Black Friday Weekend (leading into Cyber Monday) can make or […]

Is Target Playing the Long-Game Here?

Target finds itself in an interesting position.

- Inflation is driving the cost of goods higher, and Target has -- so far -- opted to bear the burden instead of passing it along to its consumers.

- It battled supply chain concerns over the peak holiday season by contracting its own ships, tapping in less congested ports, and strategically timing ship unloading efforts, ultimately resulting in +20% more inventory YoY.

- And most recently, it is raising its minimum hourly pay range between $15 and $24 in order to be a wage leader in every market where it operates.

All of these factors could weigh on margins. But Target is playing the long game. Target's inventory position and value proposition may lead to even more loyal customers.

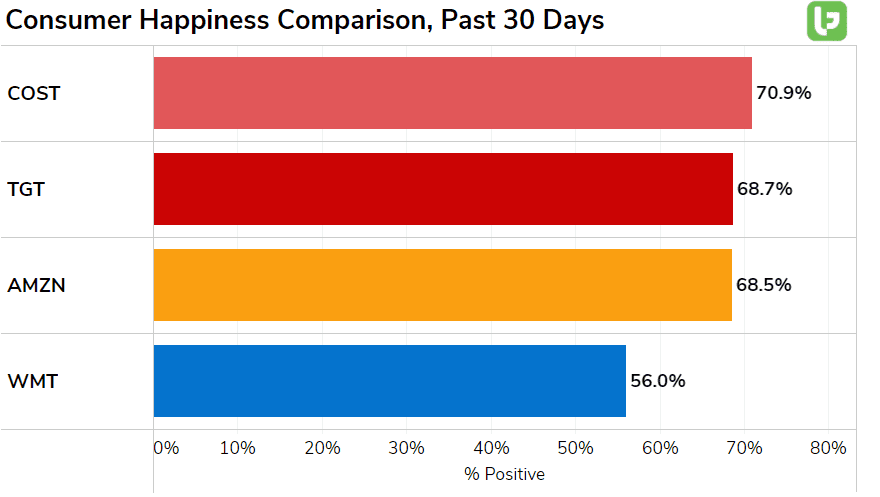

Check out Consumer Happiness levels, for instance.

The gulf between Target and most-often-compared peer, Walmart is wide -- ~13 points.

Target finds itself in between premium membership-retailer Costco and digital darling Amazon.

What is driving TGT happiness?

A superior experience, in-store and digitally.

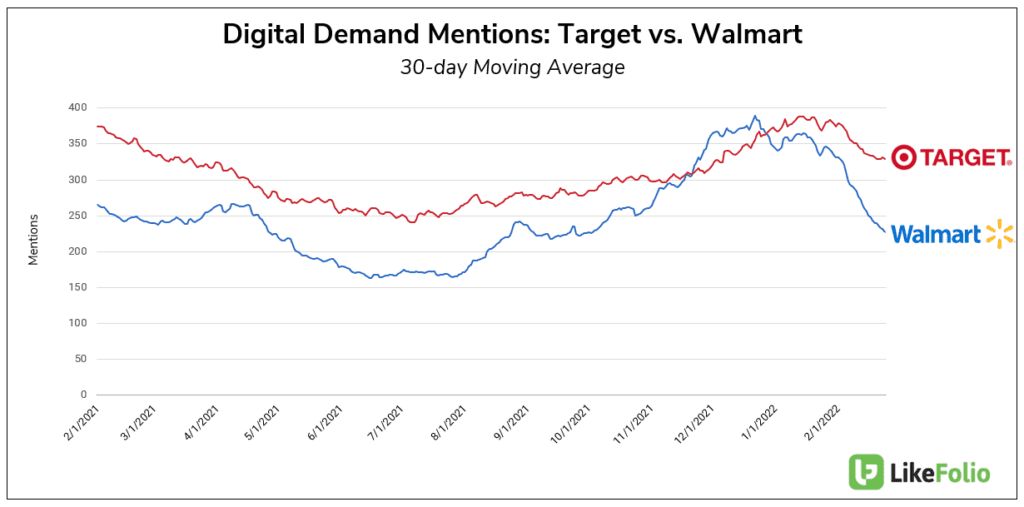

Digital demand mentions reveal Target's near-term outperformance vs. Walmart.

While both retailers are struggling to keep up with prior rates of YoY growth, Target's digital demand has increased by +5% QoQ. Walmart's digital demand tempered by -30% in the same time frame. Much of this is related to Target's leverage of curbside pickup. Target does trail Walmart when it comes to grocery delivery.

Happiness is also driven by Target's superior in-store experience vs. Walmart. Consumer mentions of shopping in a store have increased by +15% YoY.