Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

Mobile Shopping, Buy-Now-Pay-Later Dominate 2021 Shopping Trends

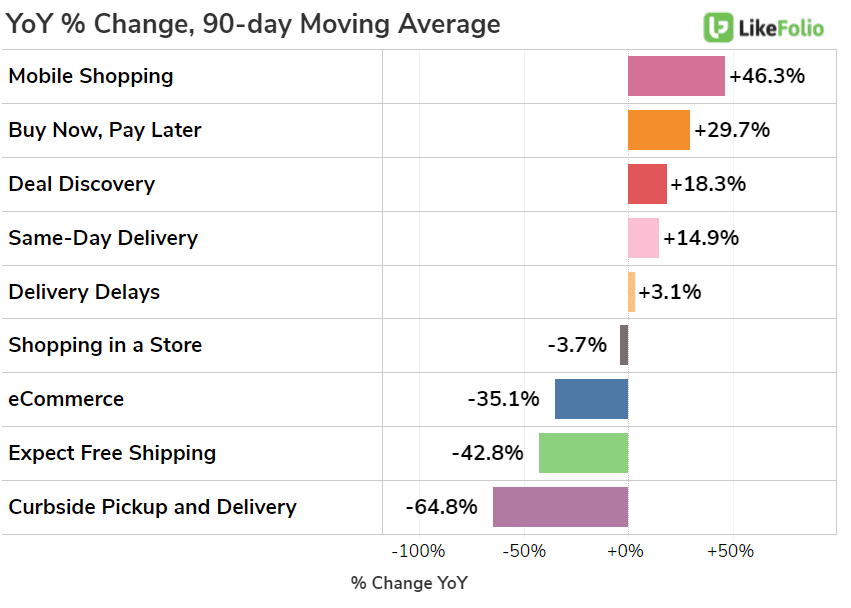

2020 was the year consumers overwhelmingly embraced eCommerce and discovered the convenience of curbside pickup. This year consumers are still completing purchases online, but new trends are popping up on LikeFolio's radar. Check out the top growing shopping trends in the last quarter:

External research confirms these findings:

- Nearly $3 out of every $4 spent on online purchases is completed via mobile device. Mobile purchases comprised ~50% of online purchases in 2016.

- The number of consumers utilizing Buy-Now-Pay-Later services grew +85% from March 2020 to June 2021, with consumers citing the ability to spread payments over time, ease of use, and assistance in budgeting as being the top usage drivers.

- The same-day delivery market is expected is exceed $8.4 billion in 2021 and reach $26.4 billion by 2027.

It's a good thing retailers have a plan...and Walmart is executing especially well.

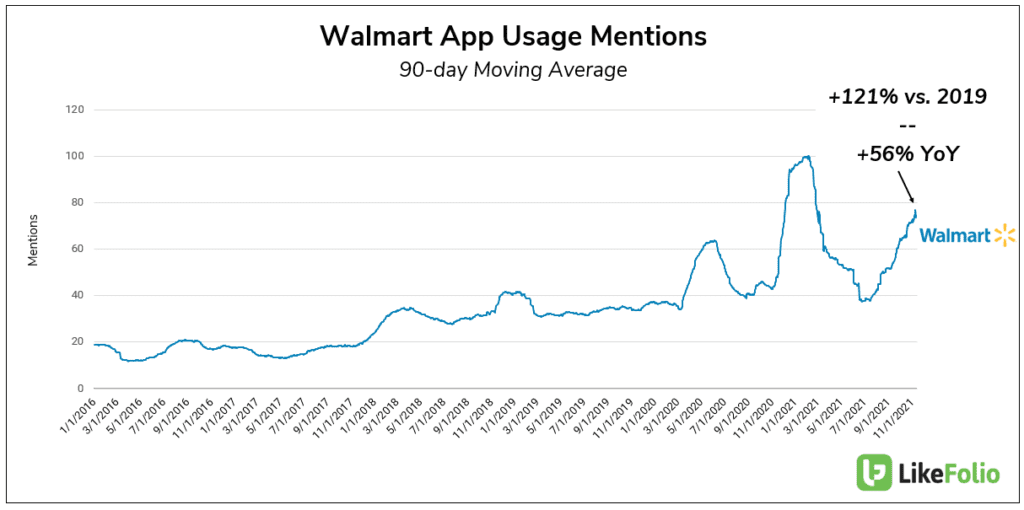

Consumer mentions of using the Walmart app have increased by more than +120% since 2019 and continue to rise into the Holiday Season.

Walmart has a major advantage when it comes to app usage: grocery. Walmart overtook Amazon in US grocery e-commerce sales in 2020 and still holds a +4.3% volume edge. (Target sits in third place by a significant margin). In addition, Walmart's omnichannel model enabled by its +4,700 store physical footprint is helping to meet rising same-day fulfillment demand. Consumer mentions of using delivery, buy-online-pickup-in-store, or curbside pickup remain +50% higher vs. 2019. Lastly, Walmart does provide BNPL services empowered by Affirm. The company replaced its traditional layaway service this year, just ahead of the Holiday season.