Last September we used Purchase Intent data to predict that […]

One Platform is Bucking the Streaming Cancellation Trend…

December 6, 2022

| ‘Tis the season – and I’m not talking about presents under the tree. At the end of the year, consumers do some serious pondering: How are they going to make their life better in the New Year? Quick thinking translates to diet, exercise, yada yada. Which is certainly true. But an interesting behavior change occurs too that has nothing to do with cutting calories. Instead, it has to do with cutting down on subscriptions. |

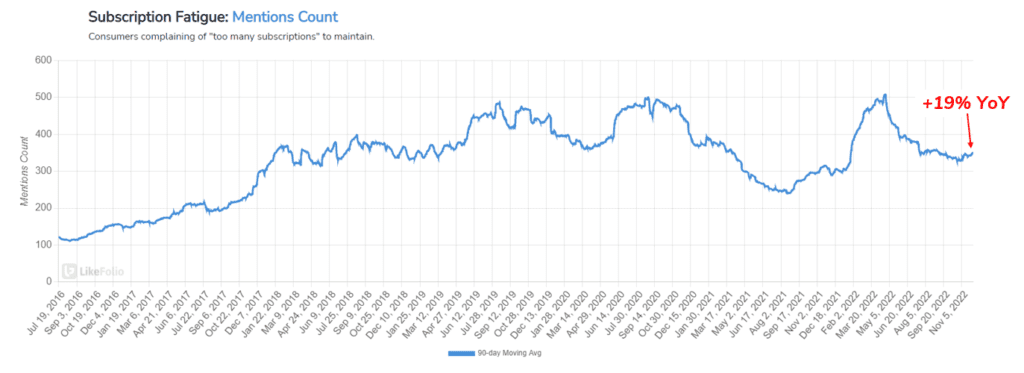

| Consumer complaints of having too many subscriptions to maintain are already on the rise, currently pacing +19% higher vs. last year. And streamers are feeling the pain across the board: |

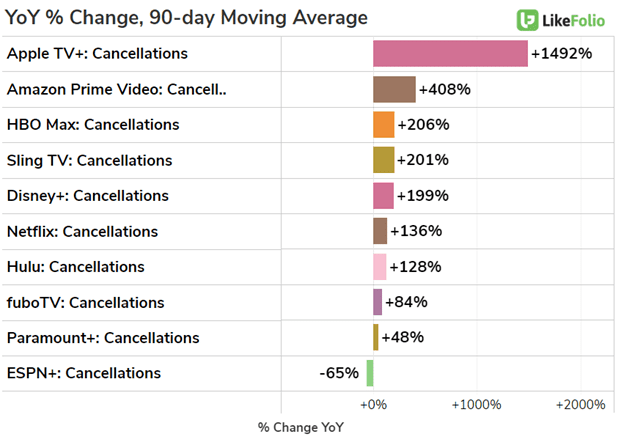

This chart is very telling. Because it reveals 2 things immediately: a big winner, and a big loser.

1) Apple TV+ dropped the ball (literally).

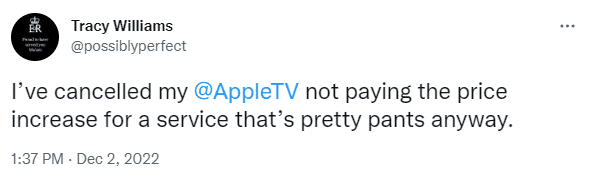

| With World Cup hype sending consumer interest in international soccer flying, now would be the perfect time to drop another season of cult-favorite Ted Lasso. But a series of setbacks including major script rewrites and increasing costs have punted the series 3 release date back significantly. A summer 2022 window was originally planned, but filming didn’t even begin until March 2022, so a 2023 release is pretty much confirmed at this point. While Ted Lasso is only one of Apple TV+’s original series, it highlights the importance of fresh new content for consumers. And unshockingly, if consumers don’t have fresh new content, they certainly aren’t willing to pay MORE for a streaming service. Tweets indicate many consumers are taking Apple TV+’s recent price hike (from $4.99/mo to $6.00/mo) as the perfect opportunity to cut the subscription altogether. |

2) ESPN+ is Leveraging its Live Sports Advantage

| ESPN+ is the only streaming platform in the bar chart above experiencing a decrease in cancellation mentions right now. Cancellation mentions fell in August, around the time college football season kicked off. On the other hand, consumer mentions of subscribing to ESPN+ started to tick up at the same time. Turns out, US consumers REALLY value live sports. |

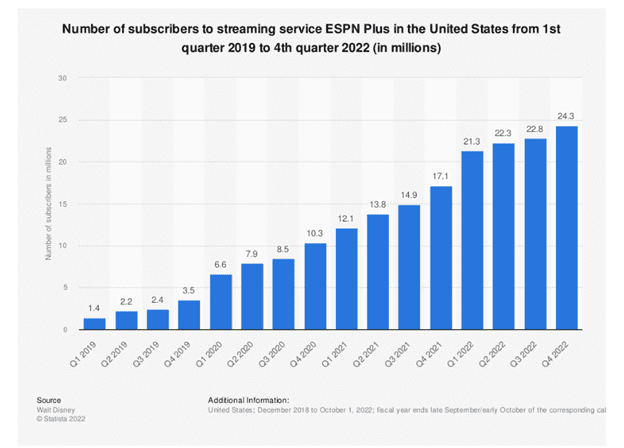

| And ESPN+’s diverse sports coverage is giving the platform a leg up on the competition. In fact, ESPN+ was a bright spot on Disney’s last earnings report, helping to offset losses in other areas of its direct-to-consumer streaming division including Disney+ and Hulu. ESPN+ subscription numbers have steadily risen since 19Q1, with the platform currently boasting ~24.3 million subscribers. |

Looking ahead we’ll be closely monitoring cancellation mentions as consumers enter a major purge period.

Right now, it looks like Apple has some work to do if it wants to continue its ecosystem dominance…at least when it comes to streaming.