Peloton (PTON) Last quarter, Peloton crushed estimates: sales grew 172% and […]

It's not time to count out Peloton ($PTON)

It's not time to count out Peloton ($PTON)

Peloton shares have fallen more than 35% from all-time highs as the company finds itself on the losing side of the reopening trade mindset.

However, LikeFolio data suggests the Street may be underestimating Peloton.

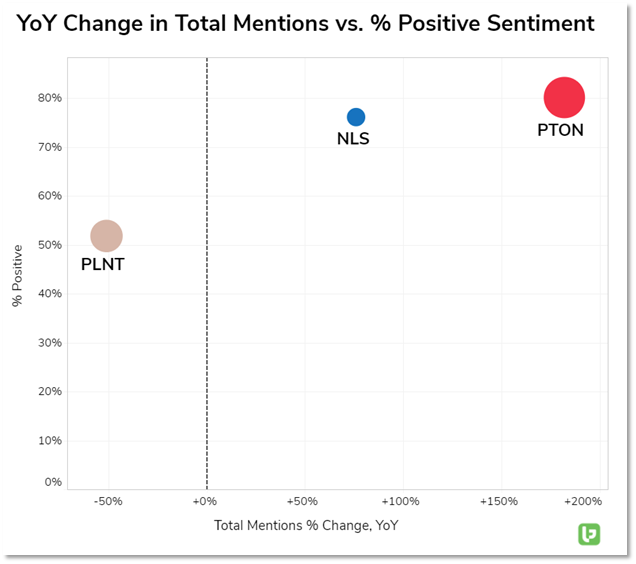

Metrics show Peloton is best in class, and has staying power.

- Consumer demand is still building: mentions of purchasing a Peloton machine continue to grow, and have increased +162% YoY.

- Total Mentions and App Usage support user retention: Peloton total mentions are at an all-time high and growing at an even faster rate than demand.

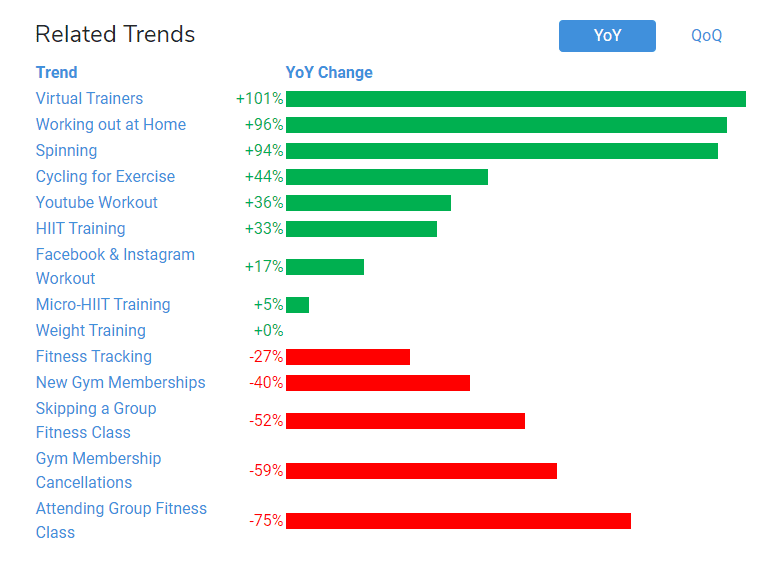

- Consumer macro behaviors suggest stickiness: the 4 trends showing the most significant YoY growth are all tailwinds for PTON: virtual trainers, working out at home, spinning, and cycling for exercise. On the flipside, gym memberships and group fitness class trends continue to exhibit YoY weakness.

Earlier this week, Peloton announced it is expanding to Australia, its first move into the Asia-Pacific market.

Peloton is also investing in fulfillment: $100 million in air, ocean freight to speed deliveries; also noting plans to acquire Precor (equipment manufacturer). Both of these moves are significant.

The largest instigator of negative sentiment we track is related to "can't get my bike fast enough" vs. the quality of the actual equipment/services provided.

While the market counts Peloton out, we see longer-term potential.