The role of retailer traders in the stock market has expanded […]

My 1-2-3 Earnings Trading Plan

By now, most of you are aware of LikeFolio’s famous Sunday Earnings Sheet – a “tip sheet” that goes out every Sunday with earnings scores and trade ideas for all of the companies reporting earnings in the week ahead.

Did we model this after a horse racing tip sheet after feeling inspired by a day at the track? Maybe. But you get the idea.

This is our high-level view of every company reporting earnings…and the metrics that matter.

But even before I look at the Earnings Sheet and dive into individual companies, I like to “zoom out” and create a foundational thesis for the overall market, and the consumer sectors that these companies are in.

Here’s my 1-2-3 process to preparing for a (hopefully very profitable) earnings season:

1. Focus on stocks where earnings signal aligns with market performance

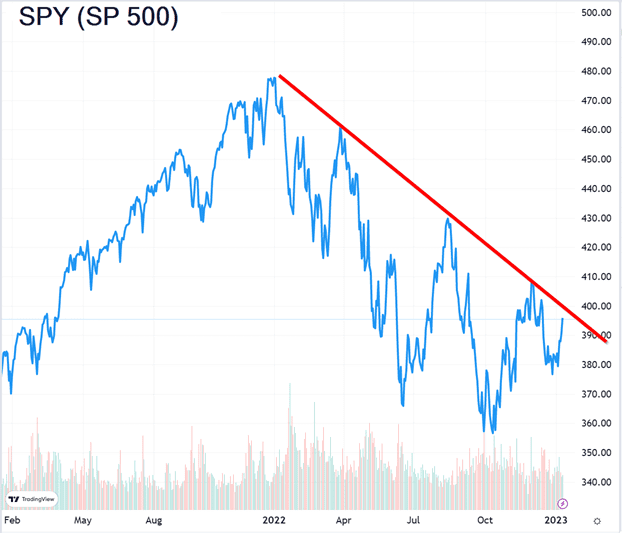

The overall market has made a nice recovery off of October lows, with an especially fruitful rally over the past couple of weeks.

Nevertheless, the overall downtrend is still intact… for now.

When I’m constructing an earnings trade, I always like to start with the overall trend of the market, as broad market movement can act as a headwind or a tailwind for individual stock positions.

As long as the S&P 500 downtrend remains in place, I’ll be leaning heavier and more aggressively into our bearish earnings signals.

Should we see a breakout to the upside for the overall market (4050+ on SP 500), I’ll be more inclined to focus on our positive, bullish earnings signals.

2. Use consumer trends by sector to spot big profit plays

Understanding where the consumer is hot… and where they’re not… is an enormous help heading into earnings.

Here’s a little cheat sheet I made for the upcoming earnings season:

This is a breakdown of overall consumer spending behavior.

Sectors on the left (green) are seeing positive consumer traction – a tailwind for companies in that sector. This could make executives more optimistic when they talk about their full-year 2023 outlook.

Sectors on the right (red) are just the opposite – consumers are cooling their spending in these categories. This could make the company more conservative in the expectations it has for the year.

If I see a negative earnings score on a company that is in a green consumer sector, or a positive score on a company in a red consumer sector … I will probably either pass -- or play it far more conservatively.

On the flip side, if a company’s earnings score lines up with the overall consumer trend for its sector… I’ll move into the trade aggressively, seeking big profits.

3. Be ready early and often

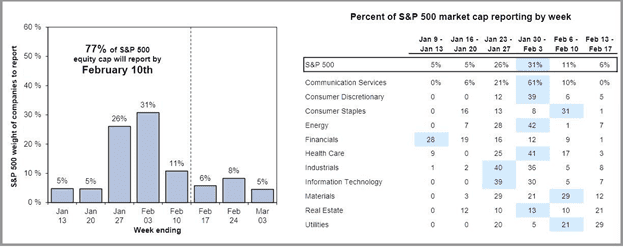

But that’s really just the kickoff to an enormous month of major earnings announcements from a bulk of the S&P 500.

In fact, 77% of S&P 500 companies will report earnings in the next 29 days.

And that means big… scratch that… huge opportunities for profit on an almost daily basis.

Exciting, fun… and hopefully very profitable.

Especially with a solid 1-2-3 plan in your back pocket:

- Focus on stocks where earnings signal aligns with market performance

- Use consumer trends by sector to spot big profit plays

- Be ready early and often

Let’s get after it!