Travel Update: Airline Earnings It's time for the airline industry to report […]

Light at the end of the tunnel for Airlines?

August 2, 2022

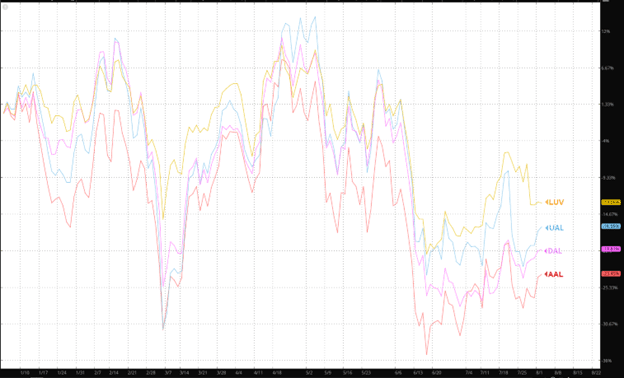

| Airlines -- and those of us flying with them -- have been through a tumultuous summer travel season. LikeFolio’s mention tracker logged thousands of mentions from consumers expressing concerns regarding flight cancellations, rising costs, and poor customer experience to boot. Layer this on top of labor shortages, rocketing jet fuel prices, and even disgruntled pilots and it’s no wonder the market is a bit timid. You can see a stock performance breakdown for 4 of the major airlines we track below: Delta (DAL), American Airlines (AAL), Southwest (LUV), and United Airlines (UAL). All are trading lower year-to-date. |

| BUT – LikeFolio data suggests airlines may have navigated through the worst of the macro pressure storm. Here’s what we’re watching: Travel Demand Remains Strong |

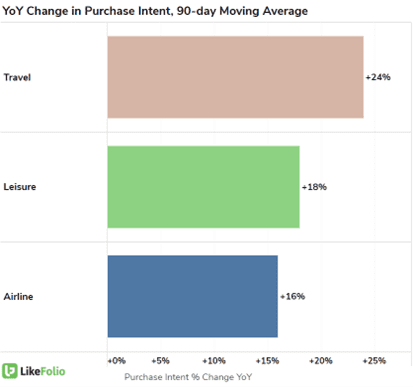

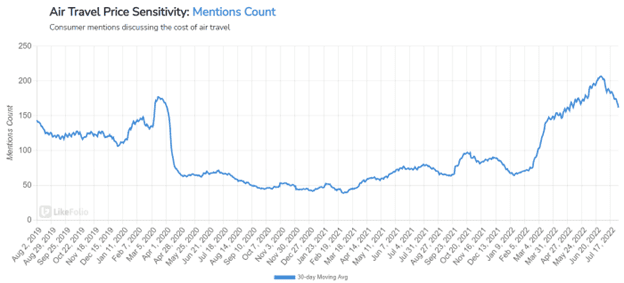

| Sector analysis for all companies in travel, airlines, and leisure suggests the consumer continues to prioritize experience spending. Across the board, mentions from consumers booking or taking a flight with an airline in our coverage list remain +16% higher YoY. Consumer Airfare Price Concerns are Falling The downstream effects of surging oil prices haven’t been limited to consumers paying more at the pump. Thanks in part to a massive increase in the price of fuel, the cost to fly domestically increased nearly 50% from January through June 2022, and consumers took notice. Mentions of flights being expensive or costing too much reached all-time high levels earlier this summer. |

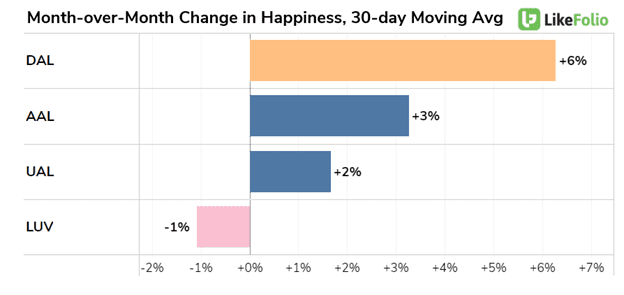

| Now those mentions are beginning to come back down. Domestic airfare is expected to drop by -25% through August from its peak earlier this summer. Qualitative analysis confirms that consumers are finding lower prices. This drop in pricing could sustain travel demand into holiday booking…an area we will certainly be monitoring. Most Major Airlines are Recording Improved Customer Experiences Three out of four of the major airlines analyzed have recorded consumer happiness improvements in the past month, a nice sign that they’re navigating through logistical hurdles. |

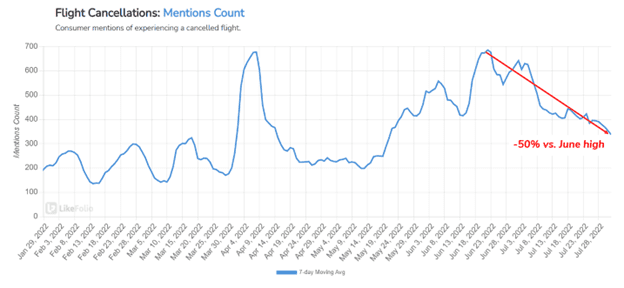

| You can see improvements in airline cancellation mentions in the same period on the chart below. |

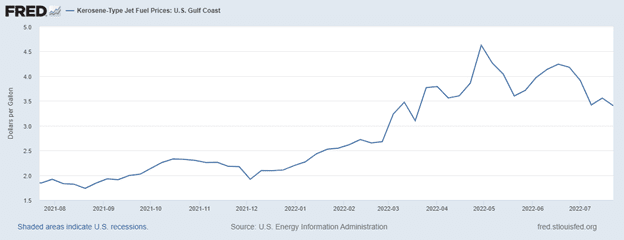

| While cancellation mentions remain +46% higher YoY, they have tempered dramatically from June highs. This certainly helps from a customer experience perspective. And airlines are making moves to repair the loss of face suffered during the height of the cancelation problem. The Price of Jet Fuel is Starting to Cool Lastly, the macro pressure driving up costs for consumers and cutting into company profits, rising jet fuel costs, has started to show SOME signs of relief. |

Fuel prices have steadily declined from the highs seen earlier this year — This trend lines up nicely with projections of declining airfare prices in the coming months.

Bottom line: Macro trends causing chaos in airlines appear to have peaked, but do remain elevated on a YoY basis.

We’ll be monitoring this segment closely to understand when long-term opportunity presents…and which players are likely to be long-term winners.

Want deeper insights? Get Free Access to The Vault.

Tags: