Drinker’s tastes and priorities are shifting in a major way. […]

iPhone Holiday Sales Off To A Slow Start

The day after the keynote address, our Consumer Purchase Intent Data was already telling us that Apple was going to have a very rough road ahead of it. Here's the full report we issued, here's the coverage it got in financial media, and here is the BEARISH APPL OPPORTUNITY ALERT we sent to members before we revealed any of that publicly.

Since then, the stock has fallen big. More importantly, we have new data to share.

Holiday Sales of iPhones

The new iPhones are an interesting mix. There is the iPhone XR for around $750, and then a big price jump to $1000 and up for the iPhone XS and iPhone XS Plus.

So which one are consumers jumping on during the holiday season? The cheapest one....

That's not good for Apple. It shows that consumers simply don't value the enhanced functionality of the more expensive models.

2018 Holiday Slowdown?

Black Friday kicks off the holiday shopping season, and is often very indicative of how the company will perform for the entire quarter. For some companies with high company seasonality, it can make or break a full year (not true for Apple).

In fact, we have used purchase intent data from Black Friday to predict stock movements many times.

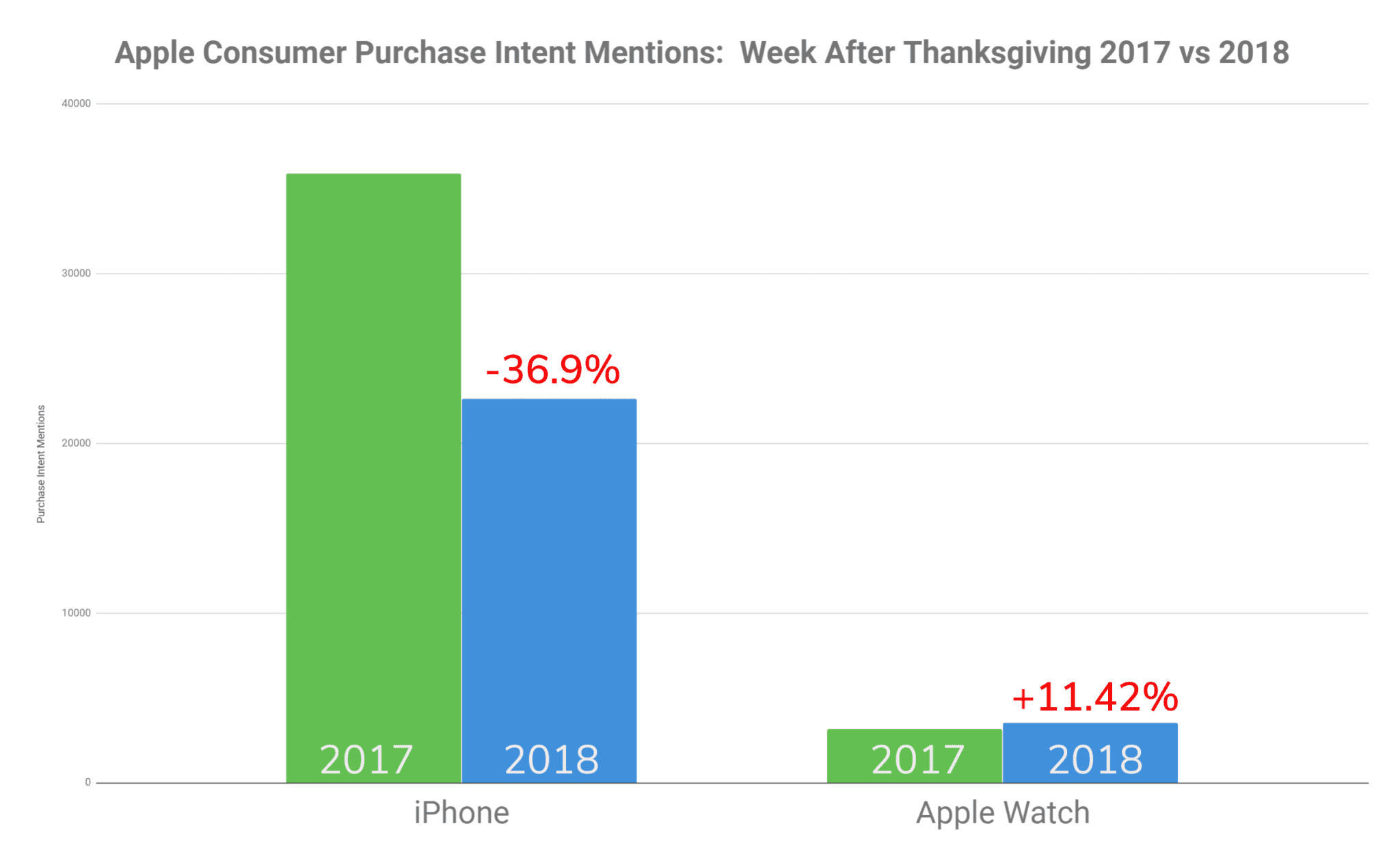

So how is Apple doing so far this Holiday season? To find out, we compared consumer purchase intent mentions for that one week period from 2017 to this year for both the iPhone and the Apple Watch:

As you can see from the chart above, the first week of the holiday shopping season has been a tough one for Apple.

iPhone consumer purchase intent mentions are down 37% compared to 2017 levels, and among those 2018 buyers, more and more are opting for the cheaper models.

A silver lining comes from the Apple Watch, which is performing well with a solid 11% increase in purchase intent mentions.

Summary -- Apple's warning on iPhone sales was warranted. According to LikeFolio data, the holiday season could come up significantly short of historical sales levels. The watch is doing well, but at half the cost of an iPhone, it only amplifies the message that consumers are looking for ways to spend less money on Apple products this year.

-- LikeFolio uses data mined from social media to spot consumer trends on Main Street before they become news on Wall Street. Memberships make this data and actionable insights available via Earnings Predictions, Opportunity Alerts, and access to the LikeFolio Research Dashboard.