Coinbase Getting a Bid (COIN) Various crypto-related stocks are having […]

LikeFolio Weekly Roundup

We logged some major earnings moves this week and learned a lot about the consumer: spoiler alert, shoppers are more selective than we've seen in some time.

We're also registering ripple effects from anticipated Trump policies, namely in crypto and autonomous driving, just as predicted.

Here's an overview of the biggest movers in our portfolio this week, through close on Thursday, Nov. 21.

Aurora Innovation (AUR): +19%

AUR shares rocketed higher after Aurora Innovation and Volvo Autonomous Solutions announced the imminent launch of factory-built autonomous Class 8 tractors, starting commercial operations with safety drivers "any week now." The trucks, part of a redefined transportation ecosystem, feature Aurora's factory-installed autonomous technology and will initially run routes between Houston and Dallas-Fort Worth, leveraging four terminals and an operations center in Texas. All of our double-downs on this name have worked out nicely.

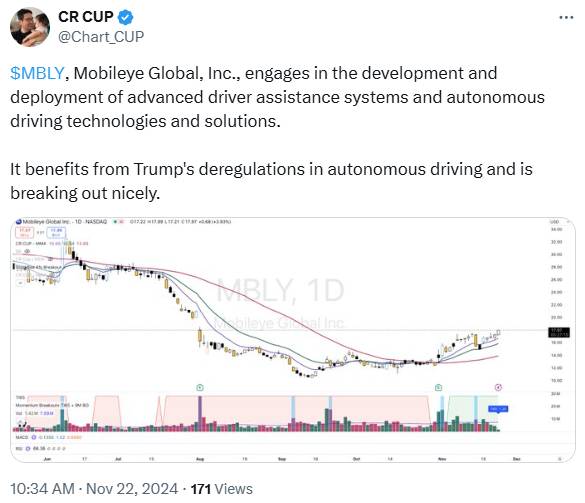

Mobileye (MBLY): +15%

Mobileye is another beneficiary of Trump's high-level deregulation outlook for autonomous driving. At LikeFolio, we like the company's pivot away from lidar and toward imaging radar and vision-based sensors. Since that announcement in September, MBLY shares have risen by ~70%, perhaps marking the true turnaround for the company. Remain bullish.

MARA Holdings (MARA): +14%

Earlier this week MARA priced an $850 million offering of zero-coupon convertible senior notes, upsized due to strong demand, to increase its Bitcoin holdings and restructure financial obligations. Approximately $199 million of the proceeds will repurchase $212 million of 2026 convertible notes, reducing near-term debt and enhancing financial flexibility. The remaining funds will primarily support Bitcoin acquisitions, bolstering the company’s asset base and aligning with cryptocurrency growth.

Dutch Bros (BROS): +11%

No major news out of BROS this week, but shares ride positive earnings momentum to a new 52-week high. Social mentions show rapid footprint expansion is building brand awareness. TOn its last earnings call the company noted, "Our real estate strategy is working. We are seeing strong new shop productivity as we have shifted our development focus and elevated our site selection process. We see increased white space opportunities as we grow. And we continue to demonstrate remarkable consistency in our shop opening cadence with 38 new shops in the quarter. We are making investments in our development and construction teams and our 2025 shop pipeline is strong, positioning us to accelerate new shop growth."

We believe BROS remains in the very early phases of nationwide rollout and market grab potential. Bullish.

Accuray (ARAY): +11%

No major news reported from Accuray, but nice to see some post-earnings recovery in this stock. Web visits remain strong, indicating growing interest, up +177% YoY and hitting hte highest levels we've recorded in the month of October.

Duolingo (DUOL): +11%

Duolingo is perhaps our favorite contrarian call that keeps winning. Its stock has pushed more than +75% higher since many investors counted it out due to rising competition from AI. Shares are pushing higher on what appears to be a delayed positive earnings reaction. The gamified learning app is expanding services beyond languages and into other areas including math and music.

Read the full roundup here, including a name on our exit watch list through the holiday shopping season...

This section is restricted to LikeFolio Pro Members only.