Travel Update: Airline Earnings It's time for the airline industry to report […]

Is JetBlue The Airline Stock To Own?

Airline stocks made gains this week...

There had been strong hopes for a travel recovery late last year and in early 2022.

But that recovery was thrown into doubt after the recent spike in oil prices.

However, after a series of disclosures from airlines on Tuesday, it was revealed that while fuel costs have impacted Q1 profitability, outlooks for the year remain positive.

That news resulted in a jump in US airline stocks.

We've mentioned many times already in the last few months that travel trends are rising, and that has not changed.

Every trend except for "Taking a Cab" and "Avoiding Hotels" are up QoQ.

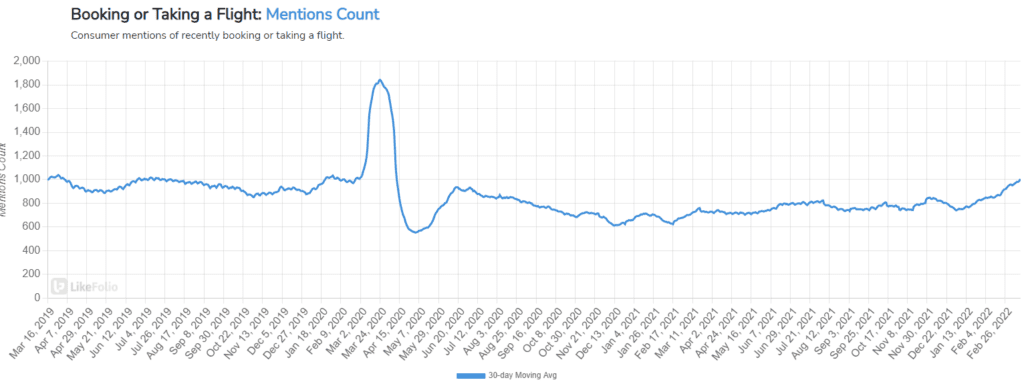

Above you can see consumer mentions of Booking or Taking a Flight.

Since January, there has been a sharp rise, so the demand is there. But, we can't ignore outside macro factors that have clearly impacted travel stocks so far this year.

However, we should see those travel trends increase further, with travel and tourism in the United States expected to reach pre-pandemic levels this year.

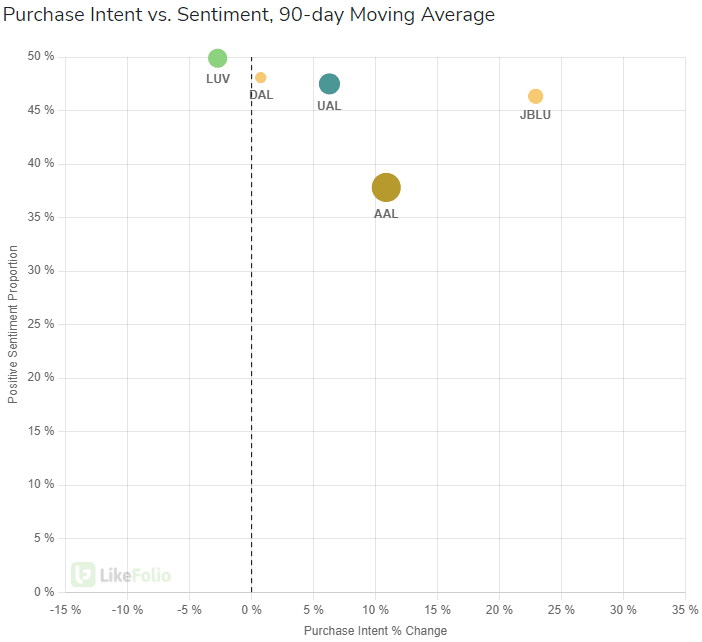

But which airline is experiencing the most demand?

Yes, it's JetBlue.

There are three reasons why we like JetBlue…

1. Firstly, one of the most profitable, if not the most profitable, airline route in the world is between London and New York…And JetBlue officially launched its LON-NYC route in August 2021.

The news came a few months after European low-cost airline Norwegian Air announced it was withdrawing all future US flights.

Norwegian also had the London to New York route in its books, so could JetBlue fill that low-cost transatlantic demand gap?

2. Travel Rules are continuing to ease.

Just this week, the UK Government scrapped all travel rules.

It means that travelers from New York to London will not need to show any Covid related documents when entering the country, making it easier to visit the country.

Unfortunately, the US is yet to scrap its Covid entry requirements.

3. JetBlue’s demand is on the up.

As we can see from the comparison above, JetBlue is outpacing its competitors when it comes to demand. To put it into perspective, ConsumerPurchase Intent Mentions for the airline are up +24% QoQ, and +149% YoY.

As we head into spring, we expect that rise to continue…

Barring any more macro shocks of course.