Dunkin' Donuts is superior to Starbucks. There is really no […]

Monday Preview

May 2, 2022

83 companies in our coverage universe are set to report this week.

Here are some highlights, recaps, and stocks to watch:

Expedia (EXPE):

- Expedia reports after the close on Monday, May 2nd.

- Travel and vacation-related trends have been on the rise for some time. However, macro headwinds (like inflation and rising fuel prices) have weighed on the industry, stunting its bounce back.

- EXPE’s Purchase Intent Mentions have increased by +42% YoY but do show some signs of tempering in 22Q2.

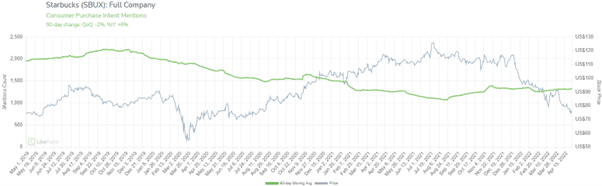

Starbucks (SBUX):

- Starbucks will release second-quarter fiscal 2022 earnings after the close on May 3.

- In SBUX’s previous report the company missed earnings expectations, largely due to rising supply chain costs and underperformance in China.

- Since then, shares have traded ~25% lower.

- Consumer demand among English speakers continues to improve, pacing +6% higher YoY on a 90-day Moving Average and +11% YoY on a 30-day Moving Average (acceleration).

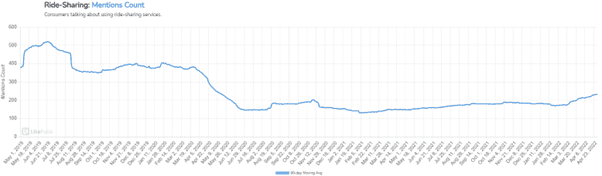

Uber (UBER):

- Uber will post earnings for its latest quarter after the close Wednesday, May 4.

- A continued return to regular nightlife and rising airport travel have bolstered Uber demand by +9% QoQ and +2% YoY.

- Genericized mentions from consumers utilizing ride-sharing services have risen at an even steeper clip, +29% QoQ and +55% YoY.

- Uber Happiness is spiking higher following the company’s decision to drop mask mandates: +5% YoY.

- Uber aspires to be a travel ‘Superapp’ and will begin rolling out additional booking services (trains, buses, planes, car rentals) in the U.K. in 2022.

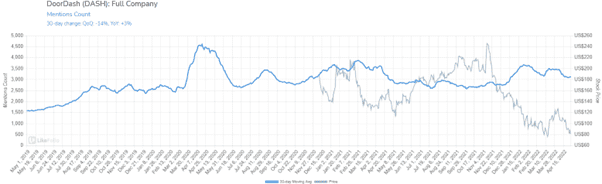

DoorDash (DASH):

- DASH posts 22Q1 earnings Thursday, May 5 after the bell.

- Overall Mention growth is flat at +3% YoY, and so is Purchase Intent growth: +1%.

- Trends suggest consumers are eating out more (going to a restaurant mentions: +25% YoY) and ordering in less (generic food delivery mentions: -4% YoY).

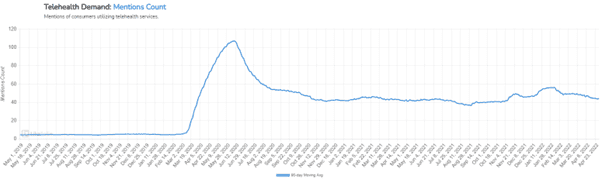

Teladoc (TDOC):

- TDOC shares plunged more than 40% in the wake of its earnings release last week after the company warned of a weak sales outlook and rising costs.

- Data shows Teladoc consumer demand mentions register well above pre-pandemic levels, currently trending +21% YoY.

- However, overall telehealth demand shows signs of deceleration. Current mentions remain relatively flat YoY, but -21% lower QoQ.

Watch us talk in-depth about these names on the TD Ameritrade Network at 12:20 ET Monday-Friday.