Back to regularly scheduled programming this week! Here are some […]

Market headwinds, travel tailwinds

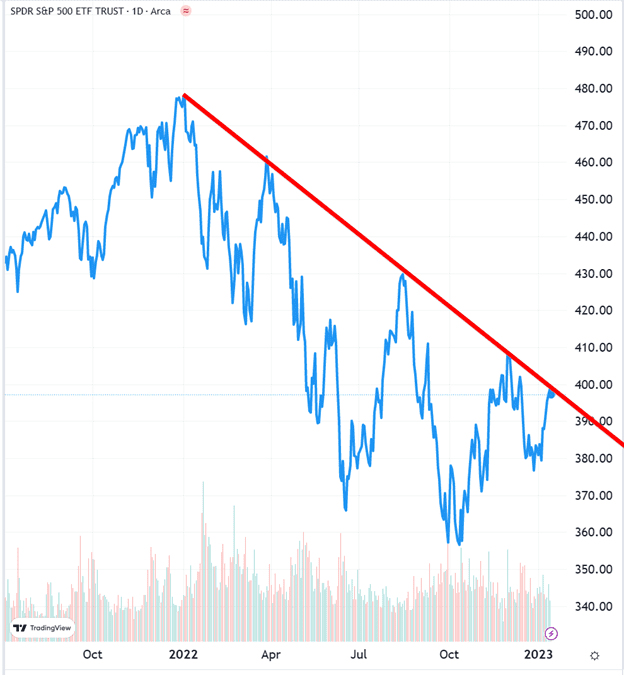

S&P 500 is now banging right up against the downtrend line… the next move could really be make or break for the full market:

Fed late week action…

Wednesday: Beige Book released at 2pm

Thursday: Fed Vice Chair Lael Brainard speaks at 1:15pm ET

Friday: Fed Gov Christopher Waller speaks at 1pm ET Friday

Federal Reserve members enter a “blackout” period from Jan 21- Feb 2, during which they are not allowed to make any public comments.

Given the recent action in the bond and stock market, we expect Brainard and Waller to be more hawkish (more inclined to raise rates or keep them high longer) in an attempt to ensure markets don’t get “too loose” during the blackout period.

This could create significant headwinds for the overall stock market for the next 1-3 weeks.

Housing clues coming in…

Wednesday: NAHB home builders’ index at 10am ET

Thursday: Building Permits and Housing Starts at 8:30am ET

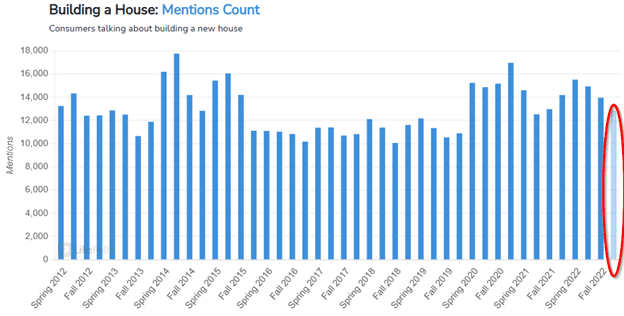

LikeFolio consumer insights for this winter are on pace for the first year-over-year demand decline for building a new house in a year.

Home Depot (HD) and Lowes (LOW) could be getting vulnerable here.

What we can learn from Delta’s (DAL) Q4 report

Shares of major airlines sank on Friday after Delta reported weaker-than-expected guidance alongside solid 4th quarter results.

DAL explained it wasn't an issue of consumer demand -- domestic passenger revenue was +7% higher vs. 2019 levels, but capacity remains slightly lower, and higher costs (including fuel, labor, and rebuilding its network) are weighing on profits.

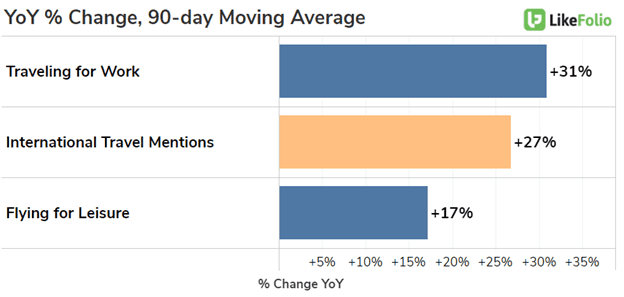

Forward-looking travel trends support solid consumer demand, with work and international travel leading the way.

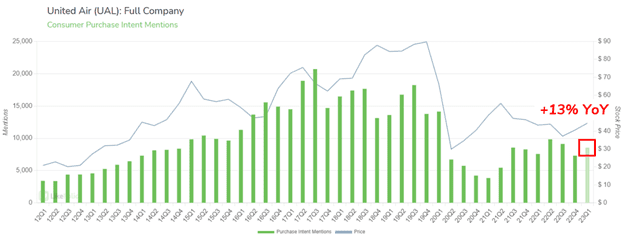

This will likely benefit airlines that have leaned into these travel drivers, notably United Airlines (UAL).

The carrier is boosting its trans-Atlantic offerings for 2023 and investing in 100 widebody jets to support its schedule.

UAL fared better than most airlines regarding the winter weather chaos mitigation. The airline cancelled 5% of its flights, better than DAL which cancelled 9% and LUV which cancelled 70% of its flights. AAL also outperformed, cancelling less than 1% of its flights.

This could give UAL and AAL an advantage when it comes to near-term elevated costs that have plagued LUV. Its holiday meltdown could cost the airline $825 million.

UAL will report Q4 earnings Monday after the bell. We’re officially neutral for this report, but do expect to see continued outperformance from UAL long-term as the company’s investments in global travel pay off.

| AAL and LUV will report earnings on Thursday, Jan. 26 before the bell. |