Is the September slump over? Perhaps for the names in […]

Palantir Technologies Shares Are Down 28% This Year, Will Q4 Revenue Be a Beat?

The company, which divides opinion amongst investors, has seen its shares plummet recently, falling 27.9% this year.

Palantir’s share price has been hit by factors such as a general market correction, a hawkish Fed, and the rise of the Omicron variant.

However, the company was consistently able to secure both commercial and government deals during the quarter. In addition, LikeFolio data suggests consumers are flocking to the company. So here are three reasons for a potential turnaround in Palantir shares….

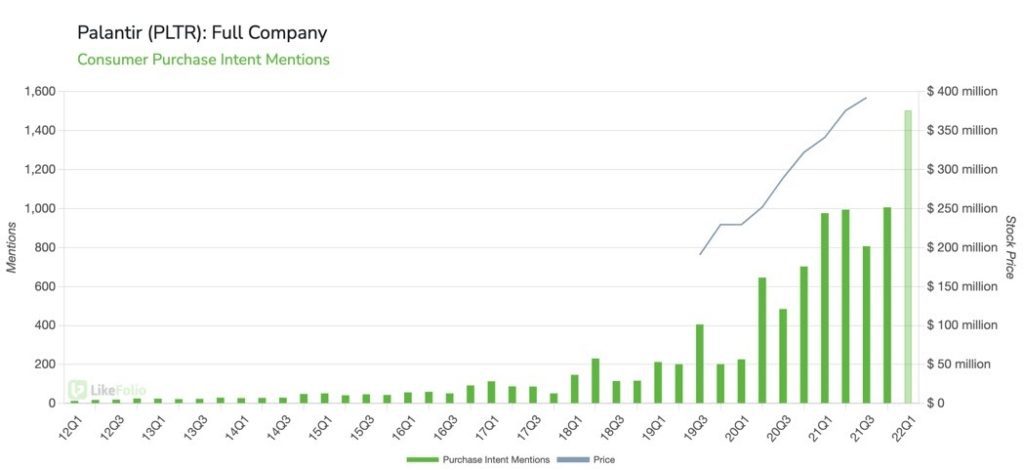

1. First is consumer purchase intent mentions — a key metric LikeFolio analysts keep a keen eye on.

As you can see, there has been a significant rise of late, with Q4 and the current quarter continuing a strong trend upwards. Consumer purchase intent mentions are up a massive 35% QoQ and 46% YoY.

While that trend has so far been unable to translate into the company’s share price, we can see — with the limited data we have — that Palantir’s revenue has followed purchase intent mentions higher.

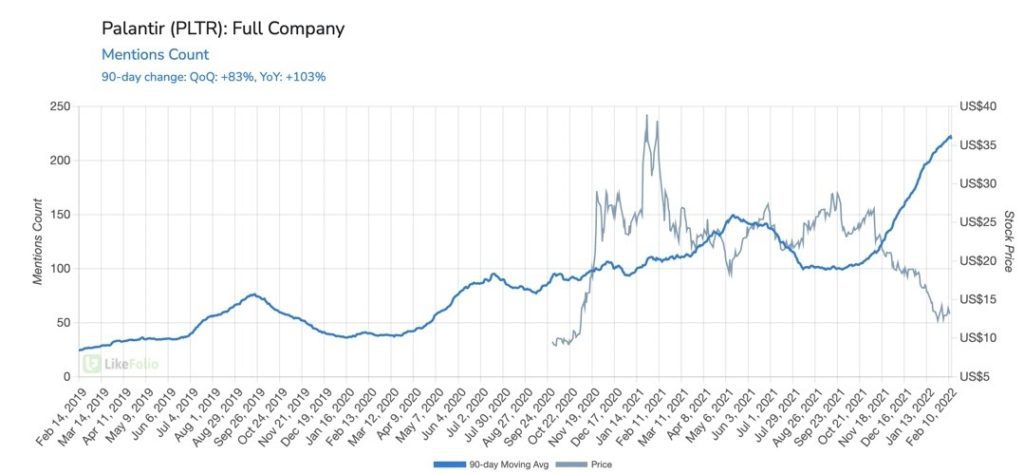

2. Overall mentions. Another one of our key metrics that Palantir is outperforming in.

Palantir mentions have seen an enormous 83% rise QoQ and an even bigger 103% increase year-over-year. It’s hard to get much better than that.

3. Despite the slight happiness decline of late (-1% QoQ), Palantir still has a super impressive happiness score of 75%, rounding off three key metrics that may see the company post a revenue beat in its earnings report.