Nike reported an awesome quarter Tuesday evening. The stock is […]

Is Foot Locker (FL) Losing Relevance with Consumers?

Is Foot Locker (FL) Losing Relevance with Consumers?

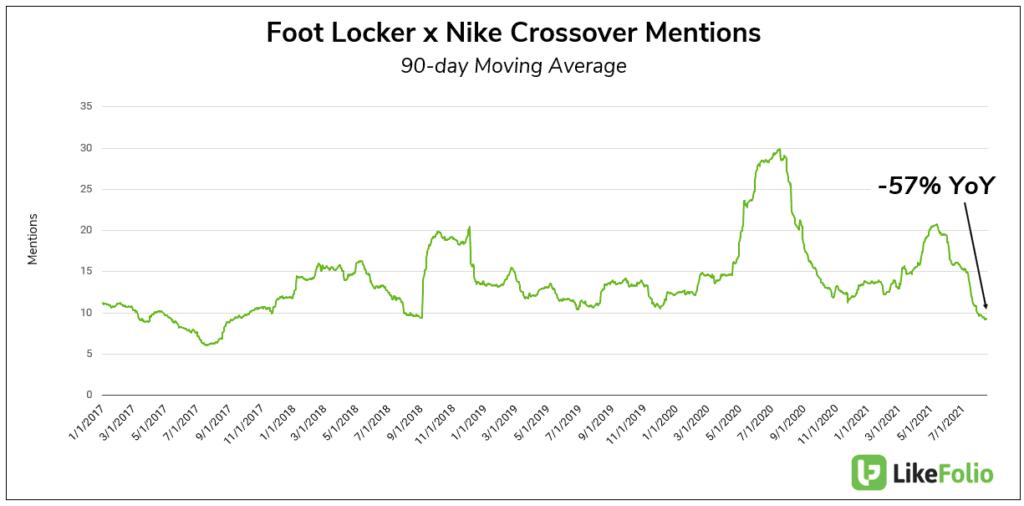

In a world increasingly shifting Direct-to-Consumer (DTC), being a location-based middleman is tough place to be. As Nike levels up its digital footprint, Foot Locker is trying to stay relevant. In 2020, 75% of the merchandise Foot Locker sold was Nike brand. LikeFolio data suggests the tie between these two brands is weakening, at least in the eyes of consumers.

Consumer mentions of "Nike" alongside "Foot Locker" have dropped -57% YoY (and remain -27% lower vs. 2019). In contrast, Nike digital purchase intent mentions have increased +290% vs. 2019, while dipping just below 2020 levels. On one hand, it could be positive that Foot Locker is loosening its dependence on Nike. On the other, it could mean some near-term hills to climb. To deepen ties with consumers, Foot Locker has employed a local strategy by hosting community events and selling merchandise from local creators. In 2019, it invested $100 million in GOAT, a leading online resale exchange: "By investing in GOAT Foot Locker doesn’t have to build its own resale platform but can still take advantage of everything that GOAT is learning about this growing segment of the marketplace. GOAT is now valued at $1.75 billion." Foot Locker is also making investments to expand its reach and absorb competition. It acquired Japanese streetwear brand Atmos for $360 million, and California shoe store chain WSS for $750 million. However, LikeFolio data for Foot Locker falls flat this quarter.

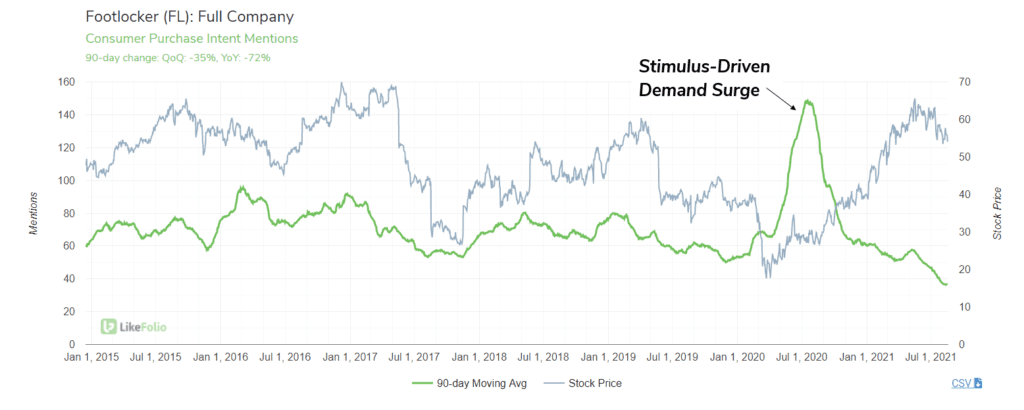

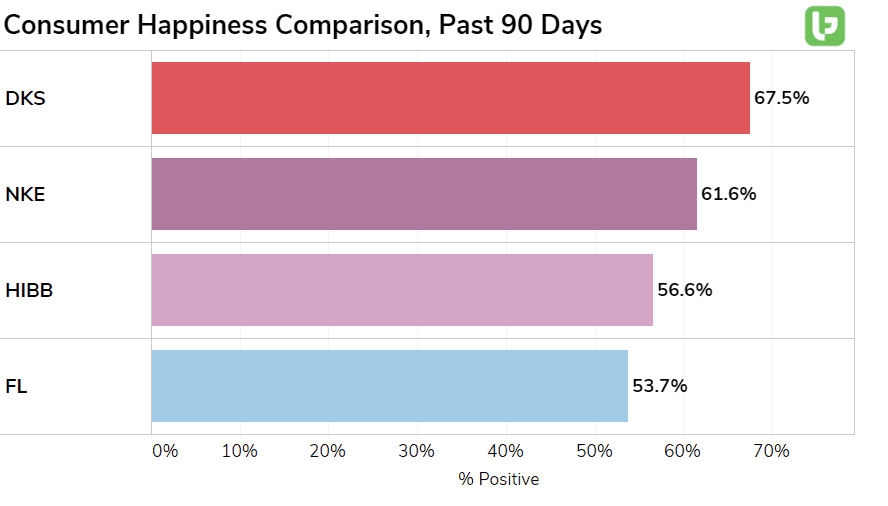

After a pandemic-infused demand surge last summer, Purchase Intent volume now rests -72% lower YoY. Not the momentum the company is looking for. In addition, the company remains at the bottom of the pack vs. peers.

We'll be listening to see if back-to-school shopping can energize this company on 21Q2 earnings August 20 before the bell.