Investor Wellness Check: Buying the Dip? Two weeks ago, the […]

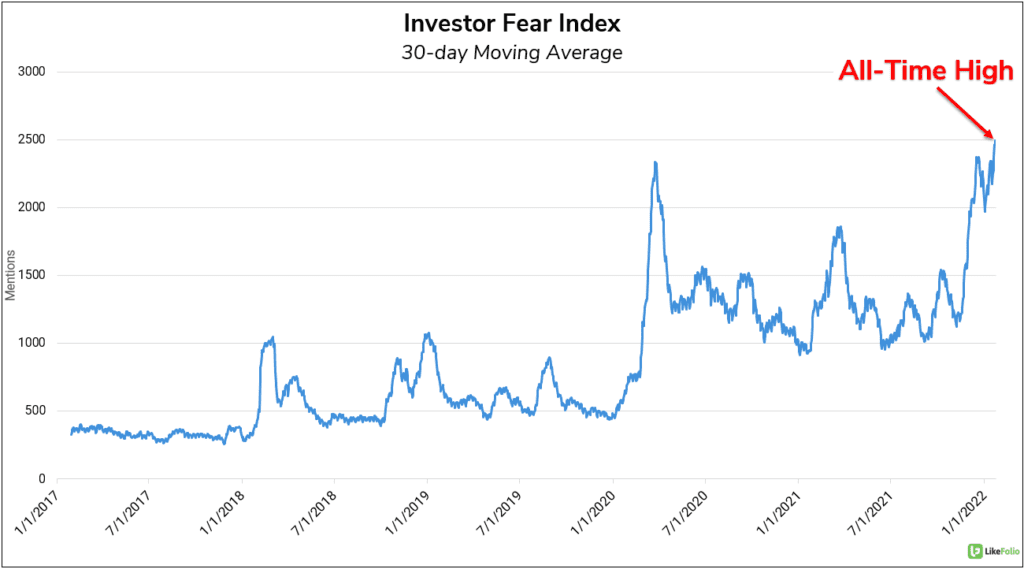

Investor Fear is at an All-Time High…

A pan-selloff has taken place over the past 2 trading days.

Unless your long portfolio is 100% Crude Oil, then you’ve probably had some difficulties this month…And the data shows that you’re not alone.

The Investor Fear Index, LikeFolio’s proprietary index which measures the velocity of tweets indicating negative investor sentiment, shows that the ongoing dip (and underlying economic conditions) have led to a serious rise in concern.

In fact, the Fear Index is at an all-time high level: +90% QoQ on a 30-day moving average.

The above chart tracks fear related to the equity market, but Cryptocurrencies have suffered far worse in the past week.

A tandem breakdown for Bitcoin ($BTC) and Ethereum ($ETH) has sent the entire market reeling lower, with a $500B market cap evaporating since the selling began last Thursday.

But, Crypto investors are used to such volatility, right?

According to the Crypto Investor Fear Index — the crypto-focused companion to the original Fear Index —cryptocurrency investors are not taking the recent sell-off lightly.

It’s fair to say that panic has begun to set in, with negative investor sentiment soaring well above past highs on a 30-day moving average. LF’s primary data source, Twitter, has seen a significant influx of all types of investing chatter over the last 2 years.

Many of these newcomers are relatively unseasoned traders, a fact which has certainly helped propel both Fear Indices to new highs.

Still, there’s palpable fear pervading the markets right now, which means potential opportunities for the level-headed.