“You know it's time to sell when shoeshine boys give […]

MicroStrategy's $500M Bitcoin Bet ($MSTR, $BTCUSD)

MicroStrategys $500M Bitcoin Bet ($MSTR, $BTCUSD)

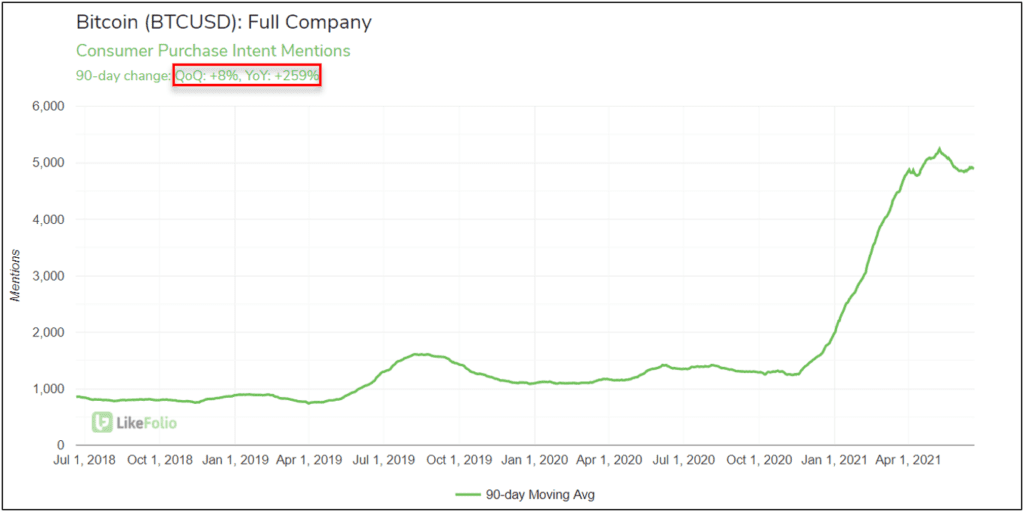

The price of Bitcoin ($BTCUSD) has been under pressure recently, down approximately -5% in the past 24 hours and -20% in the past week. However, consumer demand for the crypto market leader is holding at a higher level, with Purchase Intent mentions +259% YoY and +8% QoQ on a 90-day moving average.

Individual traders aren’t the only ones with an enduring faith in the cryptocurrency market…One notable BTC whale made a big splash this morning: MicroStrategy (MSTR), a business intelligence company that invested more than $2.2 billion into Bitcoin between August 2020 and May 2021 is still buying despite the falling price. Last week, MSTR completed the sale of $500 million in corporate bonds, with the expressed purpose of using the proceeds to purchase more Bitcoin. Today, the company confirmed that an additional 13,005 bitcoins were acquired, bringing its total BTC holdings to 92,079.