Projecting company seasonality midway through the busy season can give […]

Is Luxury Immune to Inflation?

May 26, 2022

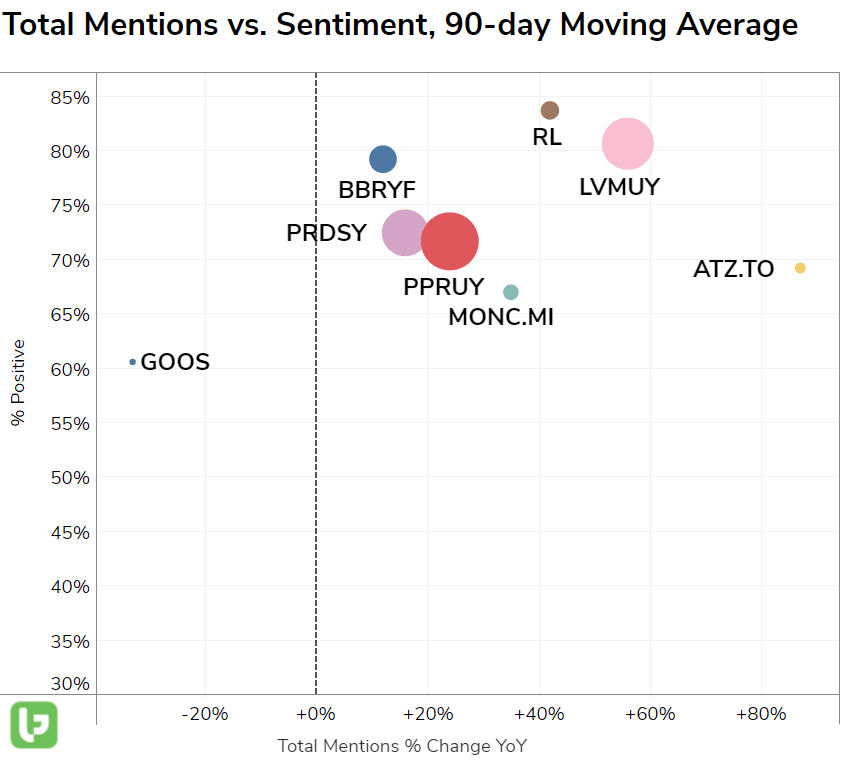

| I’ve noticed a theme emerging over the last few weeks as companies release earnings reports. It’s obvious that inflationary pressure and supply chain bottlenecks are weighing on companies (Hello Walmart and Target), alongside shifts in what kinds of purchases consumers are completing (experiences vs. goods). But consumer demand in one retail segment appears undaunted: luxury apparel. Let’s break down the top names in luxury apparel and accessories: Take Burberry (BBRYF), for example.… Burberry (BBRYF) Purchase Intent is trending +6% QoQ and +10% YoY. The luxury brand reported earnings a couple of weeks ago and revealed profitability hit its highest level in eight years. That was, as reported by Bloomberg, after efforts by the company to make its brand more exclusive and pricer. Meanwhile, D&G (Private) mentions have hit an all-time high, trending +40% QoQ and +110% YoY, fueled by its sponsorship of a Kardashian wedding. |

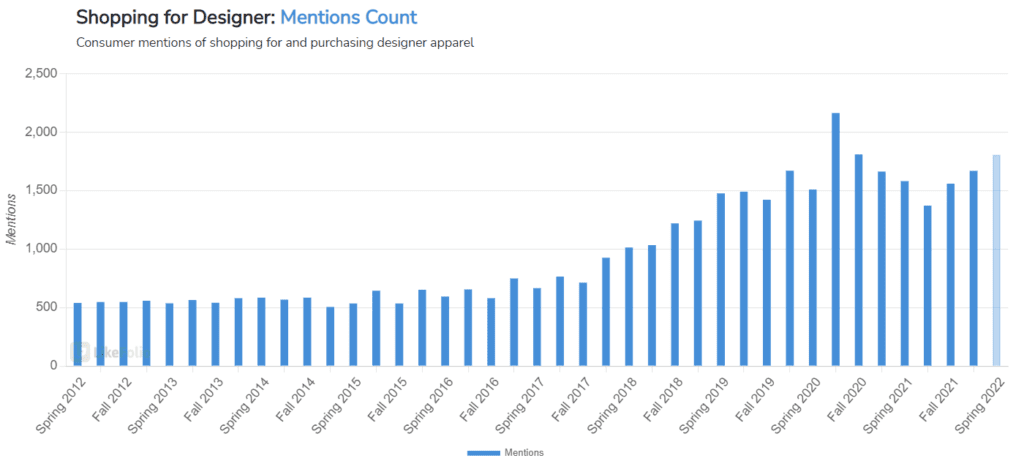

| But other brands such as Canada Goose (GOOS) and Watches of Switzerland have reported strong demand too. While inflation is soaring at near 40-year highs, the demand for luxury goods has surprisingly not faded, with higher income earners seemingly not yet touched by surging prices. In fact, mentions of shopping for designer apparel continue to rise, currently pacing +14% higher YoY. |

| This week, Ralph Lauren (RL) flexed its high-fashion prowess when it released positive earnings. The company posted fiscal Q4 revenue increased 18% to $1.5 billion, topping estimates of $1.46 billion. And, LikeFolio data shows Ralph Lauren (RL) STILL looks strong – and it is in good company… |

Aside from RL, Moncler (MONC.MI) and Aritzia (ATZ.TO) and Louis Vuitton (LVMUY) are gaining steam with consumers, although winter designer clothing manufacturer Canada Goose (GOOS) is showing signs of off-season struggles.

The question is, will the splurge on luxury brands continue to buck inflation, or will spending eventually fall in line?

We, at Likefolio, will continue to monitor these names for any sign of a change, but for now, luxury spending looks solid across the board.

Want deeper insights? Get Free Access to The Vault.

Tags: