Bed Bath & Beyond (BBBY) Last quarter BBBY shocked the […]

Is Bed Bath & Beyond Missing the Boat?

Is Bed Bath & Beyond Missing the Boat?

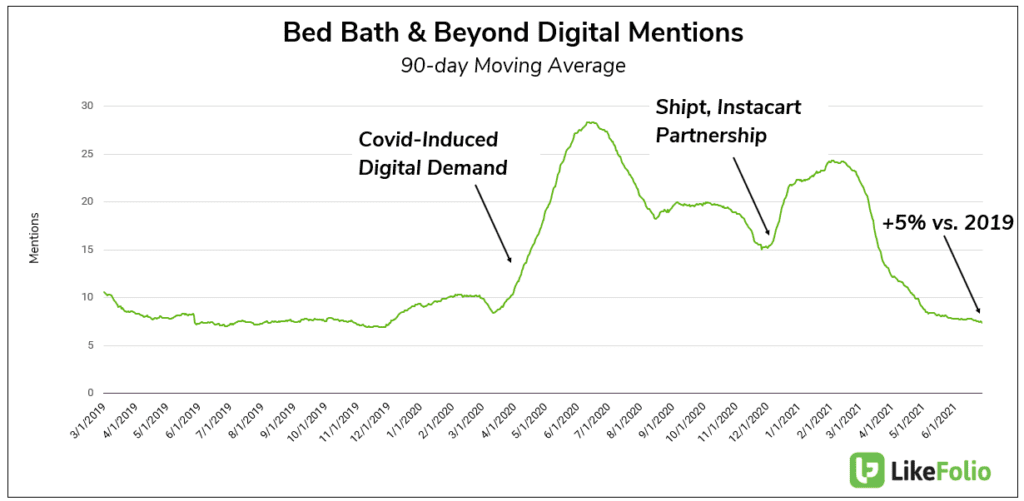

Bed Bath & Beyond did a great job of increasing its digital capacity during Covid. We recorded a home-reno-related digital spike in mentions last summer, and saw another boost after the company announced same-day delivery partnerships with Instacart and Shipt.

Now, Bed Bath & Beyond digital mentions have almost completely normalized to pre-covid levels: +5% vs. 2019.

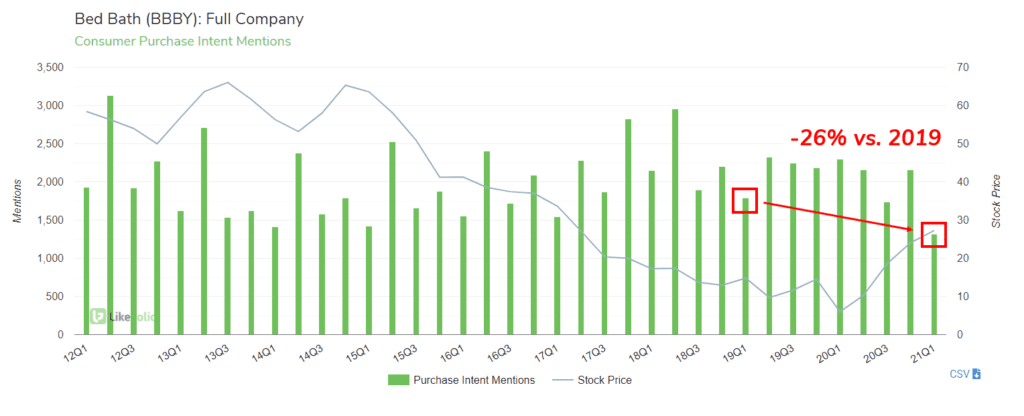

Last quarter, BBBY online sales increased +86% YoY, but weren't enough to fully offset the declines of in-store traffic -- and we don't see this changing. If anything, this has worsened.

Building on this, comprehensive Purchase Intent Mentions have dropped: -26% vs. 2019 and -39% QoQ.

But this Earnings event may be forward-looking.

Why?

Next quarter is typically "the big one" when it comes to consumer demand.

We've got a close eye on back-to-school mentions (think dorm updates, apartments, buying organization items for school). So far we aren't seeing any significant traction in this arena for Bed Bath & Beyond.

In contrast, Amazon called out major back-to-school demand on its Prime Day event.

At LikeFolio, we watched back-to-school shopping mentions increase +250% vs. the prior 7 day moving average last week during the sale.

If Bed Bath & Beyond can't tap into key consumer macro trends (including back-to-school and digital sales), the company may be in trouble.