Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

Kroger (KR) is Falling Behind its Competition

Kroger (KR) is Falling Behind its Competition

Kroger Purchase Intent is recording comparative weakness on all fronts:

- QoQ: -30%

- YoY: -70%

- vs. 2019: -29%

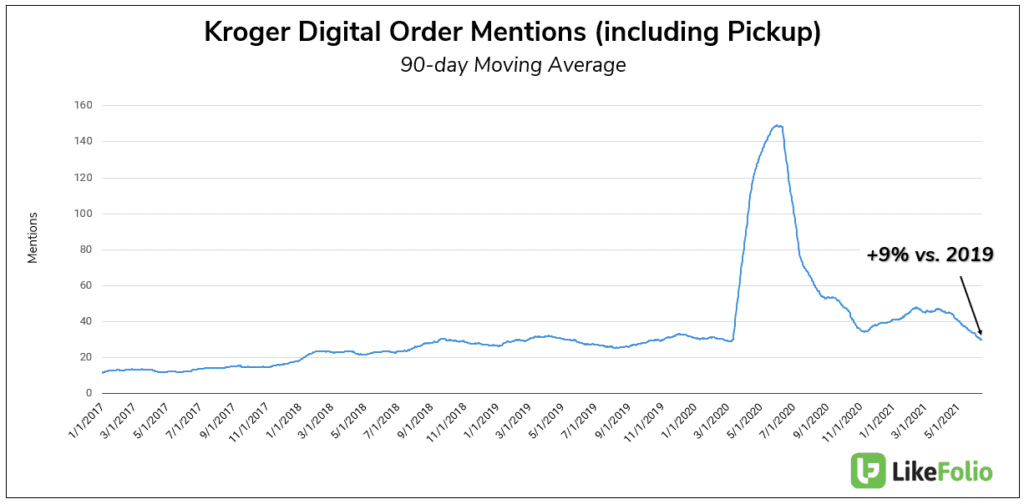

KR Digital orders including delivery and pickup mentions are normalizing, but remain +9% higher vs. 2019 levels. This sounds decent at first glance, but consider the base trend of grocery delivery: +74% higher vs. 2019.

In addition, Kroger grocery delivery-specific volume lags that of Walmart and Target. Walmart boasts a significant edge here, recording 9x daily volume vs. Kroger. Another area to monitor in the grocery segment are private label brands.

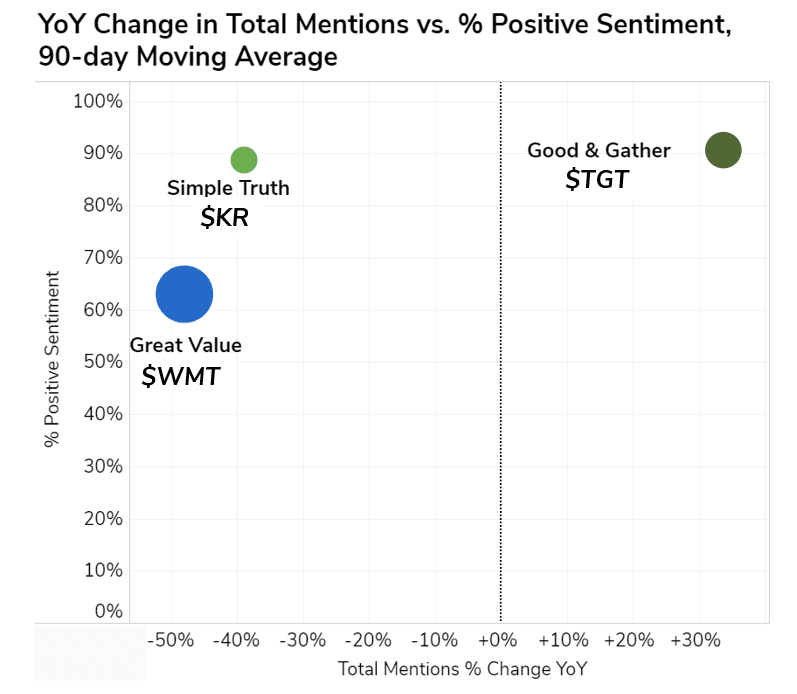

Demand for Kroger's owned-brand Simple Truth is dropping on a near-term basis. Although Simple Truth is not keeping pace with Target's Good & Gather brand, it is outperforming Walmart's Great Value in Consumer Happiness and Demand Growth.

From a company-wide perspective, Kroger is in last place when it comes to demand growth and near the middle of the pack when it comes to Consumer Happiness. What do AMZN, TGT, and WMT have going for them? Comprehensive delivery membership programs (Prime, Shipt, Walmart+), all near the same price level, and delivering items other than groceries. In contrast, Kroger's grocery delivery is around $10 every time you use it. Kroger reports earnings on June 17.