Inflation Fear is Impacting the Markets LikeFolio data shows that […]

Inflation Fear vs. Investor Fear

Inflation Fear vs. Investor Fear

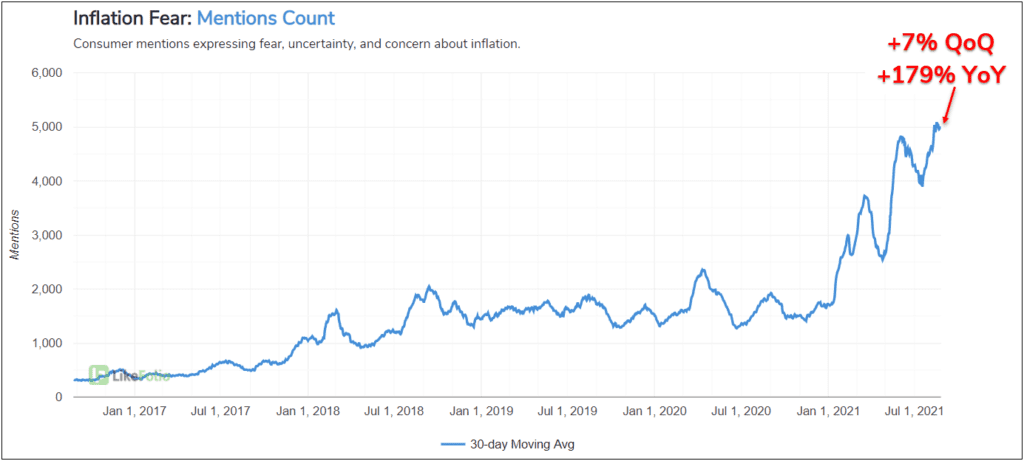

Consumers expressing concern and uncertainty about inflation, 'Inflation Fear', has proven to be one of the most powerful trends in 2021. LikeFolio data shows that awareness of inflation began to rise at the start of the current year. CPI reports have since sparked a massive move higher, with the trend up a whopping +179% YoY and still rising (30-day moving average).

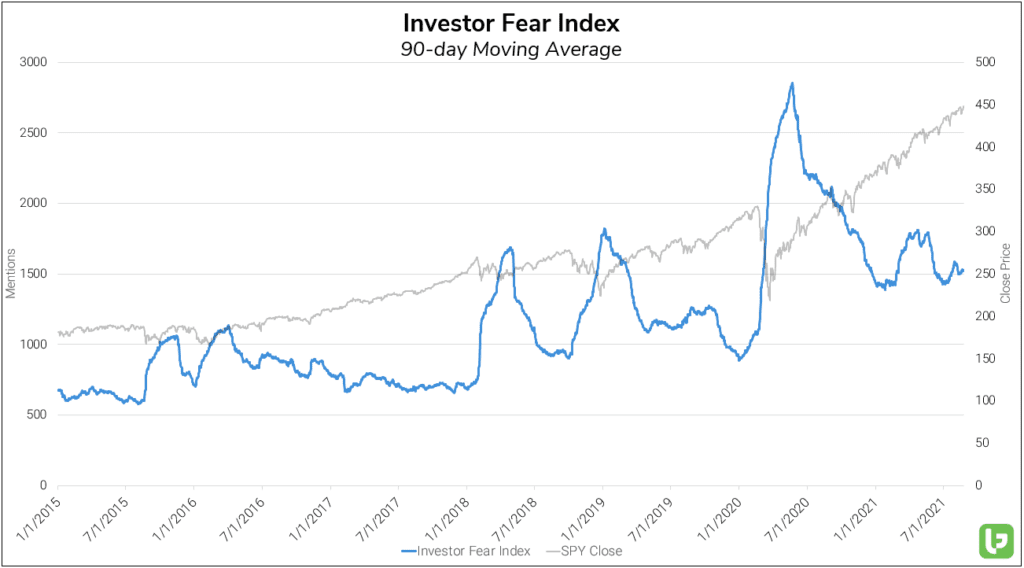

According to a report by the Bureau of Labor Statistic, the price of consumer goods rose more than +5% YoY last month – Such levels have not been seen since the months leading into the 2008 financial collapse. Conversely, investor sentiment has grown increasingly bullish, as demonstrated by the LikeFolio Fear Index.

LikeFolio's proprietary Fear Index analyzes and measures the velocity of tweets indicating negative investor sentiment over time…Although investor fear remains well above pre-COVID levels, it has pulled back significantly on both a QoQ and YoY basis: -10% and -26% respectively. When viewed in tandem, these trends provide a compelling summary of the US financial markets. The looming specter of inflation provides investors with a clear incentive to stay risk-on. Consumers’ purchasing power has come under intense pressure in recent months, decreasing the perceived risk of investing in stocks, real-estate, and even more volatile assets (crypto). Faced with negative real Interest rates, investors of all stripes are desperate for yield. Even big investment firms are making increasingly risky bets. The question remains: what happens the 'everything bubble' pops?