iRobot (IRBT) Last quarter, iRobot posted strong results: revenue increased +43% […]

iRobot showing Digital Strength, but will it be enough?

iRobot showing Digital Strength, but will it be enough?

Last quarter, IRBT handily beat estimates and grew its bottom line by 14.4% YoY.

Results were driven by healthy demand and a strong eCommerce showing. Digital orders, including those fulfilled through digital retail partners, increased +70% YoY, representing 60% of total revenue.

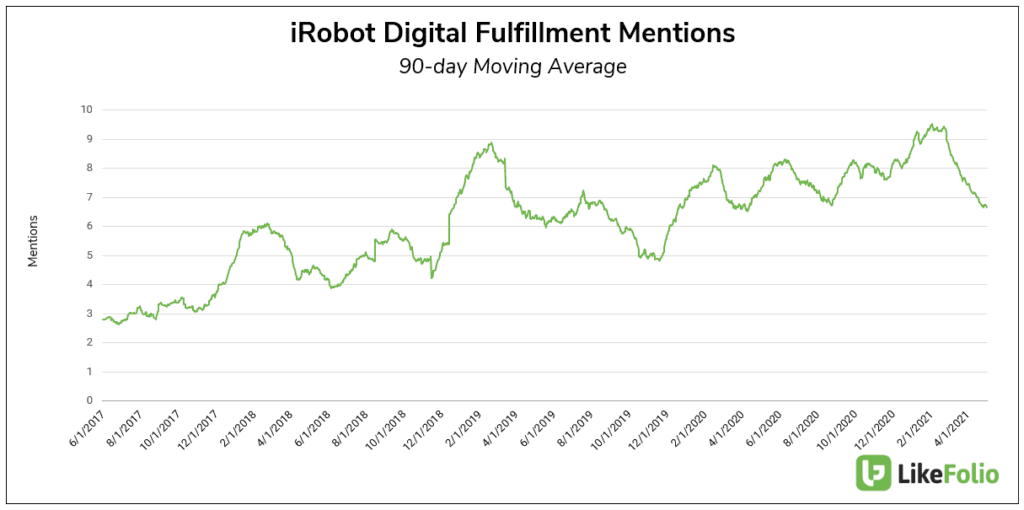

LikeFolio shows eCommerce mentions for iRobot's top products (Roomba, Braava, or namesake iRobot) increased +12% YoY in the quarter being reported. This is a deceleration vs. +26% YoY we recorded in the prior quarter, but still high comparatively.

Comprehensive Purchase Intent mentions in 21Q1 fell -17% YoY as iRobot enters tough comps vs. covid-induced buying recorded at this time last year.

Investors should also consider:

- Tariff-related headwinds. On its last call, the company noted that the resumption of tariffs for products made in China and imported to the U.S. could be a headwind in 2021 (in 2020, the company received a tariff exclusion). This is something that our data will not capture.

- The International component. Around 52% of IRBT revenue is generated in the US. LikeFolio data captures English-speaking mentions, so may not capture all facets of international growth.

IRBT reports 21Q1 results May 3 after the bell.