DraftKings (DKNG) DraftKings has been busy, and is poised for […]

March Madness is Driving Sports Betting Activity

March Madness is Driving Sports Betting Activity

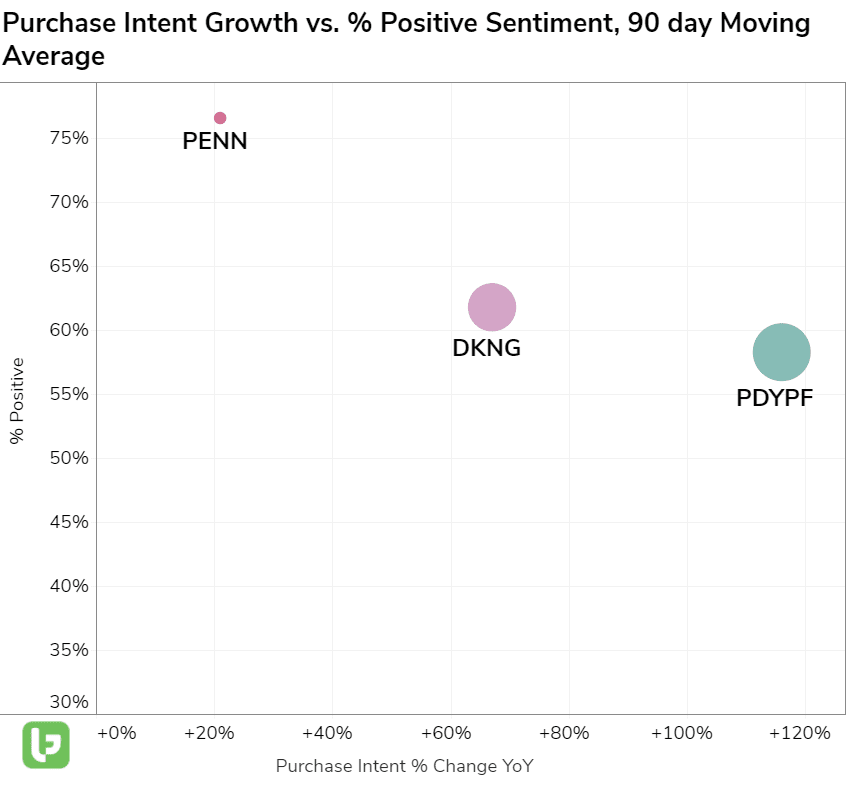

Consumer mentions of using betting a betting platform to bet on sports has increased across the board: all platforms tracked have experienced double digit demand surges in the last quarter.

- FanDuel: +155% YoY

- Barstool Sportsbook/Bets: +84% YoY

- DraftKings: +61% YoY

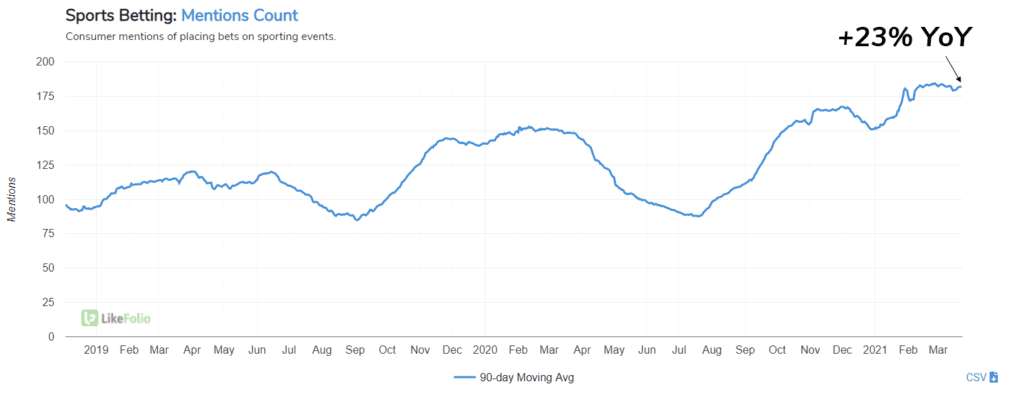

This is driven by increased adoption of sports betting in general. Our data shows this consumer behavior is eclipsing multi-year highs pacing +23% YoY.

The NCAA Basketball Tournament is driving this trend higher. On a 7day MA, these mentions have increased +60% since the start of March Madness vs. prior levels. While elevated, daily mention volume during this event has not eclipsed levels established during the Super Bowl. Comprehensively, here's how the parent companies stack up. Keep in mind, PENN owns minority stake (36%) in Barstool Sports and has exclusive sports betting and iCasino partnership. Flutter (PDYPF) is the parent company of FanDuel.

Moral of the story: Sports Betting is gaining traction alongside live sports events and continued legalization. Currently, ~86 million Americans have access to legalized sports betting (across 20 states), and this number is expected to grow. This is an enormous opportunity sports betting platforms. We'll continue monitoring the segment as a whole to spot over and under-performers. In the meantime it's clear there's a lot of upside potential for these companies.