Snapchat's IPO timing was...well... incredible. They literally took the company […]

Microsoft’s Big Bet on the Metaverse

Microsoft’s Big Bet on the Metaverse

Microsoft is no stranger to acquisitions… just ask our research team. The company has gobbled up major players like the “social” network LinkedIn and the development tool, Github.

In total, the company has logged more than 100 of these events in LikeFolio’s database over the last 10 years.

But its planned acquisition of Activision Blizzard for a whopping $68.7 billion will be its largest to date.

What is Microsoft betting on? In short, the future.

The virtual future, that is.

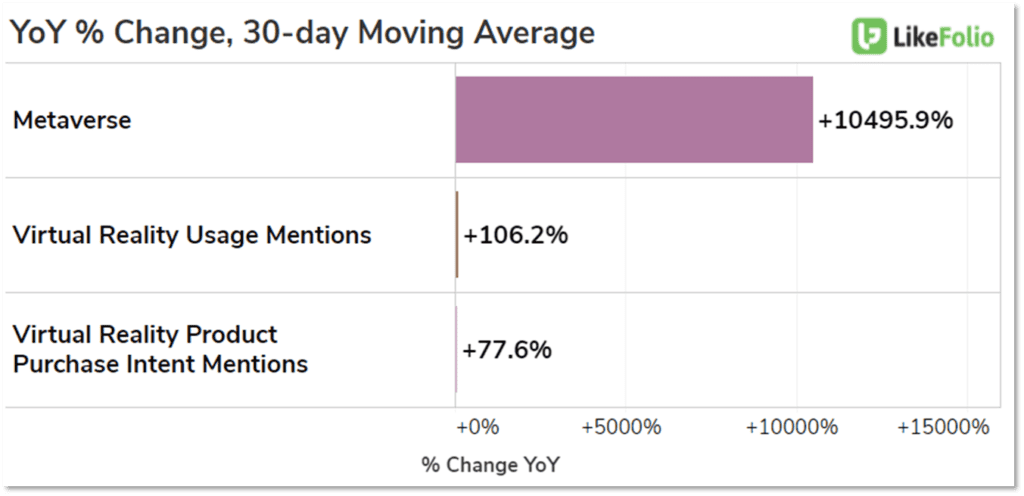

LikeFolio first noted explosive consumer interest in the Metaverse months ago. So far, this interest doesn’t look like a flash-in-the-pan type of event.

You can see just how rapidly consumer interest in this alternate universe and related trends are rising on a short-term (30-day) moving average on the chart above…Exponential.

Microsoft, like other tech firms, wants a piece of this growing pie. And its acquisition of ATVI signals that Microsoft anticipates significant expansion in this gaming segment and its potential Metaverse applications.

But even in the short term, this acquisition still makes sense.

While the concept of immersive virtual worlds gains its footing, Microsoft is welcoming in a healthy gaming suite to its arsenal.

Activision Blizzard adds several games and virtual worlds to Microsoft’s portfolio, including Call of Duty, World of Warcraft, and even the O.G. viral game, Candy Crush.

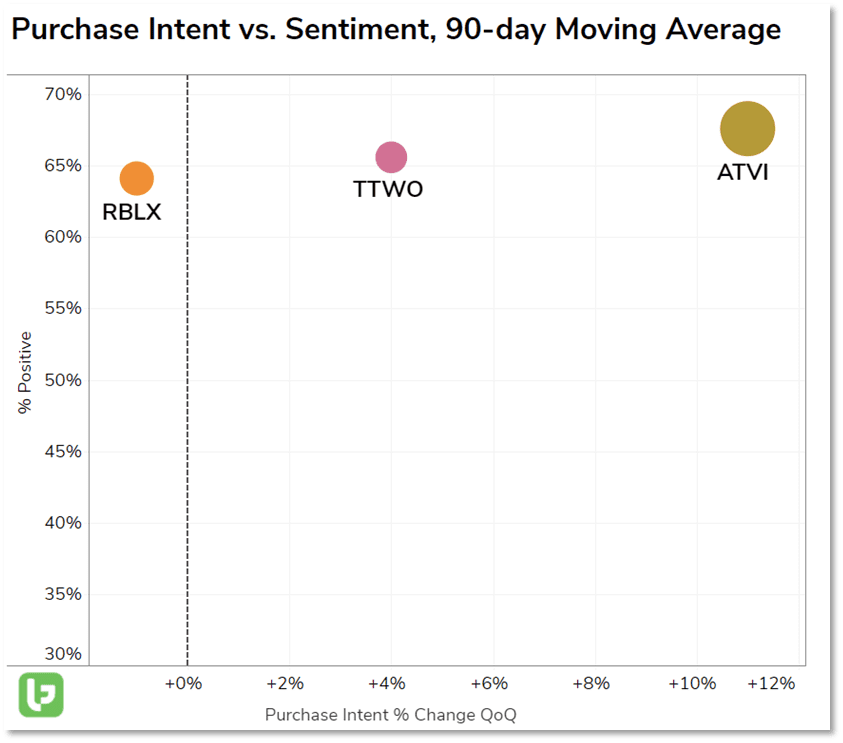

In addition, ATVI is outperforming peers in regard to Consumer Happiness levels AND demand growth, currently holding the ideal top-right position on the outlier grid below:

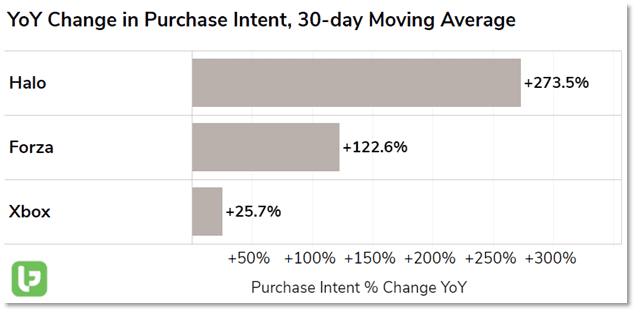

This new suite of brands will be in good company: Microsoft’s gaming segment has recorded significant growth on a YoY basis:

This consumer-facing gaming segment is largely responsible for Microsoft’s near-term demand momentum ahead of Earnings.

It’s important to note LikeFolio data can’t anticipate performance in non-consumer-facing segments of the company’s business. But we can keep an eye on its developing gaming segment. Momentum is palpable…