Tesla reports earnings after the bell on Wednesday. After last […]

Here’s Why We are Bearish Ahead of Tesla's Earnings

Sorry Tesla bulls…we are bullish long-term, but for now, not so much.

You see, at the moment, there are some headwinds that the electric vehicle giant will have to navigate first.

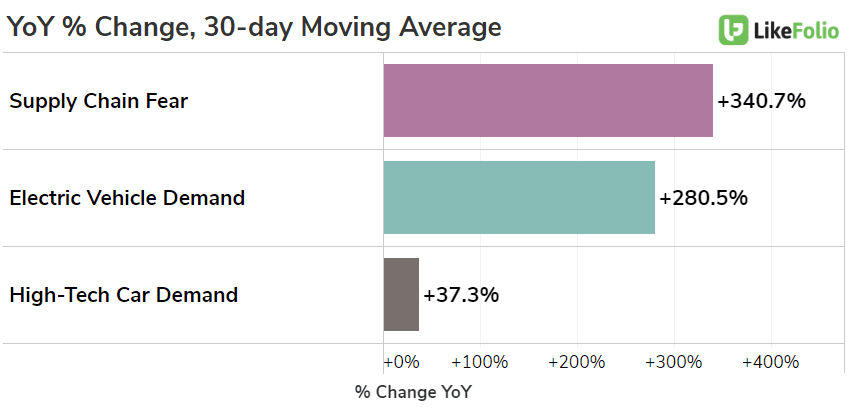

These macro headwinds are, as you may have already noted, chip shortages, global supply chain challenges, and factory shutdowns.

For example, Tesla's factory in China is currently on a production pause due to a COVID-19-related lockdown in Shanghai.

This is an issue as it can take time to beef up production at new factories.

Tesla itself warned that supply chain issues remain the “main limiting factor” in 2022.

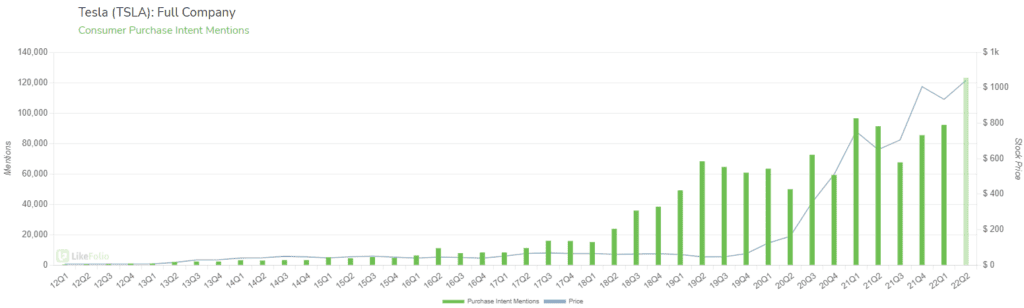

Looking at the company’s Purchase Intent Mentions, we can see that while the reporting quarter climbed +8% QoQ, it came in at -5% YoY...

(The current quarter has, of course, been impacted by Musk’s bid for Twitter)

Tesla posted its first-quarter deliveries earlier this month, which missed expectations — but it should be noted that analysts were mixed in their opinions on whether it was a good or bad report.

Nevertheless, Consumer Demand in the reporting quarter decelerated.

Furthermore, Tesla’s Consumer Happiness is lagging behind its peers, currently sitting at 70%, or -5% YoY.

For reference, Fisker’s Consumer Happiness sits at 84%, +4% YoY, and GM at 71% and +2% YoY.

And like we've stated before, EV demand is skyrocketing...

Bottom Line: So, despite a surge in EV demand YoY, the supply chain fears and other factors translate to a bearish stance heading into TSLA earnings on Wednesday.

However, as mentioned, we believe TSLA is still a long-term play if production, supply chain, and chip/battery issues and shortages ease moving into the second half of the year. At the moment though, that looks tough.