Kohl's stock was hammered in 2016 and 2017 as the […]

Monday Preview

May 16, 2022

Companies in our coverage universe, such as The Home Depot, Target, and Kohl’s are reporting this week.

Here are some key stats and highlights of the stocks to watch:

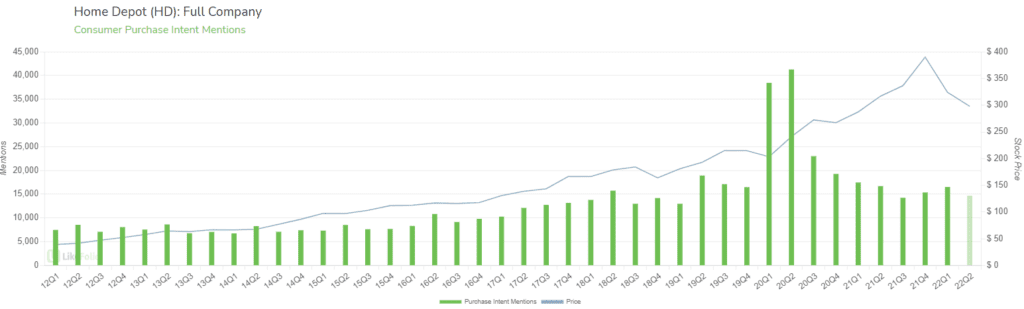

The Home Depot (HD):

- Home Depot will release earnings data for its latest quarter before the open on Tuesday, May 17.

- Purchase Intent data surged in the early part of the pandemic, with many consumers having time to renovate their homes, but now it is at pre-pandemic levels.

- Mentions of Home Renovations have stabilized at +3% QoQ and +10% YoY, while Purchase Intent mentions in Q1 closed at +7% QoQ and -5% YoY.

- Interestingly, consumers indicating they recently renovated or plan to renovate their backyard have surged +62% QoQ.

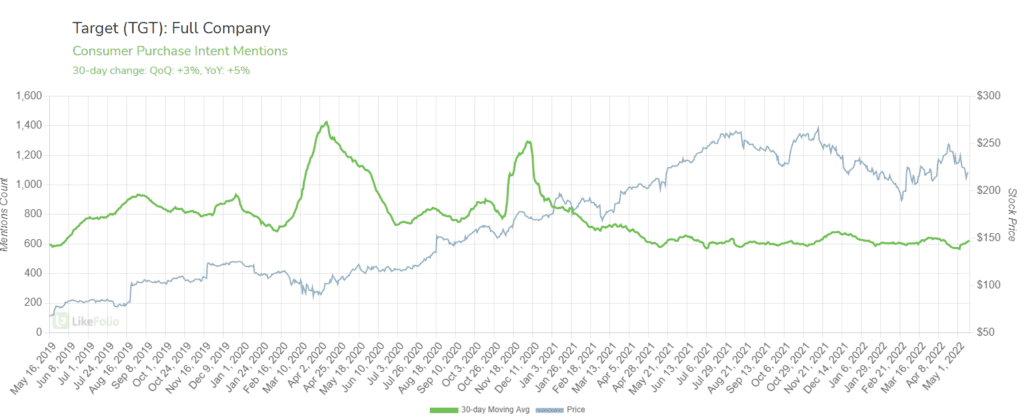

Target (TGT):

- Target will post earnings data before the opening bell Wednesday, May 18th.

- Buzz and Demand are showing near-term strength.

- Consumer demand for beauty and apparel products at Target is exhibiting signs of momentum, with demand mentions in both categories increasing +25% QoQ. In contrast, we are seeing some normalization in Target-specific home renovation and grocery demand, with mentions dropping -10% and -24% QoQ respectively.

- Based on a 30-day moving average, Purchase Intent mentions are trending at +3% QoQ, while Buzz is at +1% QoQ.

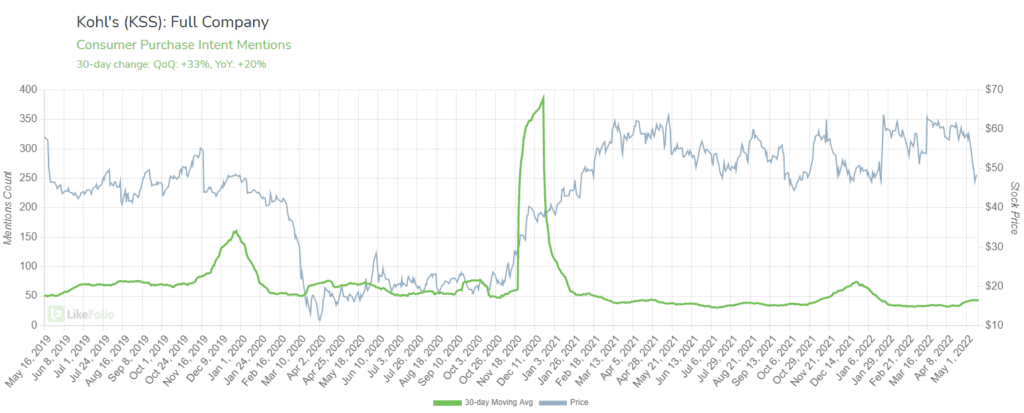

Kohl’s (KSS):

- Kohl’s will report earnings ahead of the open Thursday, May 19th.

- Shares have decreased by 40% since Nov. 21

- KSS is gaining near-term momentum in buzz and demand growth despite the happiness slowdown.

- Reports suggest KSS acquisition interest (to the tune of $8.6 B) from J.C. Penney owners Simon and Brookfield. All parties have declined official comments. In May, Kohl's blocked an attempt by shareholder Macellum Capital to take control of its board of directors to implement changes supporting a potential sale. Both are important external factors to keep an eye on ahead of this week's earnings event.

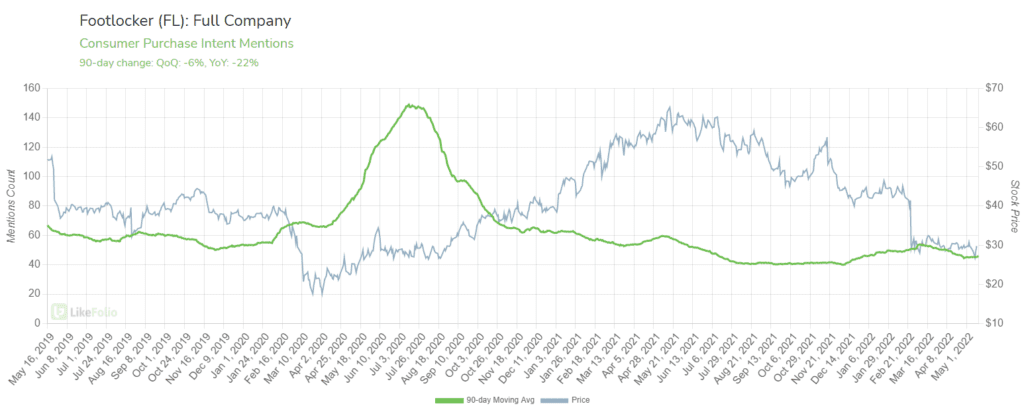

Foot Locker (FL):

- Foot Locker, which expects revenue to drop in 2022 since it can no longer sell as many products from its top vendor, Nike, will release earnings data on Friday, May 20th.

- The company’s Purchase Intent mentions data correlates with its sales forecast, trending at -22% YoY.

- However, it is seeing a strong rise in Consumer Happiness which is pacing +7% QoQ and +19% YoY, putting positive sentiment at 71%.

- Tweets suggest consumers are increasingly happy with Footlocker's online ordering system. Users report success in landing new product drops, and in communication about when drops will occur.

Monster (MNST):

- Monster missed earnings expectations but beat revenue forecasts when it posted earnings on May 5th.

- While the company has seen a jump in Purchase Intent mentions lately, +8% QoQ, on a yearly basis, they are decelerating, by -30% YoY.

- Total Mentions of Monster are similar, trending +11% QoQ and -27% YoY.

- LikeFolio data suggests other health-conscious players may be stealing market share. Demand for Celsius energy drinks are at all-time highs: +135% above last year's mark. Shares of Celsius surged +15% higher following its 22Q1 report last week after revenue surged +167% YoY. Wow.

- We're monitoring Celsius happiness alongside recent price increases to understand how this will impact demand long-term.

Watch us talk in-depth about these names on the TD Ameritrade Network at 12:20 ET Monday-Friday.

Want deeper insights? Get Free Access to The Vault.

Tags:

$FL, $HD, $KSS, $TGT, Foot Locker, Home Depot, Kohls, MNST, Monster Energy, Target