How Big is Altria’s Juul Problem?

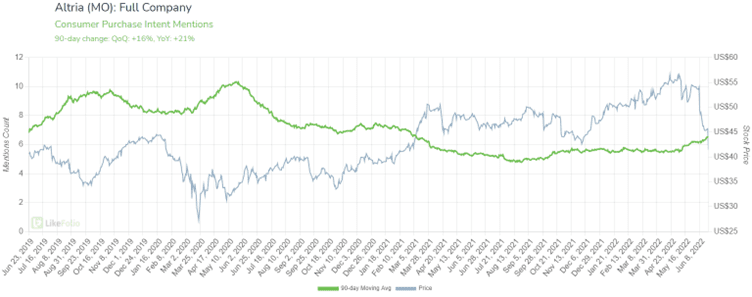

| Altria is one of our “Sin Stocks” to watch… Demand for the tobacco products company is trending +16% QoQ and +21% YoY. |

However, it’s run into a problem.

The FDA confirmed Thursday that it has issued marketing denial orders for its products in the US, meaning it must stop selling and distributing its products.

Juul has faced heightened scrutiny for a few years over its marketing of nicotine products and their appeal to teenagers.

After delaying their decision on Juul products in May to look at the public health impacts, the FDA has reportedly decided to order Juul’s e-cigarettes off of shelves in the US.

Altria, which owns a 35% stake in the vaping product's maker, tumbled 9.2% in response.

The tobacco company invested a hefty $12.8 billion in Juul in 2018.

But that has since plummeted with the estimated fair value of Altria’s investment in Juul at the end of March being $1.6 billion.

The decrease in Q1 was recorded as a pre-tax unrealized loss of $100 million (or $0.05 per share).

In 2018, Juul was said to be generating an annual revenue of around $2 billion.

However, lawsuits and awareness regarding the dangers of e-cigarettes have seen the company lose significant market share since then, and it reportedly recorded a net loss of $259 million in 2021, with net sales falling to $1.3 billion.

The decision by the FDA will likely be appealed by Juul, with its products remaining on the market until the outcome of that appeal…

So in the meantime, here’s what we will be watching:

Vaping Mentions Climb Again

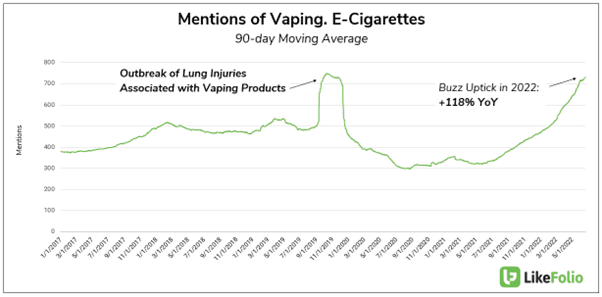

A report by News In Health stated that about 37% of 12th graders reported vaping in 2018, compared with 28% in 2017.

However, after an initial surge in the latter part of 2020, caused by an outbreak of lung injuries associated with vaping products, mentions quickly fell.

Even so, 2021 saw another uptick, which has followed through to this year.

Juul Demand

The demand decline and loss of market share is easily visualized through Purchase Intent Mentions which are trending at -4% YoY.

However, unlike vaping mentions, they are still nowhere near the highs of 2019.

If the FDA comes to the same conclusion after the potential Juul appeal, it would be catastrophic for the company’s already dwindling market share.

Bottom Line: In truth, it looks as though Altria’s investment in Juul has been a mistake. Juul’s trouble with regulators and heightened scrutiny mean Altria has always been fighting against the tide.

While there is still hope in the form of a potential appeal, Juul’s market share has tumbled since Altria made its initial investment.

Nevertheless, if there is a change of heart by the FDA, we will be watching to see if/how consumer demand for Juul products alters.