Planet Fitness ($PLNT) reports earnings tonight, and analysts are expecting […]

Is this Gym Stock Inflation Proof?

When Covid-related restrictions ended at the start of the year, gym trends surged and we noted a significant drop in working out from home.

While part of the fitness boom could, in part, have been attributed to the time of the year (New Year's Resolutions), there was no doubt pent-up demand played a leading role.

However, now that the resolutions are long gone and forgotten about, and pent-up demand is fulfilled, fitness trends have continued to climb.

According to Placer.ai, fitness club visits in 21Q4 and 22Q1 have not only matched pre-pandemic levels, but they’ve also exceeded them.

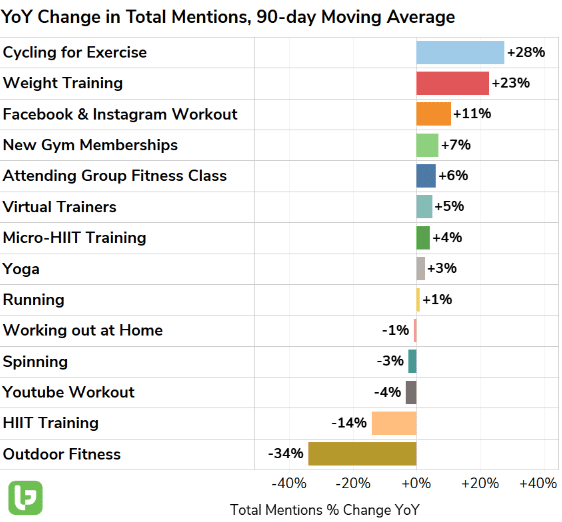

LikeFolio data shows a rise in gym-related trends too, with new gym membership mentions trending at +7% YoY, while weight training mentions are at +23% YoY.

However, with the surge in inflation, gyms and fitness clubs may have to increase prices to keep up with rising costs. While already costly gyms may suffer, this provides yet another headwind for an industry that was at a standstill for the last two years.

Even so, there is one gym that managed to capture significant market share during the pandemic, and with demand continuing to rise, it could be well-placed to benefit as consumers lower spending.

The case for Planet Fitness:

Outpacing Competitors

With health and wellness becoming even more important to consumers, Planet Fitness is well-positioned to capitalize.

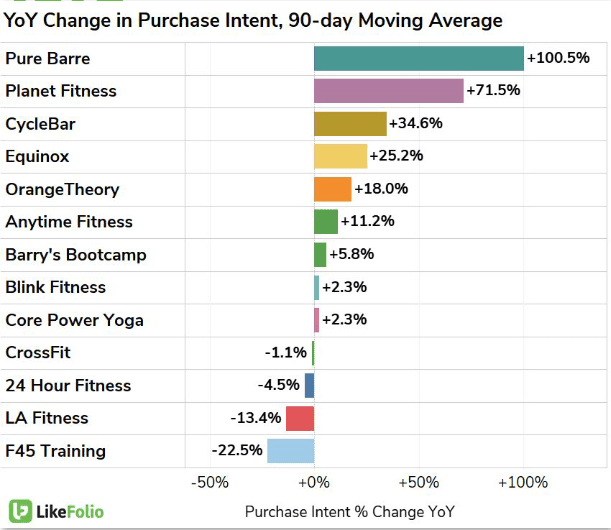

PLNT Purchase Intent Mentions are trending +72% higher YoY, outpacing other gyms such as Equinox, Anytime Fitness, LA Fitness, and 24 Hour Fitness by a large margin.

With inflation starting to hit more and more people, consumers will begin to trim unnecessary expenses such as high-cost gyms, in favor of cheaper alternatives like Planet Fitness which costs as little as $10 per month.

In a recent note, Jefferies analyst Randal Konik recently stated consumers will want less expensive and more convenient alternatives during economic uncertainty, which favors Planet Fitness.

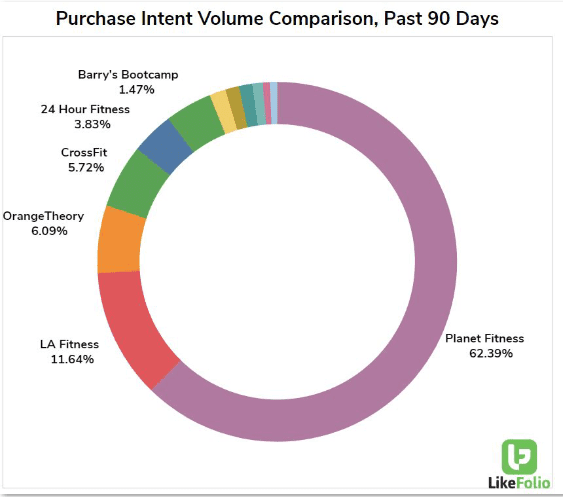

Expanding Market Share

Despite the pandemic limiting gym goers throughout 2021, Planet Fitness, as we mentioned in a recent report, has significantly expanded market share over the last year, with % of mention volume rising from 49% a year ago to 62% in June 2022.

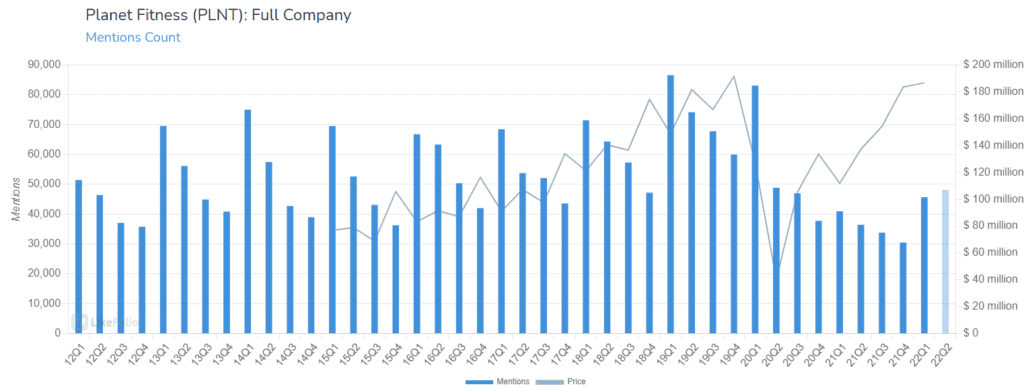

| Planet Fitness ended 2021 with 15.2 million members, and counted 16.2 million members in 22Q1. Nice traction. Consumer Buzz While still not back at pre-pandemic levels just yet, Overall Mentions are on the rise, pacing +5% QoQ and +32% YoY in the current quarter. |

More importantly, the company’s revenue (represented by the lighter blue line) jumped back to just below pre-pandemic levels in Q1 at $187 million compared to $192 million in Q4 2019.

With inflation resulting in consumers tightening wallets, potentially limiting the price they pay for gym memberships, Planet Fitness looks perfectly placed to capitalize.