Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Nike (NKE) is Benefitting From Reopening

Nike (NKE) is Benefitting From Reopening

Nike and Lululemon were huge beneficiaries of stay-at-home measures imposed in the last year. Not because stores were closed, but because both retailers deployed majorly successful digital channels to consumers. These Direct-to-Consumer (DTC) channels exploded on each company's prior report:

- Nike DTC: +20% YoY and the company booked $1 billion in online sales in North America for the first time. Digital sales are expected to account for 50% of total revenue in the coming years.

- Lululemon DTC: +55% YoY, accounting for nearly 45% of total revenue.

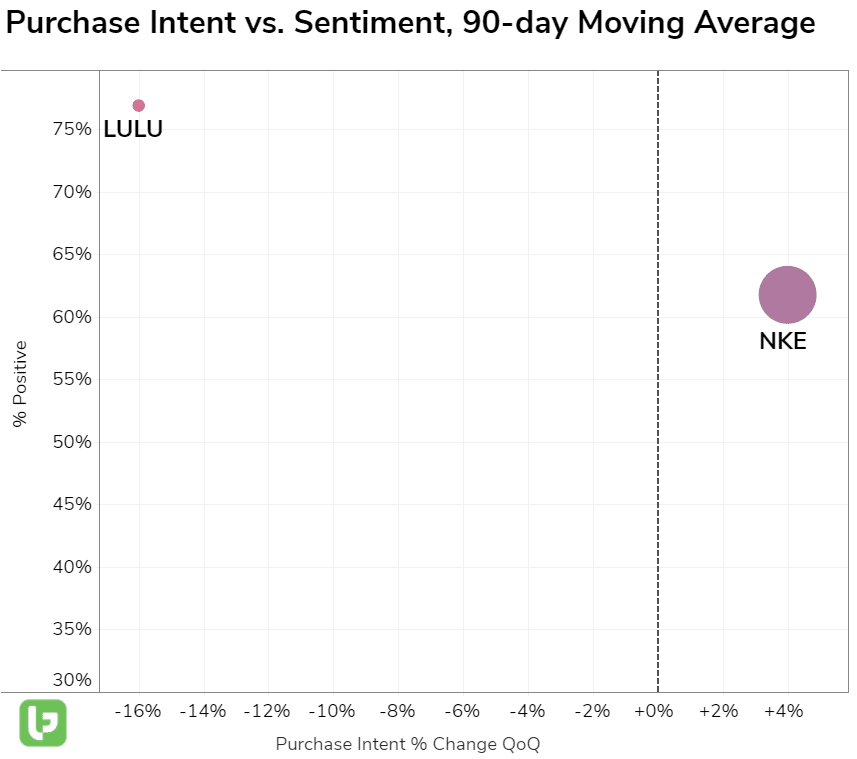

Now, we're watching Nike beginning to gain steam as society reopens:

Key Takeways:

- Nike is benefitting as consumers buy fashionable footwear to wear to social events. We know consumers are seeking to upgrade their wardrobes: mentions have increased +28% YoY. The interesting caveat here is that Nike actually has a "fashionable" application, with many consumers buying sneakers to complement their trendy outfits. Lulu doesn't have this application.

- Lululemon has an extremely loyal consumer base, driven by perceived high-quality products. LULU sentiment is ~15 points higher vs. NKE.

- Nike is maintaining its digital momentum. Nike DTC mentions are more than 100% higher vs. 2019 while Lululemon is showing signs of normalization. Lululemon DTC mentions are higher vs. 2019, but only by around ~10%.

Some of this discrepancy in digital is likely due to the nature of each brand:

- Nike leans heavier on footwear. In 2020, footwear accounted for 66% of Nike's total revenue. This footwear is often released in exclusive "drops" on its SNKRS app. This drives engagement and creates a unique opportunity for consumers to brag if they snagged (or didn't snag) a coveted shoe.

In contrast, Lululemon is mainly focused on athleisure and for the most part, item drops are pretty "neutral" or similar in nature. Meaning, how many times are users going to brag about buying another pair of the same leggings but in a different color? Nike is expected to report earnings at the end of June. We'll be watching for continued signs of reopening optimism from consumers and will revisit ahead of earnings.