The Walt Disney Company (DIS) Exactly a year ago today, […]

Is Disney Getting its Magic Back?

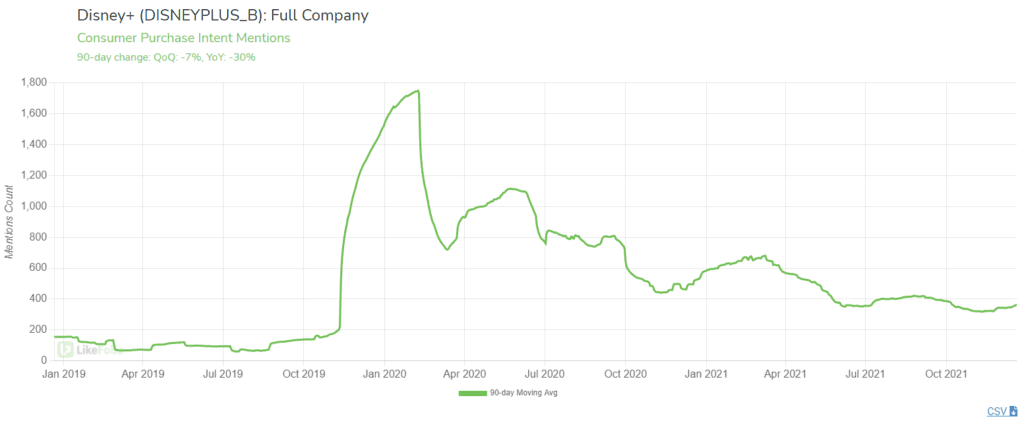

Disney had a rough go in 21Q4. Shares remain ~14% below where they were trading prior to this release when the company missed expectations across the board. Disney+ added +2.1 million new streaming subscribers but the Street was looking for +9.4 million new additions. Due to where this growth occurred (internationally), the service's Average Revenue Per User (ARPU) fell -9%. The Disney+ and Hotstar bundle in Indonesia and India is priced significantly lower vs. its U.S. alternative. And now, we're heading into a critical season. The first of the year is when many consumers scrap unused subscription services, and the week between Christmas and New Years is often one of the busiest times of the year for Disney parks. Does LikeFolio data show a turnaround? Not quite yet, but stay tuned. 1. Disney+ subscription growth is still losing steam.

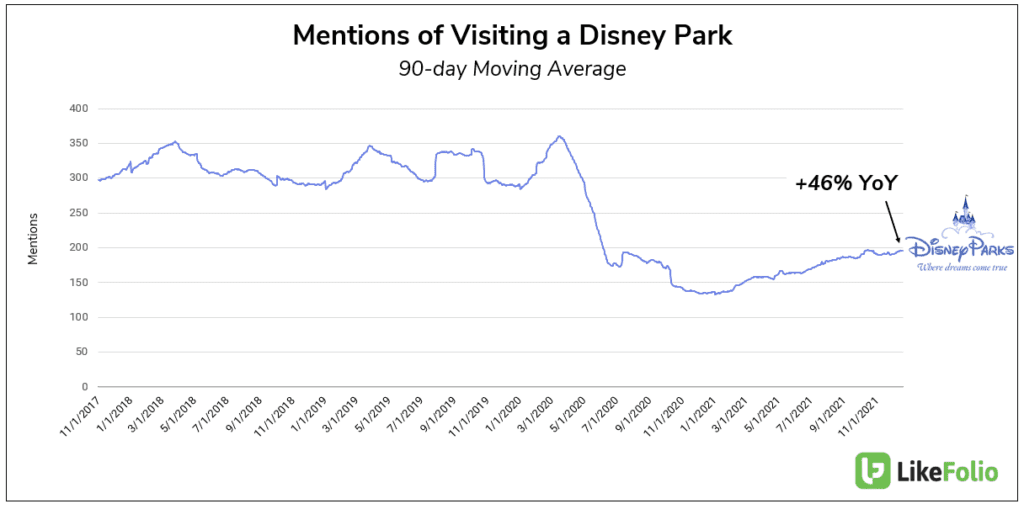

Consumer mentions of signing up for the Disney+ subscription service have dropped -30% YoY, and -7% QoQ. While LikeFolio data is unlikely to capture international mentions (a key area of growth), it's still worth noting that U.S. consumers aren't shifting their behaviors. On its last earnings call, the company noted that a major content ramp isn't expected until the 4th quarter of 2022: "Looking at fiscal '22, we are thrilled about the quality of the content coming in the first three quarters of the year, but we will not yet be at our anticipated steady-state cadence of content releases. The fourth quarter will likely be more indicative of what our slate could look like once we have tent-pole content flowing steadily from all of our industry-leading creative engines." Until then, growth is likely to continue on this trajectory. 2. Disney Parks attendance is returning but remains below 2019 levels.

Consumer mentions of visiting a Disney Park or planning a trip to visit a Disney Park have increased +46% YoY and +6% QoQ. While this is an improvement, it does represent a tempering in growth rate vs. last quarter. The "ramp" up in mentions has waned by ~5% points. And total mentions remain ~32% below 2019 levels. In addition, omicron variant news continues to dominate media cycles. TSA data suggests this isn't spooking consumer travel. In the last week, TSA throughput numbers are +123% higher YoY and +9% higher vs. the prior week.