Roku makes streaming devices that allow its customers to stream […]

Is Amazon (AMZN) the New Normal?

Is Amazon (AMZN) the New Normal?

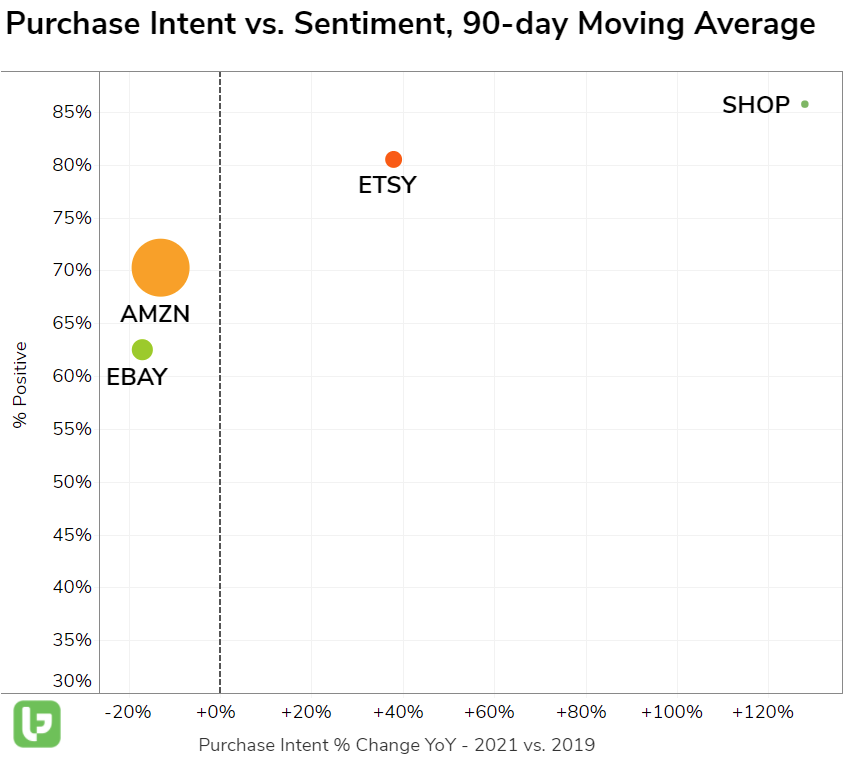

Amazon is chugging along "like normal". Prime Day sales are estimated to have surpassed $11 billion -- but the event didn't record a massive volume spike on our side. Analysts noted "slower growth"... but we're talking BILLIONS of dollars spent on a company-made holiday. This is how engrained Amazon purchasing behavior is in consumer lives. You can see the eCommerce platform's dominance in total mention volume on the outlier grid below. The larger the circle, the more mentions we've recorded.

Long-term, Amazon happiness has faltered (-3% vs. 2019), alongside platform peers like ETSY and EBAY. This is attributable to competition, higher consumer standards, and shipping delays.

Meanwhile Shopify (a decentralized platform) is helping individual companies become digitally competent -- Happiness for Shopify users has actually increased +5 points in the same time frame.

Long-term, Amazon has 3 things going for it that we're watching:

- Digital Shopping is here to stay, and could be re-energized if we regress into stricter covid protocols.

- Continued stimulus: In July, households with children under 17 began receiving monthly payments of $250-$300 for each child (for qualified income levels).

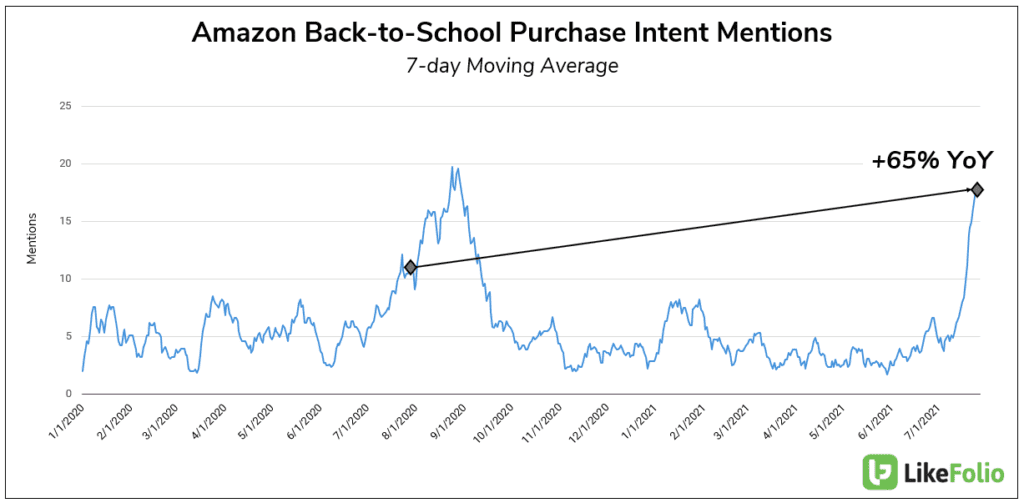

- Back-to-School shopping: consumers are still prepping for a return to the classroom. We're already showing back-to-school shopping mentions significantly higher vs. 2020.

Consumer Mentions of shopping for school supplies on Amazon are pacing +65% higher YoY(slightly edging 2019 levels)...and this is an escalation from Prime Day, where the company reported, "Prime members already started shopping back-to-school items, purchasing more than 600,000 backpacks, 1 million laptops, 1 million headphones, 240,000 notebooks, 40,000 calculators, and 220,000 Crayola products."

On the flip side (and from a speed perspective), consumer expectations continue to rise. Demand for same-day delivery has increased +14% YoY (the fastest growing shopping trend we track). This is great news if you're Target or Walmart, with a physical logistical advantage. But an area for improvement if you're Amazon.