DraftKings (DKNG) DraftKings has been busy, and is poised for […]

Okay, Sports Betting, What's Next?

Okay, Sports Betting, What's Next?

This week, 2 major players in the sports betting game posted Q3 earnings that underwhelmed investors.

- PENN shares sank by more than 20% after profits took a hit compared to last year, with the company citing Hurricane Ida and the delta variants as the main negative impact drivers.

- DKNG shares dipped by ~5% immediately following its pre-market report that featured a wider-than-expected loss but has since reversed and are trading right around where they closed yesterday.

Bottom line: neither company is feeling an outpouring of love from the market right now.

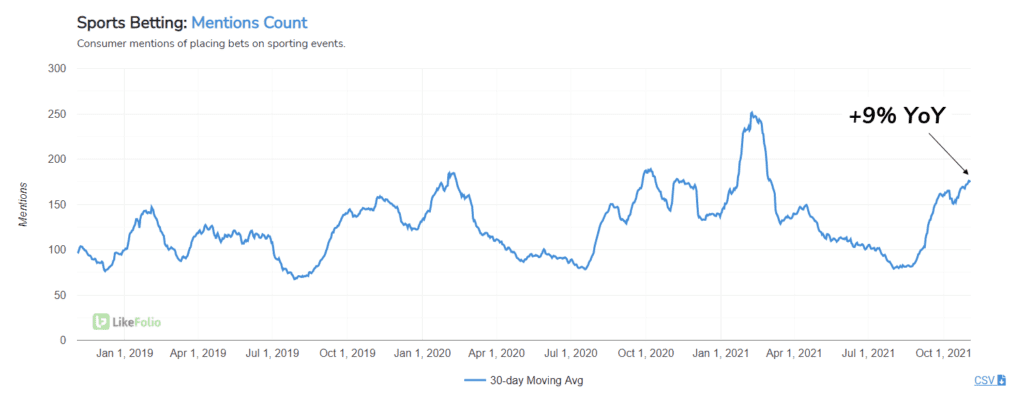

But LikeFolio data suggests there's still gas in the tank here. 1. A growing consumer trend is propelling both companies: Sports Betting.

While these mentions typically tick up to a peak during the Super Bowl, they are already outpacing levels recorded last year by +9%. Even though the federal ban on Sports Betting was struck down in 2018, legalization is now unrolling on a state-by-state level. And perhaps a bit slower than expected. Mobile and online sports betting are only legal in 19 states right now. This means tremendous growth potential is still palpable, with millions of would-be users waiting for the green light by their legislatures. 2. DraftKings and Barstool Sportsbook (PENN minority-owned) continue to exhibit growing consumer demand.

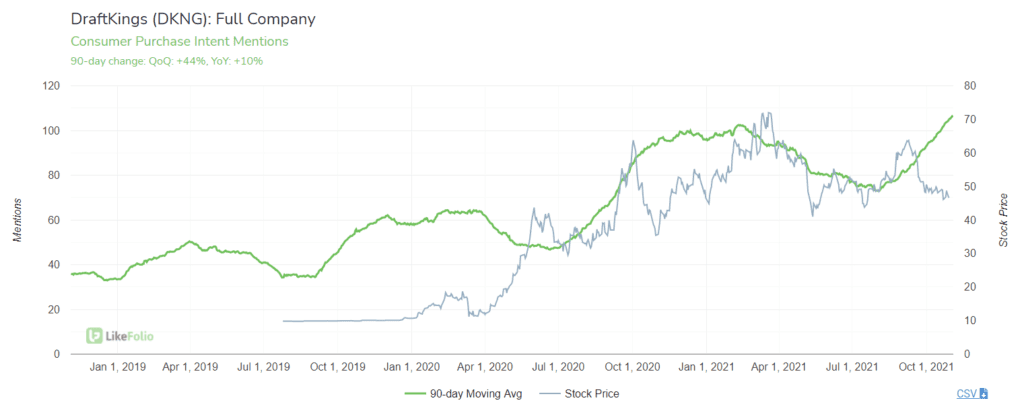

Consumer mentions of downloading and using the DraftKings platform to wager on sporting events has increased +10% YoY.

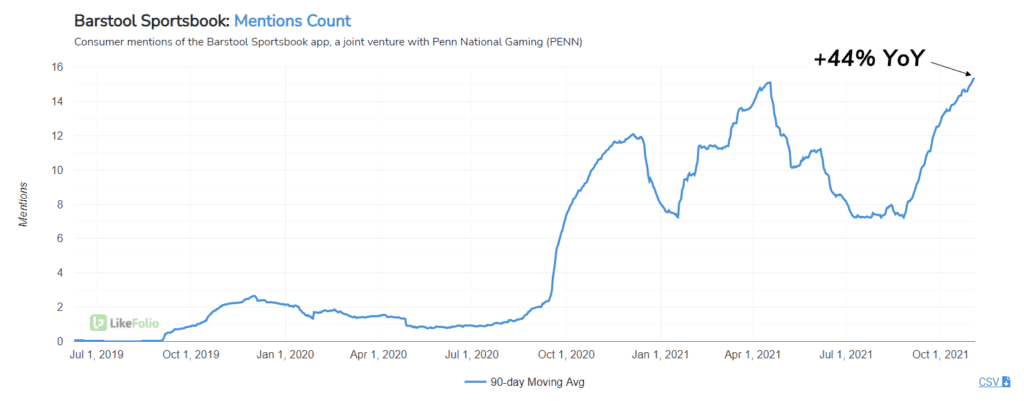

Albeit, slower growth vs. last year's rate, but still powering through all-time highs. This slow-down is what informed our bearish near-term stance on DKNG on our weekly earnings sheet. We saw promising revenue growth but were concerned about near-term profitability. Bullseye. Long-term, we still like this name, especially as it shows signs of continued market share capture vs. peer FanDuel. Penn National Mentions are a little more tricky. The company operates a mix of traditional casinos and racetracks but also holds a minority stake in Barstool Sportsbook. Barstool Sportsbook usage mentions have increased +44% YoY.

PENN noted that the Barstool Sportsbook brick-and-mortar concepts are stimulating growth and attracting a younger audience: "our retail Barstool Sportsbook concepts are continuing to stimulate database growth and increase the frequency of visitation in the younger segments while also boosting gaming and food and beverage spend.