Is Teladoc Oversold? (TDOC) A combination of weaker-than-expected earnings and […]

Mental Health Concerns are Fueling Telehealth Demand

July 5, 2022

| Mental health and awareness surrounding the topic have grown significantly over the last few years. According to Mental Health America, 19% of adults experienced some kind of mental illness in 2021 — the equivalent of 47 million Americans — and that number is growing. |

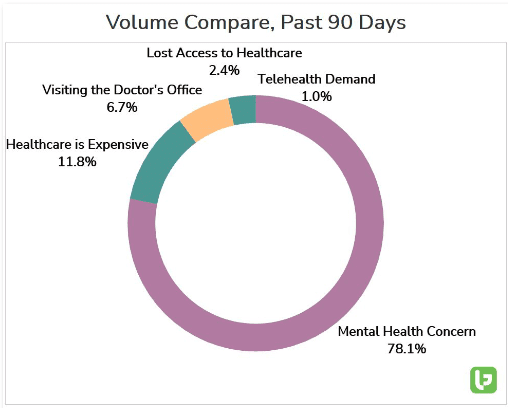

| This trend bears out in LikeFolio’s data as well…Mental health concern mentions are currently trending +64% YoY, comprising an overwhelming 78% of total healthcare mentions. It’s no surprise that demand for mental health services has been steadily climbing over the past two years, no doubt boosted by pandemic-related issues. This is having a significant impact on an up-and-coming sector of the healthcare space: telehealth. |

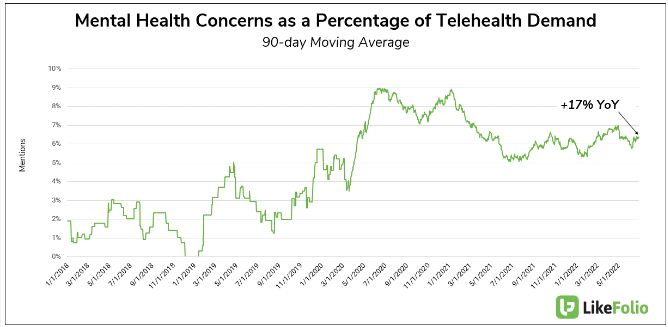

| Mental health concerns as a percentage of total telehealth demand, are up +17% YoY, nearing the highs seen during the pandemic shutdowns. Although total telehealth demand has waned as in-person visits to the doctor resumed, the growing need for mental health care has helped to keep telehealth demand elevated relative to pre-pandemic levels. |

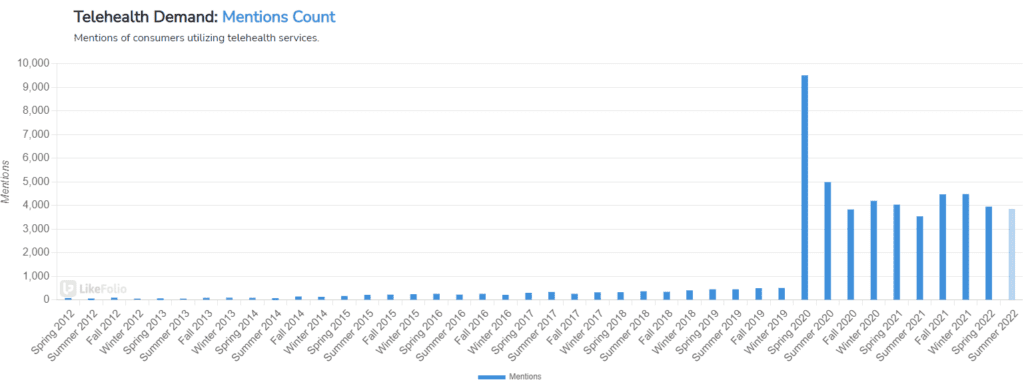

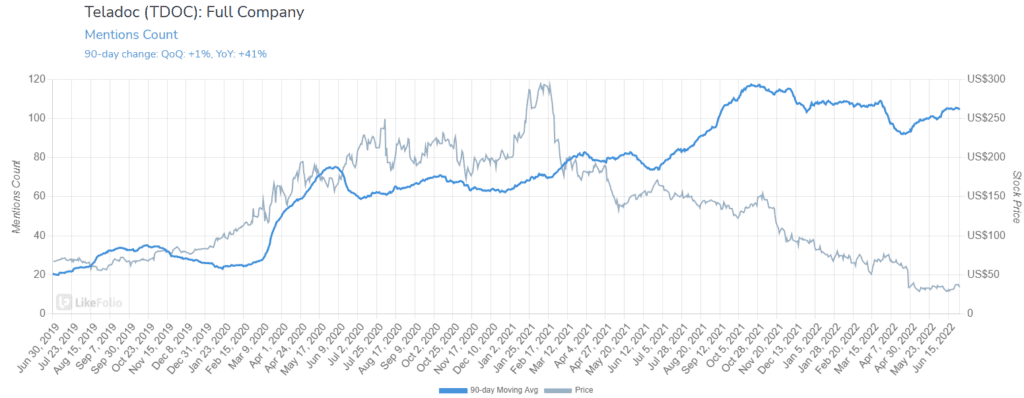

| Consumer mentions of utilizing telehealth services remain +735% higher vs. pre-pandemic levels, reflective of a long-term behavior shift (stickiness). As a result, the telehealth company Teladoc looks well-positioned to benefit. Here’s what we are watching: The BetterHelp Acquisition Looks Like a Bright Spot In 2015, Teladoc acquired the mental health services platform BetterHelp, a company that provides online counseling and therapy services directly to consumers. Underlying consumer demand suggests that this is a long-term bright spot for Teladoc. Purchase Intent Mentions for BetterHelp show a significant adoption spike in 2021 but have since normalized. However, demand is still showing promising growth, currently pacing +48% YoY. Although Total Mention volume for the brand has also pulled back from the Fall 2021 highs, it’s showing similar long-term strength, up +107% YoY on a 90-day moving average. Teladoc Talk While mental health services have been a major driver of telehealth growth and usage, full-company data for TDOC shows that telehealth (as a concept) is here to stay. Teladoc’s share price has plummeted in 2022, yet Consumer Buzz remains significantly higher than pre-pandemic levels. |

Despite a near-term slowdown in growth, mentions of Teladoc’s services are still trending +41% YoY, staying very near to the all-time high level.

Bottom Line: Growing concerns about mental health have resulted in more and more consumers utilizing telehealth and online services to reach out for help, boosting demand for companies such as Teladoc and its BetterHelp service.

It’s unfortunate that an increasing number of Americans are dealing with mental health issues, but there are definitely going to be companies that benefit in the healthcare space.

While Teladoc is on our radar, we also have a close eye on other telehealth and online health platforms such as Amwell (AMWL), Hims (HIMS), and GoodRx (GDRX).

Want deeper insights? Get Free Access to The Vault.

Tags: