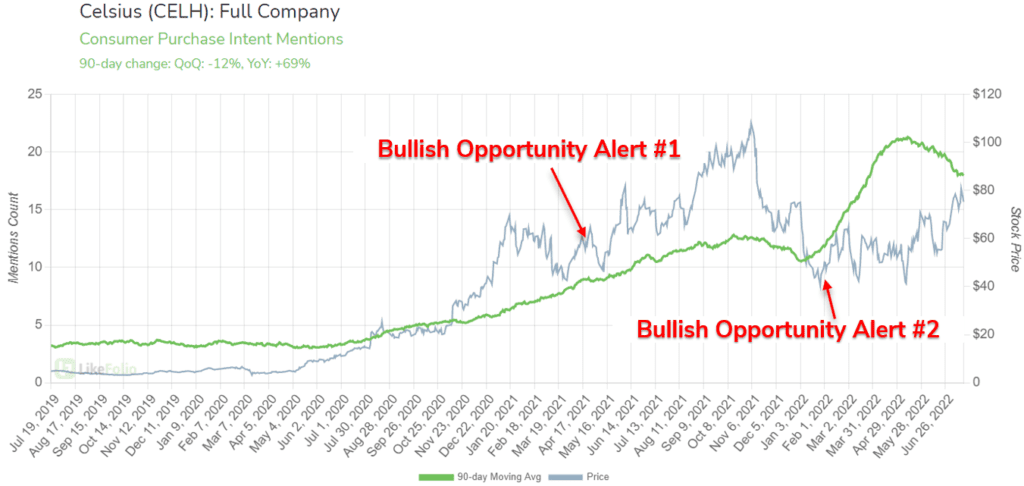

In fact, we’ve tripled down on this company, issuing Bullish Opportunity Alerts twice in the past 2 years.

In both instances, consumer demand was ramping while the market struggled to understand the hold the energy drink had on consumers.

You can see these demand mentions represented on the green line above.

And you can also see the stock gains that followed on the gray stock price line.

Both alerts presented an opportunity for more than +70% in gains.

But another thing should catch your eye.

Consumer demand hit all-time highs following consumer New Year Resolutions this year. And it’s holding higher.

Celsius is (Still) Stealing Market Share

We’ve watched Celsius chip away at the lead established by other monsters in the energy drink sector for years – pun intended.

Data suggests this demand steal remains underway.

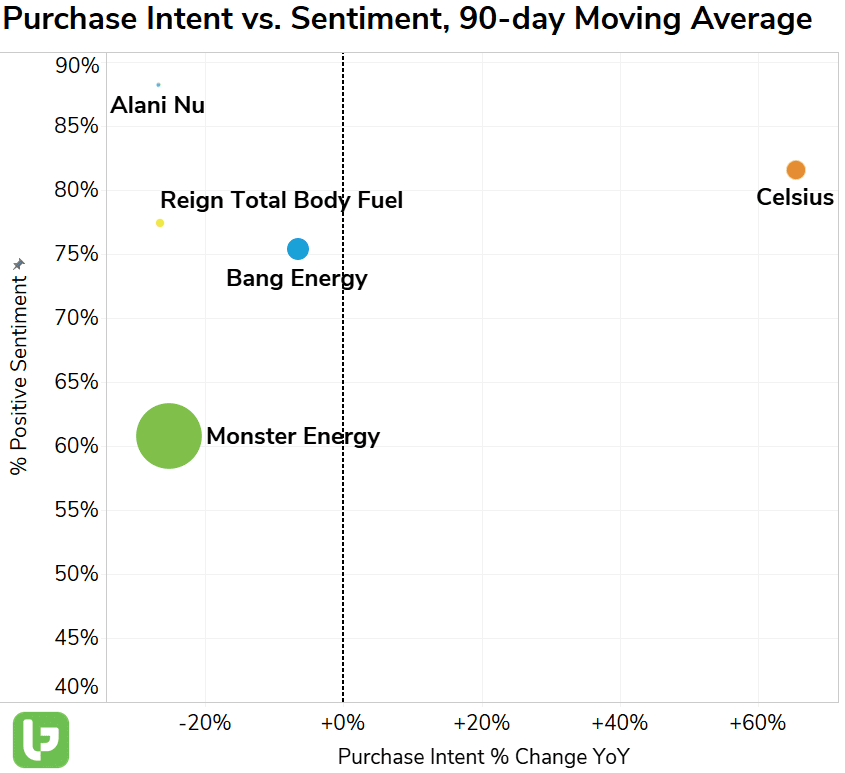

This outlier grid paints a great picture of some of the largest players in the energy drink market.

Celsius continues to outperform peers in demand growth and happiness levels.

CELH is still growing rapidly.

The potential for this growth is put into scale when you consider how Celsius is stacking up vs. energy drink behemoth, Monster (MNST).

Monster is the clear dominant force in the industry – comprising more than 80% of demand volume mentions among energy drink brands in the last month.

MNST quarterly revenue in 22Q1 came in at $1.519 billion, representing +22% YoY growth.

But Celsius is growing much faster.

CELH quarterly revenue in 22Q1 came in at $133.39 million, representing +167% YoY growth.

The tide continues to shift in favor of an energy drink that consumers don’t have to feel guilty about consuming.

And the global market for energy and sports drinks is expected to exceed $224 billion by 2026. Enormous opportunity.

We’ve got a close on CELH moving forward, and in the meantime, we’re sticking with our Bullish outlook.

CELH may just be getting started.