PayPal (PYPL) Last week we touched on a huge crypto […]

Is Crypto Entering The Slope Of Enlightenment?

“You know it's time

to sell when shoeshine boys give you stock tips. This bull market is over.”

That was the thinking of Joe Kennedy in late 1928, after getting a tip to buy Hindenburg during a shoeshine. Kennedy soon sold his entire stock portfolio and avoided one of the biggest stock market crashes in history.

The Greater Fool Theory states that it is possible to make money by buying securities, whether or not they are overvalued, by selling them for a profit at a later date. This is because there will always be someone (i.e. a bigger or greater fool) who is willing to pay a higher price.

But what happens when there is no “greater fool”, and all that is left are sellers?

You guessed it, a crash.

When Joe Kennedy saw a shoeshine boy giving stock tips, he knew that the market was likely to run out of Greater Fools soon. And it turned out that he was right.

Understanding the

Hype Cycle

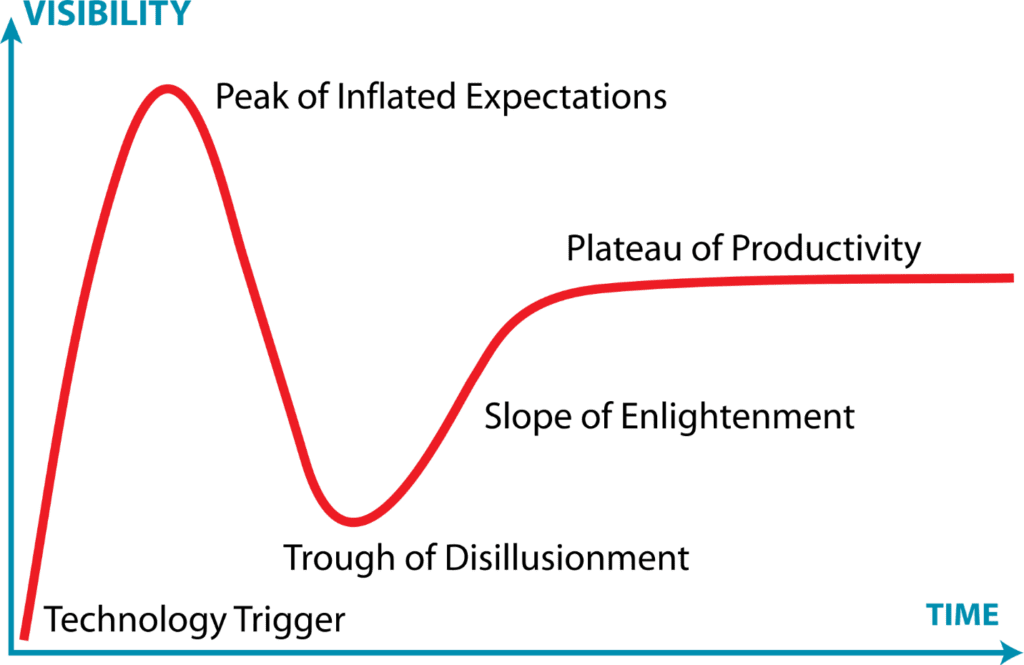

The “hype cycle”, a branded term by the research firm Gartner, provides us with a graphical representation of the introduction, maturity, and acceptance of new technologies.

As you can see, it is often the case that new technologies like cryptocurrencies will see a euphoric “gold rush” of inflated expectations, followed by a crash in interest. In fact, this “trough of disillusionment” is usually accompanied by a dismissal of the technology (and even mockery of its proponents) by the general public. Finally, technologies will begin to take hold with real-world applications during the slope of enlightenment, before becoming truly productive in the world.

Where is Cryptocurrrency In The

Hype Cycle?

To understand our position in the hype cycle now, it is instructive to look at LikeFolio’s data on each cryptocurrency. Through their proprietary technology, the firm can give us some serious insights by showing us how many people are talking about using or buying the cryptocurrency in question.

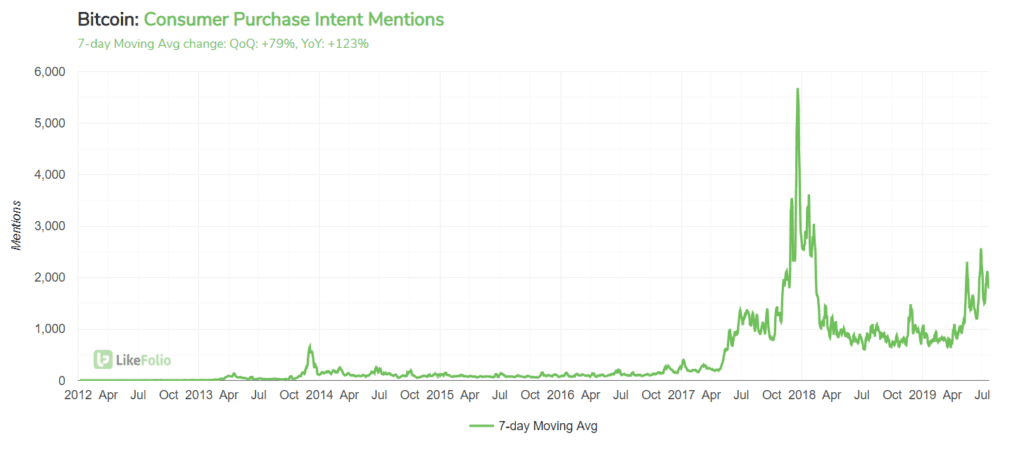

For example, the following is a chart showing the amount of social-media chatter around bitcoin over time:

Notice a familiar shape? A massive uptick in interest in 2018 (peaking as Bitcoin prices peaked near $20,000), followed by a fast a furious drop back down into what many consider to be the trough of disappointment.

But now things are starting to get interesting again, as conversations around buying and using Bitcoin are starting to grow out of the trough, which could be the beginning of the slope of enlightenment phase.

And it’s important to note that this view is not a look at the price of Bitcoin… this is a view of how many people are actually talking about interacting and using the technology itself – i.e. ADOPTION.

What's next for Crypto?

Between the LikeFolio consumer insights data above, and the recent price action in Bitcoin, it’s clear that the public’s interest in cryptocurrency is getting some wind back in its sails.

Additionally, it’s clear that we are nowhere near the late 2017 levels of expectations, which is likely a good thing in the long run because nothing can derail a new technology quite as abruptly as failing to live up to consumer (and investor!) expectations.

So we will continue to watch this space with great interest. Looking for continued clues from the LikeFolio data around consumer adoption for confirmation that we are truly in the “Slope of Enlightenment”, which could last much longer, and produce much larger profits for investors than most people are expecting.