Expect strong digital numbers from AEO AEO shares are trading […]

Oh my God, Becky -- look at that stock.

Last quarter, Levi Strauss (LEVI) shares plunged -9% after the company's Q3 report.

Trouble in denim paradise?

Not so fast.

The cause of the earnings sell-off was related to profit.

Levi adjusted its EPS guidance to the downside -- $1.44-$1.49 in Q4 vs. $1.50-$1.56 -- in response to the rising cost of goods.

Here's why we're not counting LEVI out...and why the company could be poised for a major surprise:

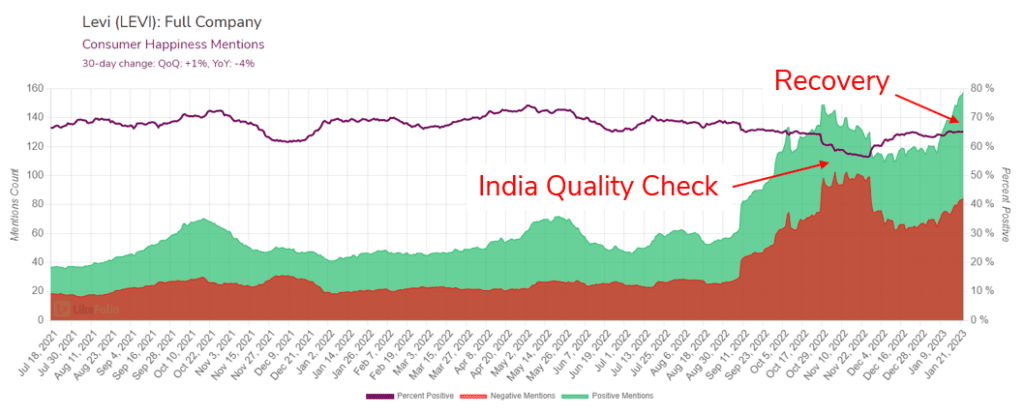

Last fall, the company received organized consumer backlash in response to the quality of its products being sold in India.

Since then, Levi Brand Happiness is recovering overseas.

Last quarter, Levi's Asian segment excluding China grew by +68%, led by strength in India.

It's positive to see quality-related improvements in the Levi brand, especially among an expanding international market.

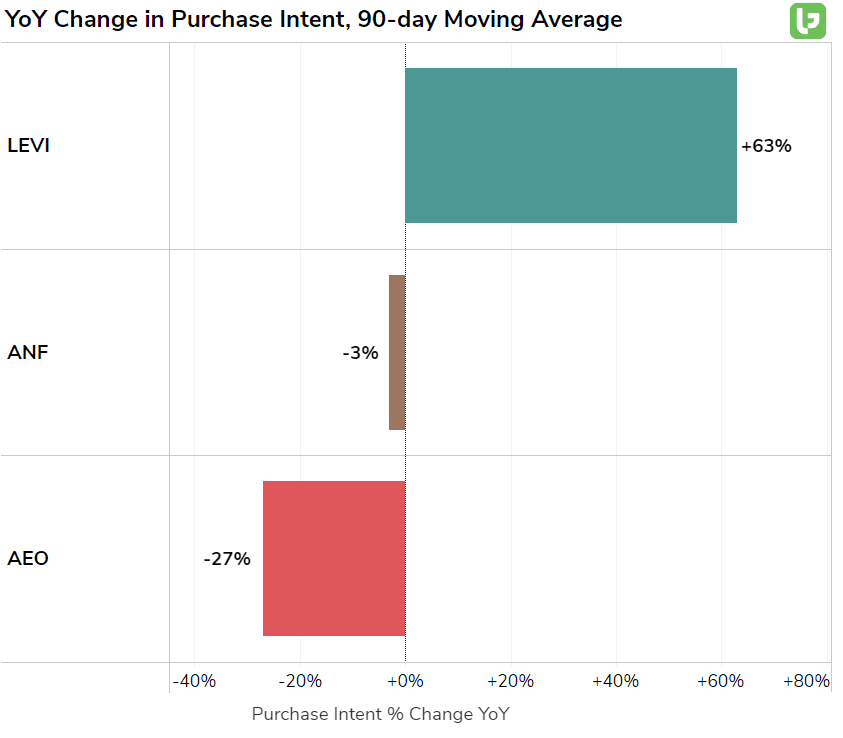

Most importantly -- consumer demand is exploding.

LEVI purchase intent mentions have increased by +63% YoY, driven by renewed brand interest among young consumers thanks to sustainability efforts and a partnership with NFL teams, like the San Francisco 49ers.

This is notably better vs. demand for retail peers like American Eagle and Abercrombie & Fitch.

| As happiness improves and demand spikes, LEVI gains pricing power. In Q3, profits were the company's biggest weakness… However, strategic pricing increases could offset higher production costs -- and pricing increases become more feasible as the brand becomes more desirable. Heading into Q4 earnings, we're cautiously optimistic. If LEVI can wrangle costs, consumer demand is likely to exceed market expectations. If costs continue to weigh on LEVI’s 2023 outlook, a dip in share price could prove to be a great opportunity to take a long-term position on this American icon. |